Josh Barro has a new piece at New York Magazine that looks at the way he’s thinking about his own investment risk. I have a quote in there about what it means when stocks and Treasury bonds fall together, as they did for a couple of days last week…

“When stocks and Treasuries both sell off, it only means one thing: Everybody’s trying to get their hands on cash,” said Josh Brown, the CEO of Ritholtz Wealth Management and a panelist on CNBC’s Halftime Report. He compared the situation to October 2008, when investors were selling not to adjust a risk mix but to meet urgent cash needs. Investors are selling not what they especially want to sell but whatever they can sell. It’s a sign of significant economic distress.

It is much more common to see correlation between high yield corporate debt and stocks than it is to see correlation between Treasurys and stocks. But it has happened. It’s very rare.

In 2017, Ben Carlson took a look at periods of time during which stocks and the Treasurys that are supposed to diversify those stocks both fell:

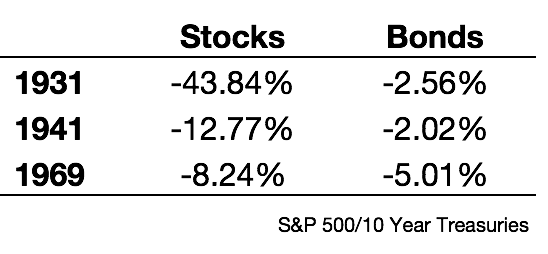

here are the three times since 1928 that stocks and bonds (as defined by the S&P 500 and 10 year treasuries) both fell during the same year:

Neither got crushed in the same year (in fact, the worst annual return for bonds since 1928 was -11% in 2009).

Josh here – the year after Ben wrote this post, 2018, it happened again, but the 10-year was only down .02% in total return, which we’ll say is flat, while stocks fell around 4.2% inclusive of dividends.

So, in only four years over the last century have stocks and bonds fallen together, and in all four cases bonds fell just 5% or less. This is how they work as a diversifier.

It’s only March, so we don’t know what the full year return for the stock market and the 10-year Treasury will be yet. I just think it’s important to remember that a systematic approach to asset allocation with rebalancing is as good a hedge as any if you can commit to it.

I also think that when both Treasurys and stocks are falling at the same time, it’s not decisions being made on the fundamentals of either that is driving the action. It’s usually because a lot of people are trying to raise a lot of cash at once. We should be careful not to conflate this activity investors betting on a particular outcome for these securities.

Sources:

How a Riskier World Has Me Rethinking Investment Risk (New York Magazine)

What Could Cause Stocks & Bonds to Fall Together? (A Wealth Of Common Sense)

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] There you can find 77266 additional Info to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Here you can find 30120 additional Information to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Here you can find 45733 more Information to that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2020/03/23/why-stocks-and-bonds-fell-together-last-week/ […]