How did you do this year?

Let’s take a hypothetical portfolio of 60% S&P 500 and 40% Barclays Aggregate Bond Index, on a total return basis. Assuming a single rebalance at the mid-point of the year, you’re up 20.1% for 2019.

Let’s say you had international exposure – this hypothetical portfolio consists of 30% S&P 500, 20% MSCI EAFE (foreign developed market stocks), 10% Emerging Markets stocks and then 40% in the Barclays Aggregate Bond Index. With this more globally diversified mix, you did 16.5%, assuming that same single rebalance at the end of June. Now of course, these are indexes, so if you’d expressed these allocation selections using the representative ETFs, you’d have had whatever trading costs were involved plus minor basis point fees (now trending toward zero in both cases).

On the equity side, the majority of these gains took place at the very beginning of the year during the recovery from 2018’s wet and wild finish, or at the end, as markets anticipated and then recieved a sort-of resolution to the trade war.

But of course, I’ve only shown you lines on a map, which tells you nothing about the sort of terrain we’ve had to trek across to arrive here. On that score, I’ll just say that of the 51 full weeks of 2019 so far, the S&P 500 closed within 2% of its 200-day moving average just 9 times (or during 17.6% of 51 weeks). So almost 85% of the time, you weren’t looking at the market’s trend and getting nervous. And, in fact, most of those 9 weeks during which we hovered within 2% of the 200-day moving average took place at the beginning of the year, as the markets fought their way back from the winter correction.

In terms of volatility, the Vix averaged 13.9 this year, which was 7% lower than its average of 15 throughout the course of the prior year. Things were cooler and calmer all around. Did you feel that way, though?

Here’s a pair of tricks I use at the end of each year that are worth considering for your own investing.

The first is cataloging a list of potentially scary things that went on throughout the course of the year now ending – you don’t have to write them down, you can just recite the list in your head and it’s good enough. And upon the recitation of each item, you close with “But I invested anyway.” It’s sort of like an Amen.

Here’s how 2019 would sound, for example – repeat it like a mantra:

The S&P 500 had no earnings growth over the prior year, but I invested anyway.

The House brought formal impeachment charges against the President, but I invested anyway.

Some of the smartest people in finance predicted recession, but I invested anyway.

The Fed was forced to begin cutting overnight rates to support the economy, but I invested anyway.

The last round of Silicon Valley “unicorns” melted down upon IPOing, but I invested anyway.

Auto loan delinquencies rose, causing the media to dub them “the new subprime”, but I invested anyway.

The national debt hit a record $23 trillion, but I invested anyway.

US government spending hit $4.75 trillion while its revenue was just $3.65 trillion – leading to a $1.1 trillion annual deficit, but I invested anyway.

A few of the frontrunners for the Democratic nomination were open proponents of socialism, but I invested anyway.

The trade war caused recession-like conditions for entire American industrial sectors, but I invested anyway.

Negative-yielding bonds proliferated around the world and the 10-year Treasury rate plunged, but I invested anyway.

China’s economy slowed to its worst growth rate in 30 years, but I invested anyway.

The President went to war with his own Federal Reserve chairman, but I invested anyway.

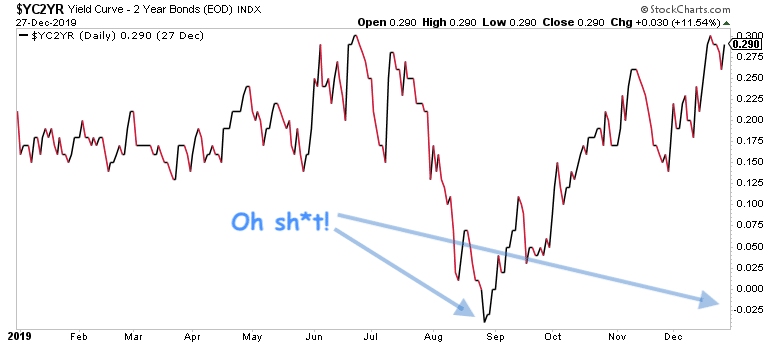

The yield curve inverted, but I invested anyway.

God, I love this chart – the difference (spread) between 10-year Treasury yield and 2-year Treasury yield. As this spread falls and then inverts, meaning the cost to borrow short-term rises above the cost to borrow long-term, it is said to represent a majorly pessimistic outlook on the part of investors, lenders and other very important people.

What a difference a few months makes. Between Labor Day and Halloween, we experienced the entirety of a fear-greed cycle on Wall Street with almost no fundamental change whatsoever in the actual economy on Main Street. This demonstrates the power of sentiment over the prices of investable assets. (You can watch the Father of the Yield Curve Indicator explain his creation to Michael and I this fall.)

In 2019, these issues (and others) caused tremendous headline volatility but very little actual volatility in the US stock market. It wasn’t preordained that things would have turned out this way. Any one of these issues could have caused significantly more downside for our investments and then the people warning about them could have said “I told you so!”

It’s also quite possible that some of the above items haven’t fully played out yet, and we’ve only seen the tip of the iceberg in terms of the threats they pose. I accept that possibility, as we all must. That’s why stocks and many pockets of the bond market are called “risk assets.” It’s the risk you’re taking that pays you, and it doesn’t pay you all the time.

Acceptance of this is mandatory if you intend to earn a return on your investable assets. There are those who tell you they can mitigate, or even eliminate, these risks, but even if they can, there is a price to be paid – sometimes a price higher than what the risks you were trying to avoid in the first place would have extracted from you! “More people have lost money waiting for corrections and anticipating corrections than in the actual corrections.” – Peter Lynch

The S&P 500 gained almost 30% on a total return basis for 2019. Those who embraced the uncertainty got paid. Those who fled uncertainty can now claim, with utter certainty, that they fell far behind their fellow investors once again. Their sole consolation – at least the macro newsletters were really interesting this year.

Here’s my other trick – I like to start off the new year assuming things are as good as they’ll get.

Of course, I have no basis to assume I’ll be right. There’s no way I could tell you anything about how 2020 will play out with any certainty. I have opinions. Some will be right and some will be wrong.

But if you start out with the assumption that next year’s gains will have a hard time matching this year’s, there are two roads you can take.

The first road, which is paved with good intentions but leads to the land of folly, would be to make drastic changes in a portfolio or to bet heavily on one particular outcome or another. This could drive a less temperate investor toward, oh I don’t know, swinging to cash, or excessively hedging with options, or doubling up on Treasury bonds and gold.

Then there’s the road I take. I assume that 2020’s 60/40 portfolio of US stocks and bonds, or 30/20/10/40 global asset allocation portfolio, will fall far short of the 20% or 16% gains of 2019 just as those on the first road do. But it is my response to this assumption that makes all the difference. Rather than making big bets based on a dour hypothesis for the year to come or enacting drastic changes to my asset allocation, I concentrate on how I can do well regardless.

And this leads to a commitment to raising my savings and investment rate.

Every month, my bank automatically transfers a certain dollar amount into my Liftoff account, which is an automated asset management service we built in partnership with Betterment. The contributions I make into Liftoff are in addition to my regular 401(k) contributions. The investment objective I built into Liftoff is geared toward using this money for my children far in the future. Maybe it’s for grad school or to help them out with their first apartments after college. As such, the allocation is on the aggressive side.

My wife and I decided to double our contribution to the Liftoff account beginning in January. This will require us to spend less on other things throughout the course of the year, which then forces us to look even more closely at what we spent money on this past year. It’s a helpful exercise on multiple levels.

Saving and investing twice as much next year as we did last year gives us a better shot at negating the possibility that next year’s returns won’t be quite as good. And, if the year should end with a negative return in the stock market, as 2018 did, that’s even better, given that we’re a decade away from putting the money to use at the earliest. The lower our average purchase of the Liftoff portfolio’s ETFs is, the higher the expected returns long-term. I’m not rooting for a year of poor returns, but I am saving and adding to that account as though it’s likely. And if the unthinkable happens, another blockbuster year for all asset classes, then so be it. You won’t see me upset about that outcome either.

Liftoff has no minimum and setting up your own portfolio on the site takes just a few minutes. If you’re a young investor just getting started, or a more experienced investor whose portfolio doesn’t yet meet the minimum for full-fledged wealth management, this might be a good option for you. Go ahead and check it out.

And use my trick – don’t count on high returns, count on yourself being able to increase how much you invest throughout the course of the coming year. It’s a way better use of your mental energies than predicting market returns, for the primary reason that you actually have some control over it!

Read Also:

How I invest my own money (TRB)

and

Try Liftoff here, there’s no minimum to get started

Here’s me and Michael Batnick talking about how we built Liftoff with Jon Stein and Dan Egan of Betterment this summer:

… [Trackback]

[…] Here you can find 36355 additional Information on that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] There you will find 21882 more Info to that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Here you can find 68968 additional Info to that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2019/12/30/two-investment-tricks-you-can-use-for-2020/ […]

order original cialis online

Health

buy cialis now

SPA