One of the single greatest ways to better understand the markets is to know the biggest, most influential companies really well. But this is time-consuming and an ongoing process. You’re never done.

Even if you’re an indexer (or a financial advisor using indexes in portfolios), if you don’t grasp the themes and concepts that are moving the biggest stocks within the indexes, then you’re not really doing your job as an investor. It’s hard to be an expert on all 500 stocks in the S&P 500 (and nobody is in real life) but certainly you could do worse than to keep track of between 10 and 20 companies from time to time, in different industries, to give you a good perspective on why things are moving the way that they are.

One of the blessings I have as a full-time cast member on CNBC’s The Halftime Report is that I have to come correct each appearance. I can be asked about a host of different topics at any moment while on the show and my role is to be current, informed and knowledgable on enough of them so as to be helpful for the viewers. This forces me to stay engaged with individual names at a level that I might not have to under other circumstances. And through the prism of knowing what’s going on with firms from Home Depot to Nvidia to Disney to Prologis, I think my perspective on what’s driving the markets has improved overall. I’ve been doing the show multiple times per week since 2011, so it’s been a long journey of learning, researching, formulating opinions, changing them and being honest with myself about my own limitations.

I think that if every investor had a system to keep up with a handful of important names, it would greatly improve their understanding of the big picture. In the age of indexing, the need to do this has become lost on many. You’d be amazed at how many “market watchers” have settled into the shorthand of just looking at the S&P 500’s current level, assessing the valuation and trend, and then professing a strong opinion about whether or not its too high or too low. Without even understanding what it is about the individual components of this index that’s driving the decision making of the crowd. Imagine trying to understand the climate of the United States by taking an average of all the temperatures in every city around the country and saying “It’s 56 degrees today in America, which is lower than it should be.”

So, if you’re with me on the need to keep up with what’s going on at the stock level, and you want to get better at making this a part of your regular routine, how do you do it? It’s not easy. So much of the content coming out in the form of “news” is just clickbait. Look up the ticker symbol on any site that you use to follow stocks – almost everything there is an article written by a computer or something to do with what prices have just done in the last 24 hours. And really, who gives a s***?

The most valuable resources to understand companies can be found among the materials filed by the companies themselves. They must give out information and make disclosures from a regulatory standpoint, and this is where research should begin. But then again, we’re faced with the problem of having to sift through too much stuff and keep track of too many filings. If we’re not professional analysts covering these businesses for a living, it’s too much work for too little reward.

Which brings me to quarterly conference calls. They are, in my opinion, the most bang for your buck in terms of time spent versus what you come away with. You get to hear from the CEO and CFO every 90 days, walking you through the latest developments at their respective corporations. Then you get to hear thoughtful questions being asked of the management by Wall Street’s sellside analysts, who know these businesses inside and out. If you want to get to know a company like Adobe or DR Horton or Caterpillar or Lyft, one hour per quarter, listening to the conference call, is a cheat code. It gets the job done and you can listen while doing other things, like commuting, exercising, bike riding, hot air ballooning, whatever.

But here’s the problem – a problem I believe has now been solved:

Have you ever noticed that the Investor Relations pages on public companies’ websites are always different from each other and hard to navigate? IR pages suck. And nothing is worse than trying to listen to the latest conference call on a company’s website from your phone. You have to not only keep the phone’s screen open, you also must stay on the Chrome or Safari app to continue listening. If you close your internet browser app, the audio turns off. This prevents multi-tasking and makes the listening experience on the go a huge pain in the ass. It’s the opposite of a podcast – clumsy, unreliable, complicated, annoying and too chore-like to become habit forming.

What if I told you there was a way to listen to any earnings conference call you want, in the form of a podcast, from an app on your phone? What if learning about DataDog, Crowdstrike, Salesforce, Gilead and all of the other exciting companies that are changing the world was as easy as checking out an episode of Joe Rogan or Bill Simmons or even Downtown Josh Brown 🙂 ? Sounds pretty good, no? Well then, my friend, do I have the app for you. It’s called, appropriately enough, Earnings Calls, and is available now for your phone. It’s absolutely free to use and you should start using it today.

I’ve been using the app to get to know a lot of the new generation of stocks that have come on the market over the last few years, to listen to their CEOs explain their business and to have a better grasp on the biggest trends moving the markets. I fell so deeply in love with the ease of use of this tool that I felt compelled to cold-call the creator and tell him. Hadi Yousef graduated college just four years ago, and in addition to having a full time job in tech, he’s also become an investor in his spare time. He recognized the problem with IR sites that I’ve identified, and set out to do something about it.

Hadi launched Borsa Finance, the company that runs the Earnings Calls app, and has done some of the most painstakingly laborious work imaginable – getting every conference call audio file from every public company he can into his app. And if you search around, you’ll see that they’re all there – small caps, blue chips, every sector, every industry. You can even download these calls if you’re getting on a flight (lol) or going somewhere with spotty wifi. It’s miraculous what he’s been able to do. He’s got around ten thousand people currently using the app on a monthly basis and I told him it should (and will) be more like a million someday.

We talked about some of the ideas he has around building out a premium service within the app for buyside and sellside analysts, portfolio managers, etc, and having the more casual retail user boost its overall popularity and stick around for free. It’s a great idea – freemium works. Hadi thinks that curating insights from select calls or doing annotated transcripts and other value-adds will be coming down the pike as he builds out his team. I’m extremely bullish on this. I’m extremely bullish on Hadi in general. He has identified a huge opportunity in financial media and wasted no time building a solution for it, almost all by himself. This kid is going to crush it.

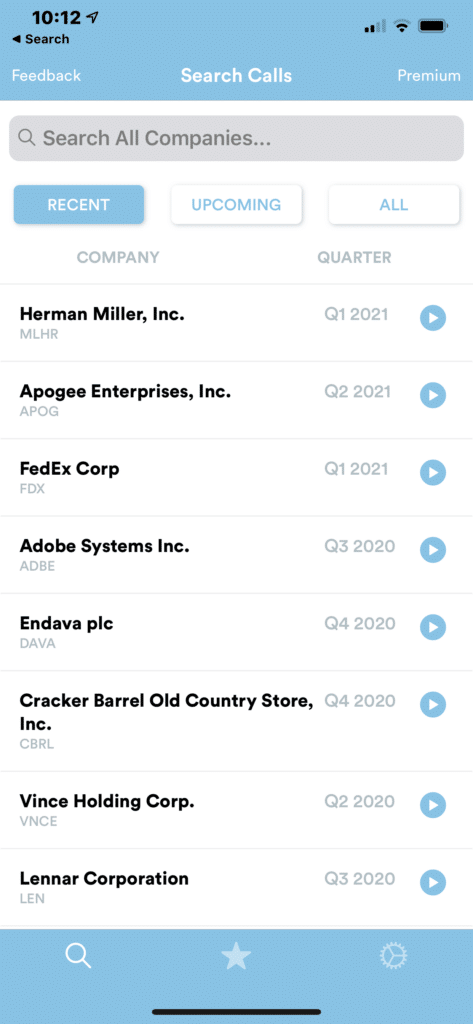

When you login to the app the first thing you see is a list of the most recent quarterly conference calls that have been added to the app and converted into podcasts:

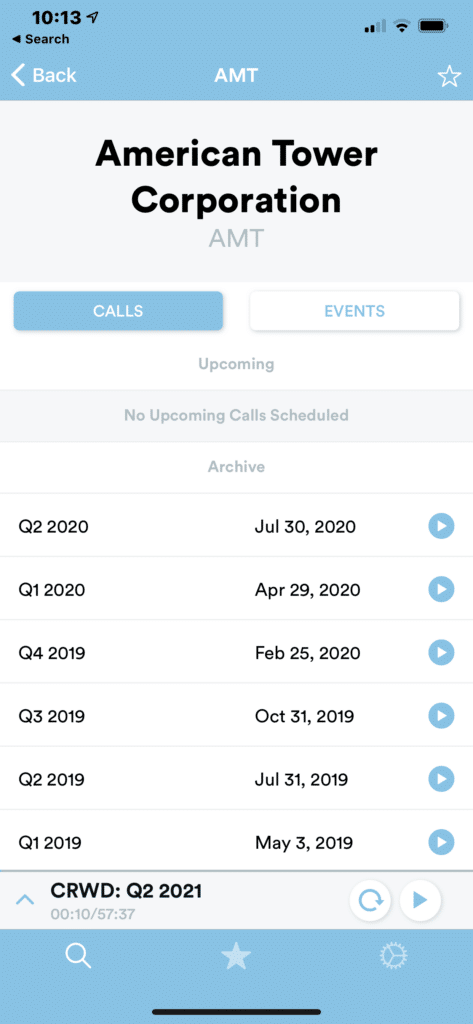

But you can search by company name and quickly find all of their recent calls in reverse chronological order, most recent call at the top. By hitting the star, you can build a list of favorites so the new calls in your universe of companies are even more accessible in the future:

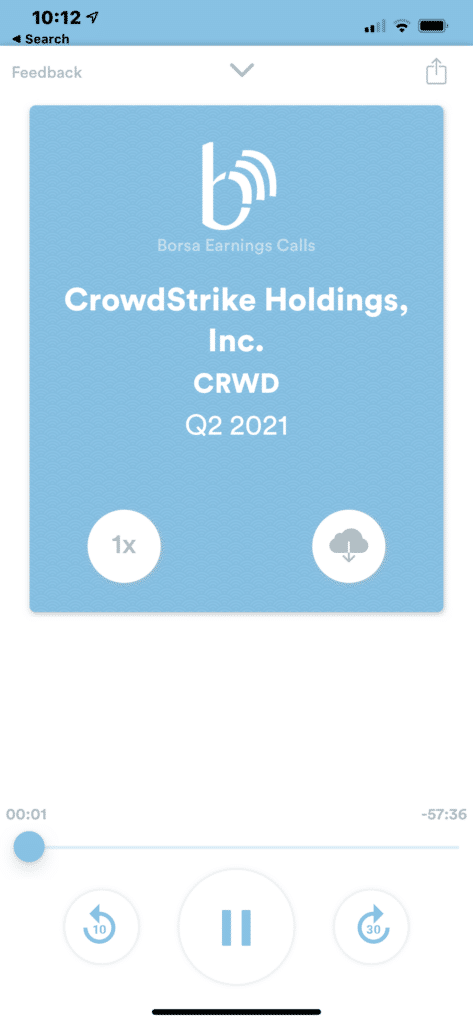

And then you just play it. And do whatever else you want to do while listening and learning:

So my suggestion for investors would be to incorporate an hour or two of corporate conference calls into their weekly routine. If you own individual stocks and are active in the markets, then you already know exactly which calls to start listening to. And if you’re more of a passive investor, then try to select company calls that are either important to the indexes already, or that you keep hearing people talk about but are not well versed in yourself.

After a few weeks of this, you’ll be a better, more informed investor, with an improved handle on what’s going on in the markets and why. And the next time we’re heading into earnings season, you’ll be able to have a playlist ready to go!

Apple / iPhone users: Get the Earnings Calls app here.

Google / Android users: Get the Earnings Calls app here.