Facts

“News guy wept and told us, Earth was really dying, cried so much his face was wet, then I knew he was not lying” – Five Years

As I write, over 1.6 million Americans have contracted the virus and almost 100,000 have died of it. We have more cases and more deaths than any other country. The city I work in and the county I live in are two of the hardest hit areas on the planet.

39 million Americans have filed for unemployment in the last two months. In April, corporate borrowers defaulted on $35.7 billion of bonds and loans, the fifth-largest monthly volume on record. 2020 is on pace to exceed 2009’s full-year bankruptcy record for public and private businesses with more than $50 million in liabilities. 15 million people didn’t pay their credit cards off last month. One fifth of renters didn’t make a rent payment for the month of May. Millions of mortgage and auto payments have already been missed.

During the last recession, there were 160,000 business bankruptcies between 2008 and 2010 – the majority of which were liquidations, not reorganizations. As much as the Treasury and Fed have done for us so far (more on that below), it’s hard to imagine we won’t at least match those numbers during the current economic emergency.

Bank of America Merrill Lynch estimates that there are six million small businesses in the United States that have between 1 and 500 employees and I am the CEO of one of them.

This is the story of how we fought for our small business so far and the adventures still to come. This blog post has its own soundtrack, and it’s ? percent Bowie (I went back to the classics in my isolation, didn’t you?). You can play it on Apple Music or Spotify while you read, or just go play it later.

I’ve screwed up a lot of things in my life but I wasn’t going to screw this up. It’s a crisis and the whole point of being a financial advisor is to help clients with advice – especially during a crisis. If I can’t get this right, then I’m of no use to anyone. At least, that’s how I thought about it.

Stress

“These are the days it never rains, but it pours” – Under Pressure

In the middle of March, I felt like I had the weight of the world on my shoulders. Which is not good, because the last two times I was hospitalized for crohn’s disease, it was from stress and overworking myself. And this spring was not exactly the best time to be rushed to an emergency room in New York.

February had been a great month for me, personally and professionally. I was working on projects I care deeply about. Celebrated my 43rd birthday on the 25th. I was looking forward to bringing my kids out to California for the first time to see my brother’s family. Disneyland too. We were so excited.

The night NBA commissioner Adam Silver canceled the rest of the season, everyone in America instantly understood that this was going to be a major, mass-disruptive event. We’ve never had a recession be agreed upon by 300 million people all at once. We’ve never had a recession caused on purpose because there was something worse out there we had to hide from. Historically, even wars have been stimulative for the US economy. This time was going to be different, and everyone knew it.

I couldn’t sleep. Maybe for weeks. And while there were people risking their lives in hospitals and saying goodbye to their loved ones, we don’t feel our own individual stress on a curve, or in the context of someone else’s. Even acknowledging, out loud, that other people are going through a worse situation doesn’t help us trick our own body into complacence.

Your hypothalamus doesn’t care about your relative safety compared to someone else’s as it sounds the alarm. Your amygdala doesn’t consider other people as it passes on its signals – this is an ancient part of your brain that developed to keep your great grandfather from being eaten by something with sabreteeth. Your pituitary glands don’t feel for others as they pump the adrenocorticotropic hormone which lets the adrenal glands know to pump their epinephrine, and so on. Your whole nervous system is now engaged, the gas pedal is pushed to the floor and held there. It’s not designed to react to your empathy for others, it’s designed for your own survival. And when it remains at this heightened state of vigilance for days on end, you’re in trouble.

Insomnia

“I’m sinking in the quicksand of my thought, and I ain’t got the power anymore” – Quicksand

I was never worried about getting COVID-19 myself. I stopped going into Manhattan during the first week of March because I take Stelara, an immunosuppressant. When we got our antibody tests back in May, we found out that my wife already had the virus but somehow I didn’t. Either I’m really lucky or one of our test results was false. But what I was really worried about was my business. While I couldn’t do anything about the health crisis, I knew what I had to do to for the firm.

We manage money for just over 1,000 families with a staff of 32. We can’t see any of our clients face to face right now. We can’t get together in a room with our employees to strategize. But we’ve got to carry on no matter what. It’s our only reason for existing.

And it’s not just money that we manage. We have our clients’ futures in our hands. Their freedom. Their hopes and dreams. The things they want to be able to pay for next year, next decade. The educations they want to fund, the memories they want to create. The plans they have for their final years. The legacies they want to leave behind afterward. It’s all on us. And what’s all on us is all on me. The decisions I make, the orders I give, the actions I endorse – everyone plays their part, but I have to own the result.

I don’t know how the industry CEOs I look up to, like Peter Mallouk, Ric Edelman and Ron Carson, handle times like these. I probably should have called somebody to talk about it. My friends in the industry checked in on me. “Everything’s fine, I’m good,” I bullshitted everyone, myself included. Tequila was involved. Before I forget, Sonya, Doug, Tyrone, Nina, Justin I appreciate you.

I know it’s not cool to run a wealth management firm and admit you have hard days or worry about stuff. You’ll almost never see anyone do it. It runs counter to the image they’re projecting. Fine, I’m the only one.

Crash

“Sailors fighting in the dance hall, oh man, look at those cavemen go” – Life on Mars?

The markets go from all-time record highs to a bar brawl in like ten seconds. The panic is primal. Oh man, look at those cavemen go.

The S&P 500 lost one third of its value over the course of three weeks while the CDC was laying out a scenario in which as many as 160 to 214 million Americans could get sick, with up to 21 million people needing hospital beds, of which there are just 925,000 available in the whole country. If you weren’t terrified after hearing that analysis from our leading health authorities, then god bless you. I was, even if skeptical that such a worst case would actually play out. Thankfully, we run rules-based strategies, systematically, and “Josh’s Feelings” are not an input to the models. Our tactical strategy, Goaltender, had taken some risk off for clients, but the drawdowns across global equity markets were incredibly severe. There were days where the NYSE was halted multiple times. There were ETF crashes and bond market spreads blown out like sails in a storm.

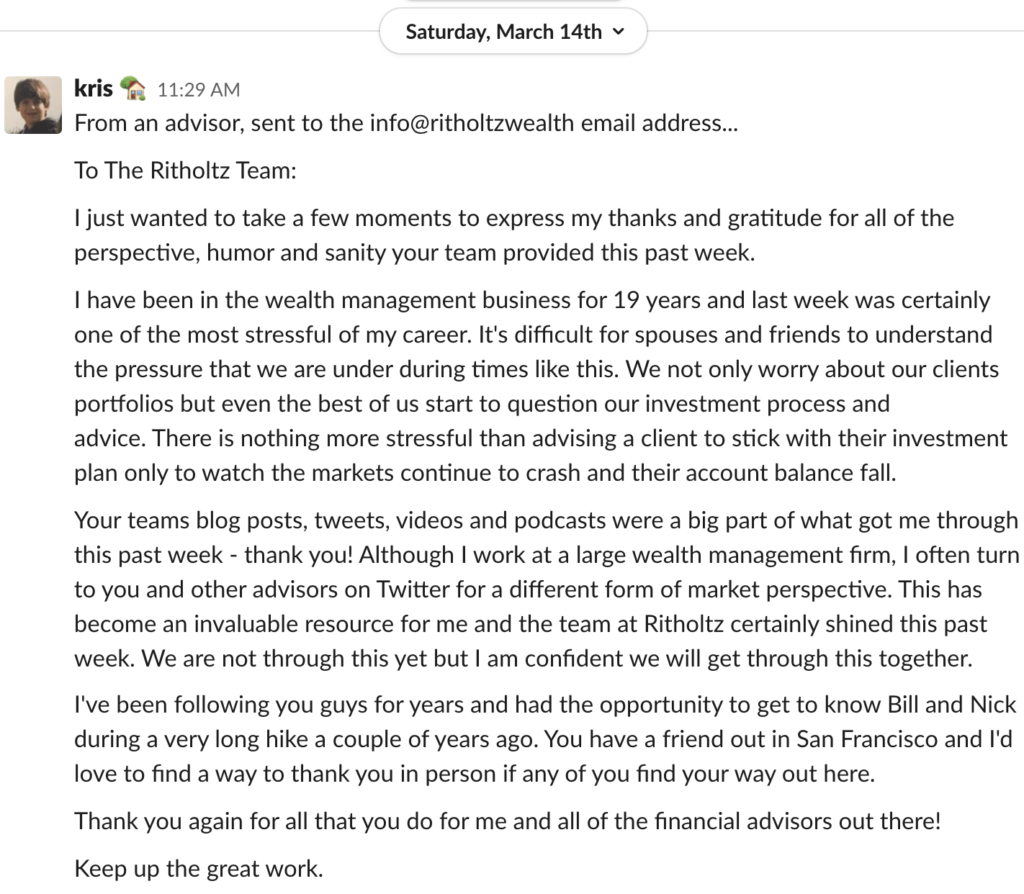

Looking back at those tumultuous early weeks, there was one skill I was able to lean on: Communication. I wrote my way through the crash. It’s really the only skill I possess in any noteworthy quantity, I’m not good at much else. But being able to effectively and persuasively communicate with everyone was the thing I had to be able to do.

I used my words. I used my tone. I delivered my message with conviction. I backed up my ideas with facts and logic. I tried to say things that were meaningful and encouraging.

Headlines

“Oh, my heart’s in the basement, my weekend’s at an all-time low” – Queen Bitch

The most crucial thing I put out was a letter during the second week of March, making a singular point about investing through a crisis. Write these words down for yourself; I learned them from someone and now you can learn them from me:

Without a doubt, the news will get worse from here. But its ability to shock us will diminish.

That’s it.

That’s the only thing you needed to understand to hang on to your portfolio and not trample on your own best laid plans.

You had to know this:

The news about the US economy was not getting better at the end of the financial crisis. But stocks stopped going down every time that bad news hit. Eventually, bad news fatigue had set in. This happened with regards to potential terror threats in the wake of 2001. It happened during the Asian currency crisis of 1998. It happened during the Latin American defaults of the same era. It happened during the Ebola scare of 2014. It will happen now.

As bad as the news will be, its ability to shock us will diminish. We will reach the point of “Let me guess, sales are down this month.” The shocks – and there are many shocks still to come – will continue. But our reaction to them cannot remain at the current intensity forever. We are not going to have a 75 Vix for six straight months.

But it wasn’t enough to just know it. You also had to believe it. As an advisor, you had to internalize it and embody it in the course of all your Zooms and calls and emails. As a client, you had to accept it almost ecclesiastically. How do you get people to do that? You write it and say it and repeat it and enforce it so many times, and with so much zeal, that the listener is literally submerged in the message.

This message has already turned out to have been precisely correct. When I write to my clients, I don’t expect the universe to comply with this sort of instant gratification. The news worsened and the market stopped reacting. As I write, the major stock market indices have recovered a great deal of their March losses already, despite continued deaths and infections. This has been incredibly rewarding for those who were able to grit their teeth through the economic situation and remain calm. Historically, this has always been the case, but the time frames differ.

People

“Don’t let me hear you say life’s taking you nowhere” – Golden Years

We didn’t have clients panicking out of their portfolios as the Dow Jones Industrial Average plummeted thousands of points and the hospitals in Detroit, New York, Chicago and New Orleans began to burst at the seams. Where there were cash needs and requests, we were able to calmly satisfy them because our strategies are all liquid. My traders and administrative staff never dropped the ball. I should point out that our twin custodians, TD Ameritrade and Charles Schwab, have been incredible throughout.

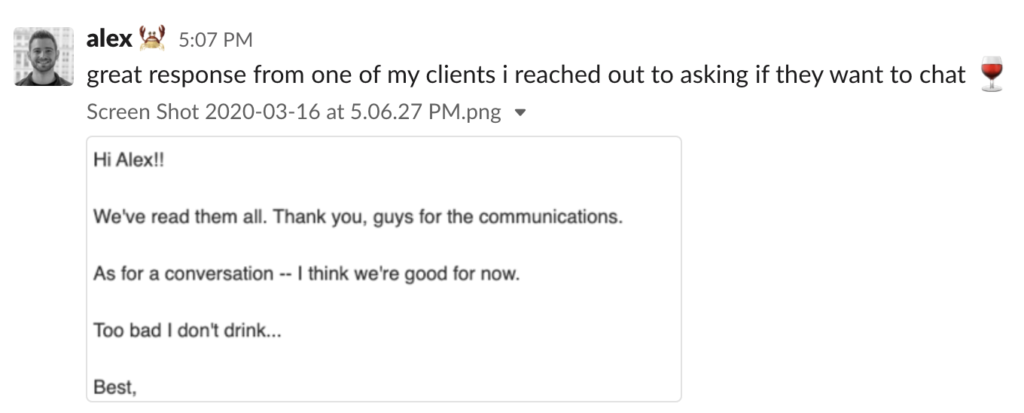

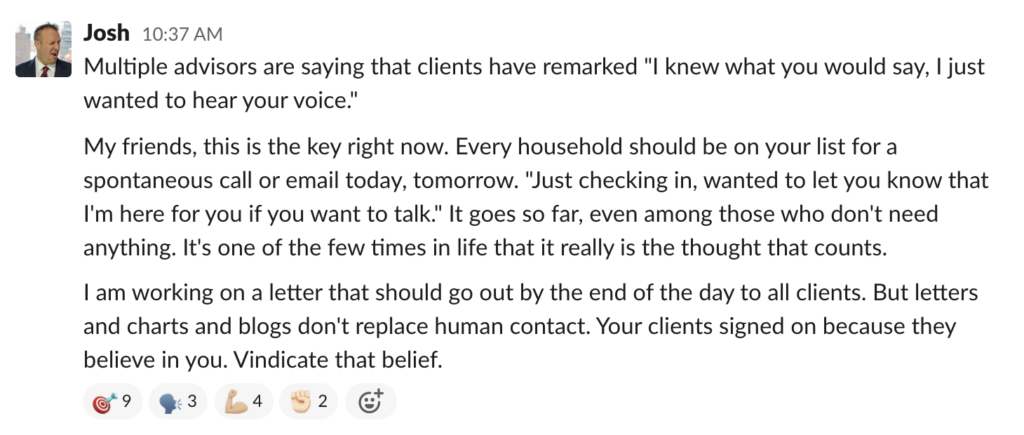

When you run a financial advisory practice during a crisis, you have to know that your client-facing advisors are on top of their relationships, offering guidance and encouragement, accentuating our risk management capabilities, suggesting contingencies and just genuinely listening. You can write all the update emails and quarterly letters you want, but they’ll never substitute for direct contact between a client worried about their retirement savings and a trained professional allaying those concerns.

Our advisors across the country have been handpicked by us and believe in what we’re doing, body and soul. They are mission-driven people, attracted to the firm’s philosophy from a time even before they worked here. I never had any doubt that these conversations were taking place for even a moment. My faith in our people might have been the thing that saved me from panic, just as I thought that it was I who was busy saving others.

Leadership

“Who knows? Not me. We never lost control” – The Man Who Sold the World

The restauranteur Danny Meyer (Union Square Cafe, Shake Shack), a hero of mine, explained in his book Setting the Table, that if you don’t take care of your employees first, then they won’t take care of your customers and your business will never reach its full potential. Here’s a version of this message, via INC:

Contrary to the popular mantra “the customer is always right,” Meyer says the best way to ensure a great customer experience is to put your employees first. After all, he adds, there’s no other way employees could outperform in front of customers if they don’t feel good about themselves. And if that doesn’t happen, how can your business outperform before your investors? “That’s how I came up with this counterintuitive prioritization,” Meyer says.

Of course he’s right. Look at the the most successful businesses where interactions between staff and customers are so critical, like Costco and Starbucks – it is apparent that their employees like working there, and this comes through in the customers’ experience, which eventually shows up in the form of dollars and cents for profit-seeking shareholders.

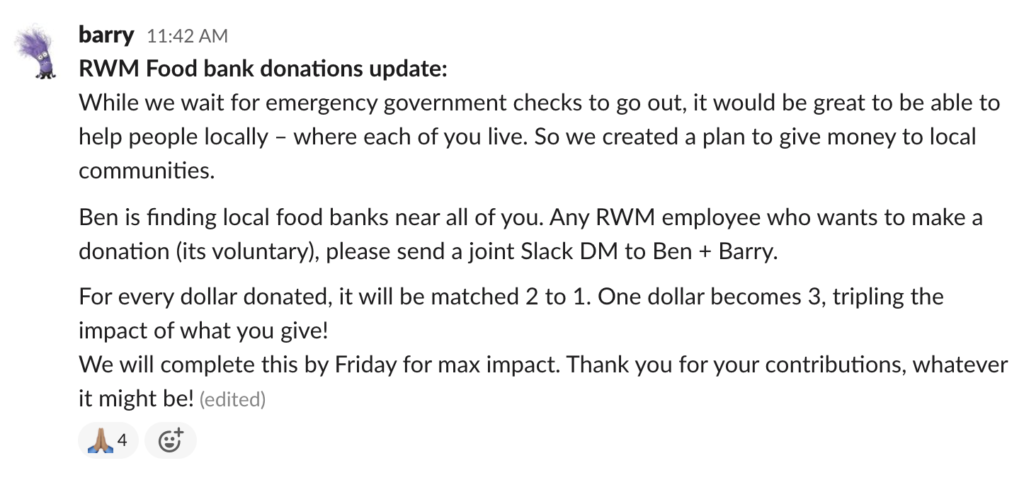

It helps that my partner Barry and I are on the same page about this topic. He treated me like gold back in 2011 when we began taking on clients together. He didn’t have to. Barry held all the cards and I was lucky to be there. I then watched him treat everyone we brought on to the firm in the same way. Benefits, 401(k) match, raises, time off, profit-sharing, firm trips, Christmas parties, spontaneous lunches – there’s never a conversation or a debate. Barry wants everyone in the firm to feel the way he does about what we’re doing and how we’re doing it. It’s innate.

Michael Batnick likes to joke that Barry speaks the same way to the guy who delivers our mail as he speaks with Ray Dalio or Mark Cuban. He loves people, all people. I learned a lot about leadership from watching the way Barry treats everyone. I had always worked in these horrid, eat-what-you-kill commission brokerage environments, where it was every man for himself and no one got anything without a fight. Nobody ever took care of me, so I got tough and learned to take care of myself. It didn’t go well. I never knew there was another way.

It took me years to acclimate to the environment Barry had cultivated around us. I spent a lot of that time waiting to see what the catch was, or for the other shoe to drop and kick me in the head. Never happened. Barry’s philosophy became mine.

Uncertainty

“We live for just these twenty years, do we have to die for the fifty more?” – Young Americans

My responsibility is to my clients, but I cannot meet that responsibility without my coworkers. I remind the staff of this every chance I get. It’s not a cliché. “I can’t do this without you – all of you – I need you all.” It’s become a mantra during my weekly Zoom meetings with everyone.

I made a promise early in the crisis that no matter what, I was not going to cut back anyone’s hours or lay anyone off. When my CFO Bill Sweet informed me that Q1 billing had already fallen 12%, I knew this wouldn’t be an easy promise to keep. But I have a habit of saying things from the heart and then doing whatever it takes to back them up after. I’m very insecure about letting people down, so putting myself in the corner is, perhaps, an inadvertent motivational tool.

The crisis sucks for all businesses and ours is no different. The things we aren’t able to do make me sad every time I think about them.

We threw a massive for-profit conference last year (Wealth/Stack) as we’ve done every year prior and spent twelve months traveling from city to city, speaking at events and meeting with potential clients and possible advisor hires. We had a firm-wide retreat in Austin, Texas last summer and we were planning our next one for this June. Over the last few years I went everywhere – Chicago, San Antonio, New Orleans, Kansas City, Toronto, Orlando, Nashville, Miami, Scottsdale, San Francisco, Milwaukee, Minneapolis, Detroit – all documented with smiling photographs on social media and new friendships in each place I visited. It became a way of life.

We expected to be able to carry on this year as always. I highly doubt we’ll be able to do anything at all now. Holding a massive conference with 700 attendees or traveling to meet prospective clients in 2020 seems like a fantasy today. It’s devastating because this is how we built the firm. The financial impact of these lost opportunities will be felt immediately, the emotional impact will linger on for longer.

Let’s talk about small business and its role in the economy for moment. This weekend’s feature at Barron’s, by Lisa Beilfuss, makes it clear how critical we are:

Small businesses are responsible for about half of U.S. employment, half of gross domestic product, and 40% of total business revenue.

Small businesses—those with fewer than 500 employees—and franchises together account for nearly two-thirds of the more than 20 million jobs lost since March, according to data from payroll provider ADP.

Thirty-nine million people have been thrown out of their jobs in the first six weeks of the crisis, with headline unemployment now at 15%, and firms like Goldman Sachs saying as many as a quarter of all working Americans could be unemployed before this ends. Well, not my employees. Regardless of how bad the recession or the markets get, regardless of how many of our clients are impacted by the economic fallout from the shutdowns. I’m not willing to let a health crisis that the government failed to protect us from jeopardize what my people and I have poured our hearts and souls into all this time.

Action

“Still don’t know what I was waiting for, and my time was running wild” – Changes

We reached out to JP Morgan Chase, our bank in midtown Manhattan, to see about the small business lending program. We don’t have any outside capital. We never raised any money or sold any shares to private equity firms. We have no backing from anyone else. We’ve always run the firm’s finances very conservatively, so we had no outstanding loans or debt, no lines of credit and no Plan B. Just an American Express card that gets paid off every month.

Fortunately, we are the epitome of an American small business. We qualified for the SBA-backed payroll protection loan after submitting our information and attestations. Two and a half months worth of employee payroll. I’m never comfortable taking on debt, but I’m even less comfortable about the idea of having to let people go. I would never be able to look myself in the mirror again if I had made that promise and didn’t back it up with action. It took a while for the approval to come through and I sat around my house praying it would all work out. During that two week stretch, I was probably impossible to live with. I don’t handle anxiety as well as I should.

But it did work out. Thank you, Chase Bank! Thank you, SBA! It’s the news I needed and it came at the right time. Many of our peers of a similar size and employee headcount throughout the industry were able to make use of the program too. Being able to assure the firm that we’re keeping everyone and honoring all of our financial commitments meant everything in the moment.

A family member who advises me informally about running the business helped me come up with an emergency plan for what and who I would cut if I had to in the early days of the crisis. I tore it up.

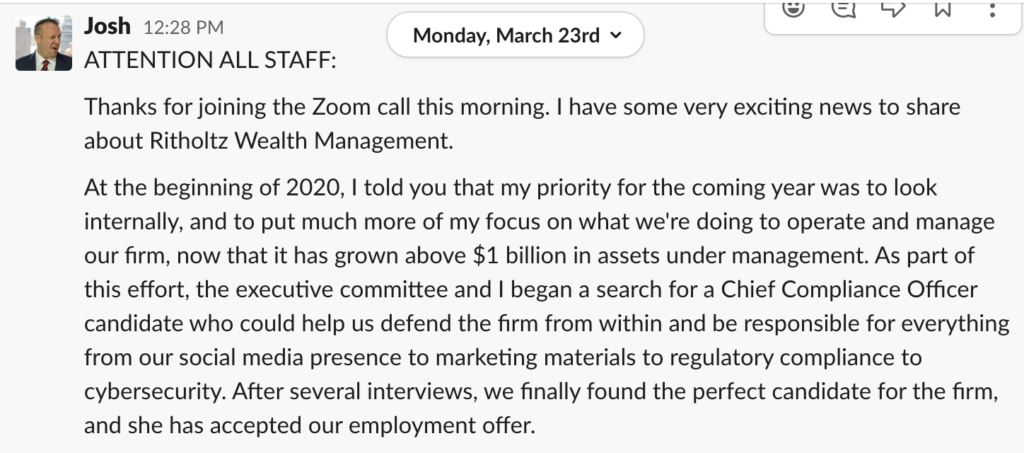

We had a new employee that we had made an offer to in February. She was about start work just as the world came to an end overnight. The first email she sent after the lockdown of New York City was an offer to defer her salary or renegotiate for lower pay. If you ever come across a new hire with that attitude, you know you’ve found someone truly special – that’s what they mean by the term true colors. I said “We’re paying you what we promised. You start on Monday, from your house.”

As of Friday, May 21st, the Small Business Administration had approved loans for 4,406,267 small businesses like ours. Four point four million businesses. So far, over $512 billion has been loaned out by 5,506 banks, fintech companies and other lending institutions. That’s an incredible total and it’s still climbing – there’s plenty of money still left in the program, over $100 billion as of this week. PPP is currently supporting more than 50 million jobs, according to Torsten Sløk, chief economist at Deutsche Bank Securities. Good.

The hope is that companies all across the country will do their part, keeping their staffing levels constant and not cutting wages while the economy has time to reopen. We won’t be able to guess at the success of the program until two months from early April, when the money began to go out through the banks. We’ll probably be better able to judge this fall when we can determine if two and half months of payroll ended up being enough for businesses to keep everyone on.

You won’t hear anything from the other hundreds of thousands of financial firms that borrowed from their banks to preserve payroll under the present economic uncertainty. Almost none of the four and a half million business owners across the country who took on debt to keep their workers will be speaking or writing about it. But I have this public platform, so I wanted to use it to express how grateful I am.

Team

“Then we could be heroes, just for one day” – Heroes

Late March gives way to early April. It’s raining constantly in New York and all I do is eat and work. Often at the same time. It’s disgusting. I should be locked away in an attic somewhere out of view, or confined to the belfry of a Gothic church. Don’t look at me.

I discovered Boursin cheese. Are you kidding me.

In client accounts, we’ve already pulled off a tactical shift and a rebalance into the falling market for strategic asset allocation models (they’re called Voyager, Pioneer and Mariner, named for NASA missions that had varying degrees of distance to travel). I have full-time traders who are doing the highly demanding and sometimes thankless work involved to make sure every trade that needs to happen is happening, every exception is being excepted, every rebalance goes off without a hitch and block allocations across models are matching up with the mandates of each individual household. It’s a difficult task in calm markets. In environments like March and April, it’s diabolical. But we’re doing it. So far so good, even though it’s possible that the worst is still to come. No one believes we’ve seen the lows.

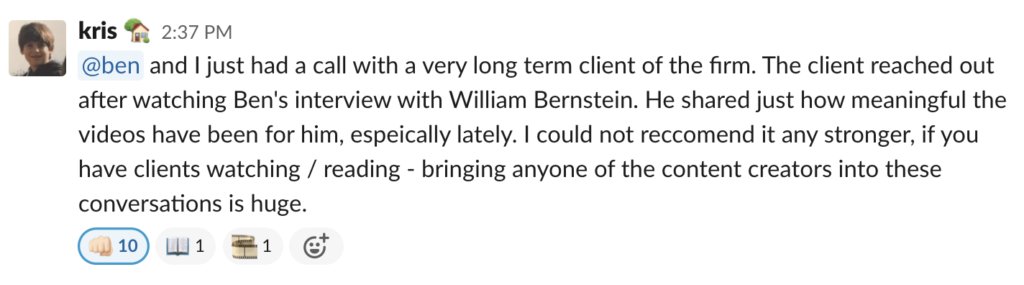

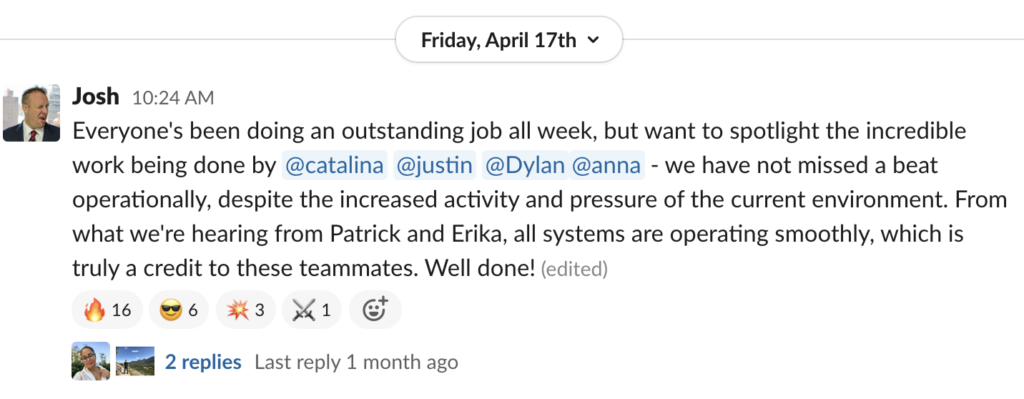

Our advisors are logging calls on Salesforce like crazy. I’m checking in with my partner Kris Venne, our director of wealth management, to see that everyone who is client-facing has the tech and broadband they need. Salesforce lets us know which households are hearing from us, how often and when. It’s working, they are rising to the occasion. They’ve even managed to bring on some new clients. The advisors are calling each other to check in and compare notes from coast to coast. This is happening organically, unbidden – I’m overcome!

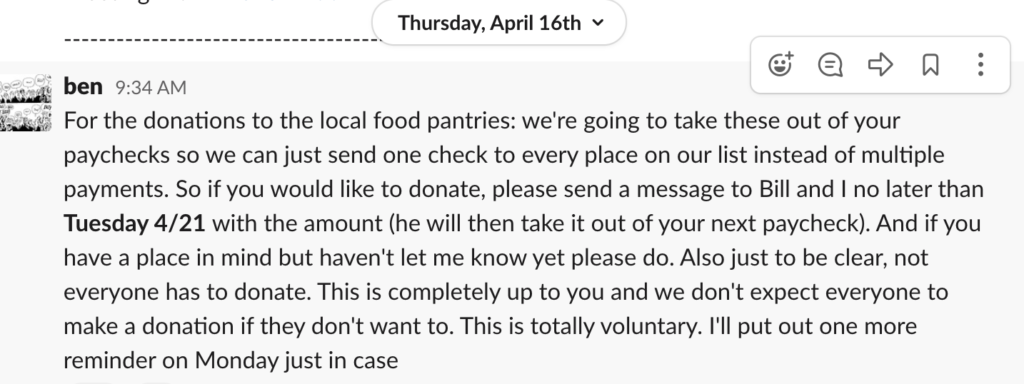

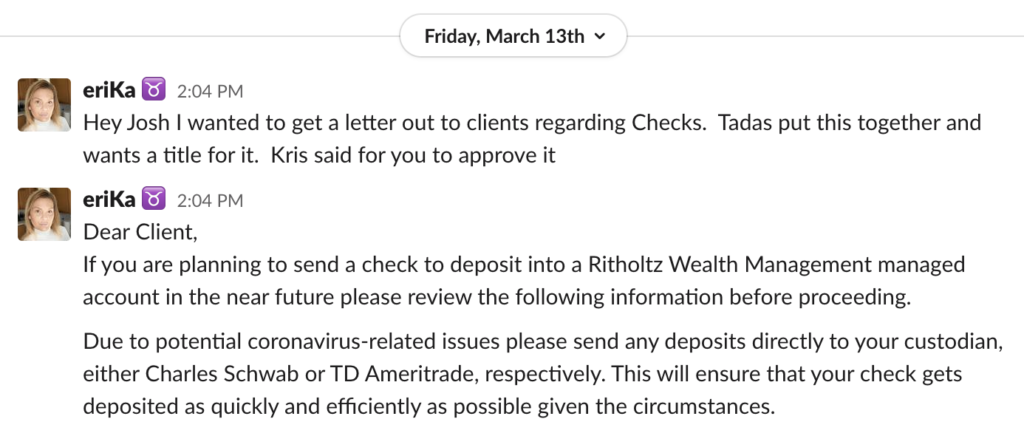

Our administrators are working from home, handling confidential forms and files, opening new accounts, executing client requests, sending and receiving money back and forth from banks to brokerage custodians back to banks. Mail is being forwarded to people’s homes. Documents are being stored in the cloud. Compliance procedures are being adhered to. Every task that is executed also has to be overseen. It’s the kind of work that keeps coming from eight o’clock in the morning and doesn’t stop until after five. Each morning brings an inbox full of fresh requests and orders. But we’re executing. My people are whacking every mole.

On the content side, we are cranking: Blogs, TV, YouTube, podcasts, columns, quotes, social media. All day. All night. Charts, stats, recollections of crashes past, context, history, science, psychology, data, opinion, news analysis, more context, more charts. Are you listening? Can you hear us? Are you watching and reading? Are we helping you? Are we getting through?

We’re shooting, recording, filming and editing content from our homes, collaborating across the country. Sure, it required some additional equipment and software, but what was really needed was the will to do it. We’re scrappy like that.

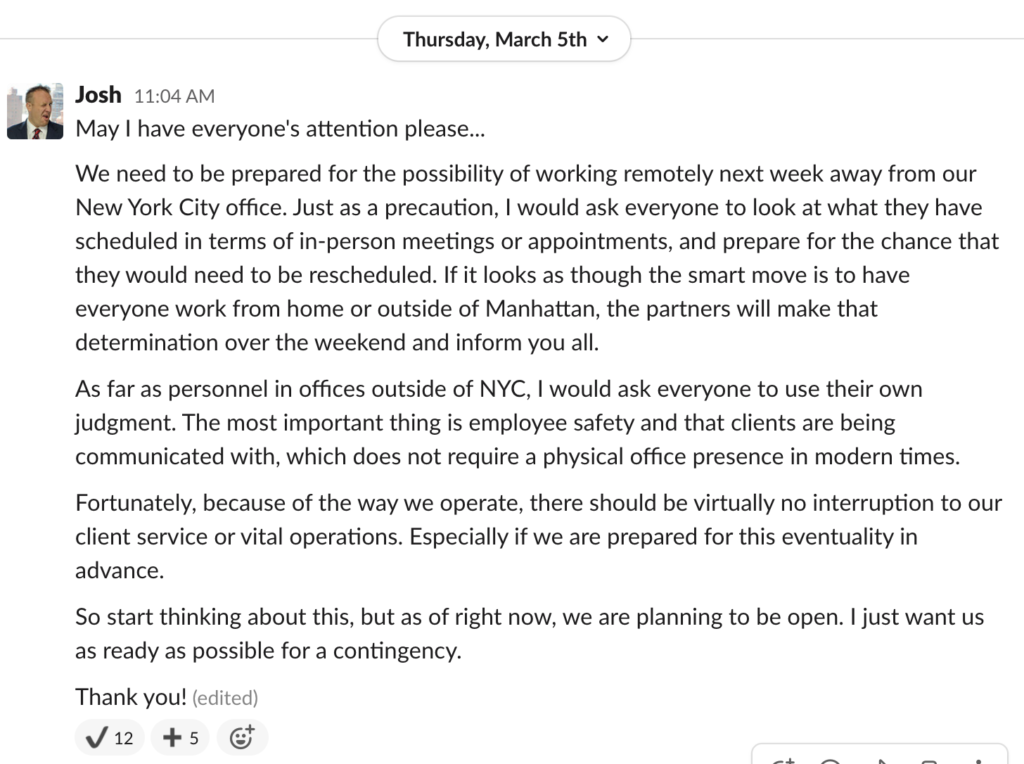

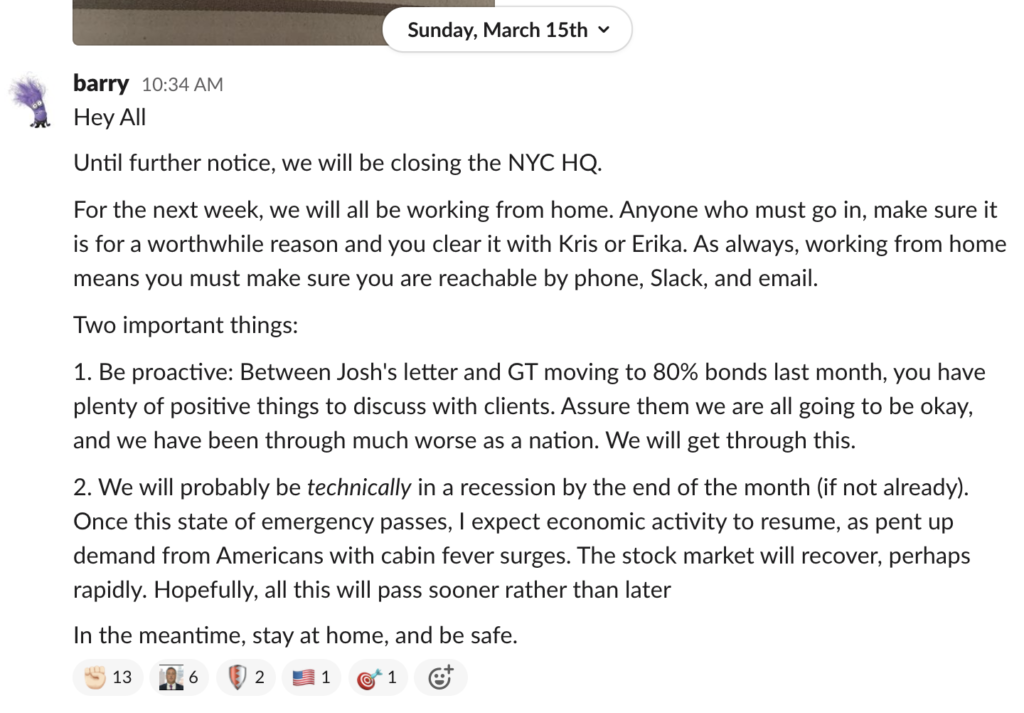

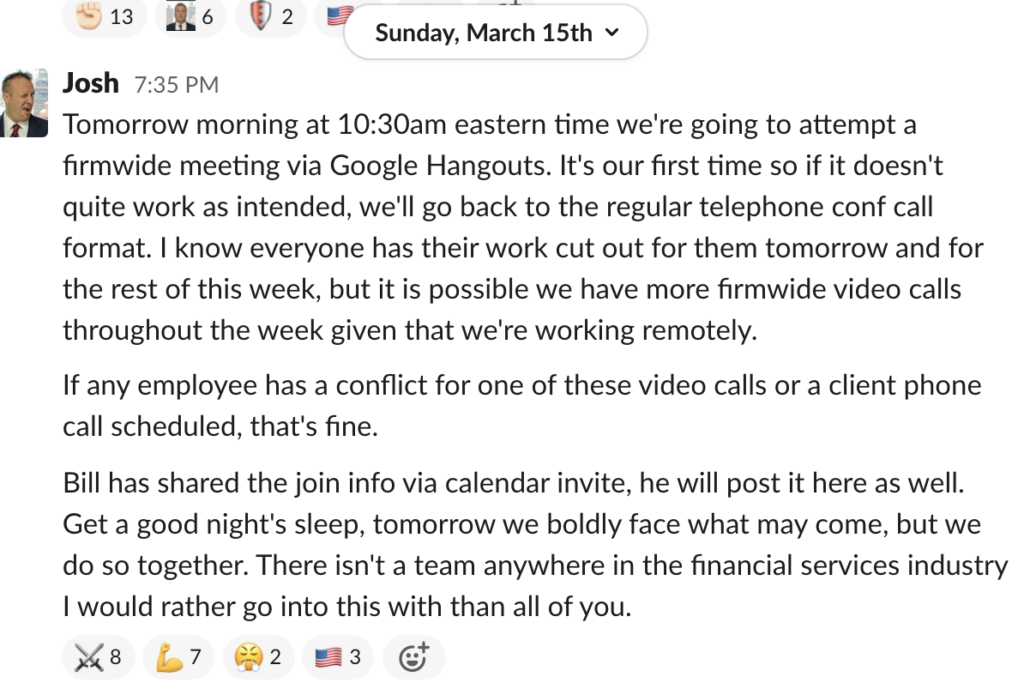

We’re remote but working as a team. Slack sits in the middle of all of it. Slack is a beehive. We are buzzing. I was joking around with Slack’s CEO Stewart Butterfield the other day saying “I feel like I should be paying you guys more.” He told me not to worry, there’s always a way to pay more.

There are errors here and there when everyone’s remote. Miscommunications that cost money. We’ll eat the costs. We’ll swallow the errors. It’s remarkable enough that we can operate under these conditions. It’s okay.

The reopen

“Now it’s time to leave the capsule if you dare” – Space Oddity

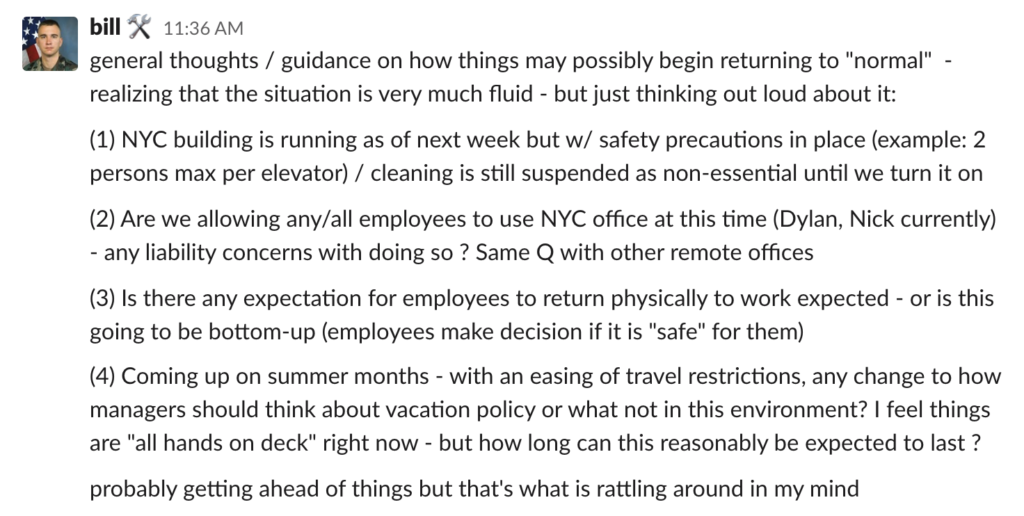

I have no idea how to reopen the firm. None. How could I? No one does. There is no instruction manual. There is no precedent. The feds are leaving it up to the states and the states are leaving it up to the business owners. There are rules and guidelines and guesses. Okay, here goes nothing! I’m guessing lots of cleaning supplies and a shared calendar will be involved.

My executive committee consists of eight men and women who are all doing their best to balance family and business, life and work. We’re now faced with some decisions to make about what sorts of risks are worth taking. The firm is burning tens of thousands of dollars per month on rent for facilities that we can’t even use. But I’m not calling the landlords and asking for anything. We’re paying, in full, on time. This is not a good reason for me to make people take mass transit to go and sit there. The cost is the cost, and we will bear it regardless. Safety first.

Based on what we’re reading and hearing, it is unlikely that we’ll have more than a few people in the office over the summer on any given day. It makes our jobs harder to stay remote but it makes our commutes shorter and we’ll just have to take the good with the bad. Before putting fifteen people in the New York area back on subways, busses, ferries and trains, I want to give it a few weeks to see if there’s a resurgence. There is an economic cost to that, but health comes first. This is the attitude many employers are exhibiting and I think it’s the right one.

As to our employees who are already remote, I leave it to their discretion when they want to resume seeing clients in person or reporting to their remote offices around the country. It’s not for me to tell people when they ought to feel comfortable. I can only provide them with the resources they’ll need along the way.

We told clients to remember what it felt like to live through this crisis at its worst. Save this memory. Store it away. We said someday we’d be asking them to access these mental files during the next crisis – whether two years or ten years from now. We’ll remind them how we got through it together.

This is how.

This is ourselves…

“Under Pressure” post soundtrack:

This post is dedicated to the 13,000 registered investment advisory firms in America and their 835,000 employees. Our industry serves 43 million clients nationwide and we are proud to be a part of it. Thanks to all of our colleagues who’ve shared their stories with us as we’ve shared ours.

slots for free https://slot-machine-sale.com/

coin slots still in vegas https://beat-slot-machines.com/

ali baba slots game free https://download-slot-machines.com/

free online igt slots https://411slotmachine.com/

horseshoe baltimore slots https://www-slotmachines.com/

caesars casino free slots https://slotmachinegameinfo.com/

dissertation writing tutors https://buydissertationhelp.com/

medical dissertation writing help https://dissertationwriting-service.com/

writing psychology dissertation https://help-with-dissertations.com/

apa reference dissertation https://mydissertationwritinghelp.com/

writing a doctoral dissertation https://dissertations-writing.org/