This is the biggest story of the week.

Here’s JC Parets at All Star Charts:

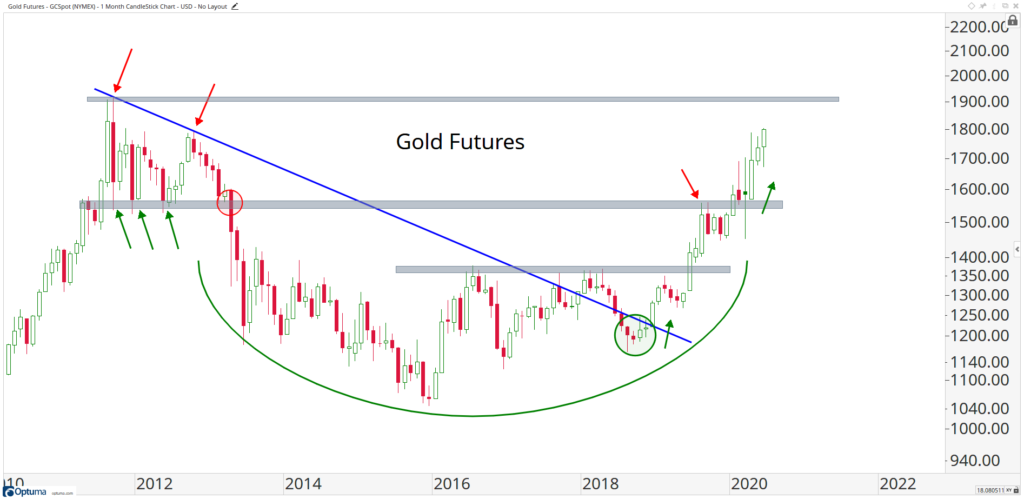

There has only been one other month in the history of the universe where Gold closed at a higher price than it did yesterday. That was August of 2011. The trend here is still up:

There will be a lot of conversations about why it’s going up.

Some are buying because of the coming political instability surrounding the election. Some are buying because the Fed and other central banks around the world are continuing to kitchen-sink the pandemic response, to the tune of tens of trillions of dollars. Inflation fears, deflation fears, geopolitics, pick your reason.

Asking people why they’re buying gold is like like asking people why they smoke weed.

Your college roommate used to say it helped him focus on studying. Your girlfriend smoked to party. You got back into weed when the kids were born to help you relax. Your dad secretly smoked weed to fall asleep. Your mom’s boyfriend with the crystals and turquoise jewelry smokes so he can “reach a higher consciousness, man.” And then you run into those people who explain to you why they use indica sometimes and other times sativa, and on and on. It’s endless. And it’s not really important what the story is. Price is all that matters, it’s just a commodity. Either people want more of it or they don’t.

In my experience, these things trend and feed on themselves. There will be some popular narratives that arise to “explain” what has already happened with gold’s price. People will adopt these stories and internalize them into a belief system. Don’t do this. Let’s not get religious about trades.

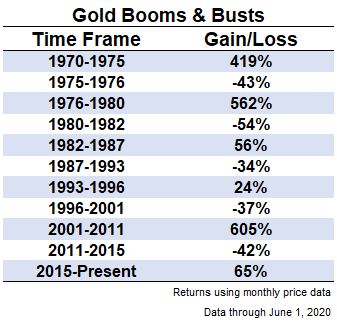

Like every commodity, gold is subject to dramatic boom and bust cycles. It’s always a trade, having negative expected returns, but if bought and sold well, people can make money being on the right side of these trends. My firm’s director of institutional asset management, Ben Carlson, wrote to our clients about gold last night, and put together this look at the boom-bust cycle for the commodity:

I don’t think there’s any information from the history of gold rallies and slumps that will be helpful to predict the future price – but this history is supremely helpful to understand the fact that rallies can go on for a long time and end as abruptly as they began. If you just kept in mind this one fact, you’d be way ahead of most of the people you’ll hear talking about gold in the coming months.

… [Trackback]

[…] There you will find 53547 more Info on that Topic: thereformedbroker.com/2020/07/01/the-gold-breakout/ […]

… [Trackback]

[…] There you will find 10454 additional Information to that Topic: thereformedbroker.com/2020/07/01/the-gold-breakout/ […]