I don’t think I would ever invest money with someone who isn’t on Twitter.

Let me take a step back before you totally lose your mind over this statement.

My friend JC Parets sent this picture to me from 2010 – it’s me, him, Brian Shannon (@AlphaTrends) and Dr. Phil Pearlman (one of the founders of StockTwits). We invented Finance Twitter, talking about markets and investing and trading on the site before we even had a name for what we were doing. There were others, but not many, who were also active online at the time.

We came up with the cashtags, we came up with the conventions and the language of the thing, we were founders of a culture that eventually became way bigger than most would have imagined (Howard Lindzon knew what would happen, a decade in advance).

Lots of the early participants of FinTwit are gone now. Not, like, from the earth…just gone in terms of people following them or gone from the web period. This happened mostly because they added little value and people stopped following them or, in a few extreme cases, they were outed as scam artists or frauds (shout to Stock.ly).

For a long time, people giving financial advice were nameless and faceless, completely out of the public eye. They developed new business through referrals and in-person networking. They mostly worked for gigantic corporations and were dis-incentivized by their firms’ compliance rules from saying anything publicly or having any opinions that could reach beyond a one-on-one conversation with a single client at a time.

What I’ve found, in many cases, is that this was the best setup for these people possible. Because they didn’t have all that much to say, and lots of what they would have said about investing, fees, market timing, portfolio construction, fund selection etc would have been destroyed were it to have been vetted in a global marketplace of ideas. Twitter would not have been kind to the expressed opinions of the old school brokerage firm advisor, because for the most part those opinions would have reflected the sales cultures that most of us brokers had grown up in, myself included.

The social web would have been an unforgiving crucible for all of the things beneficial to a profitable big-firm brokerage practice. These ideas below specifically – and their proponents – would have been burned off like the impurities they are in the fires of evidence and proof:

- High turnover is better than low turnover

- The pursuit of outperformance is more important than costs and taxes

- There is a way to predict which managers will outperform

- Fund selection is more important than investor behavior

- Concentrated stock positions make more sense than diversification

- Reacting to news and headlines is a legitimate strategy for retail investors

- Markets can be bested by timing

- There is the potential for reward without a corresponding level of risk

- Following the moves of billionaires is appropriate for everyone else

- Strategists can foresee where stock markets will end the year 12 months in advance

These ten ideas, among many others, are the kind of thing that Boomers could be convinced of, despite a complete and utter lack of evidence. This was made possible by the fact that they were said in person, or over the phone, on a one-on-one basis, by nameless, faceless advisors in non-descript conference room settings, in living rooms, on a golf course or at a steakhouse over drinks. These ideas had never been publicly debated in an interactive forum like Twitter, for millions of people around the world to both participate in and observe.

Until the last five or ten years…

Since the advent of financial social media, they’ve been tested in the crucible and they’ve been found wanting. Some of the biggest beneficiaries of the debate raging on the web about investing truths have been companies that haven’t even participated. To my knowledge, there is no one from Vanguard, iShares, Dimensional Funds or State Street Global Advisors battling it out online each day – and yet they’ve recieved almost every investable dollar of the spoils of this war.

If you think the concurrent rise of Finance Twitter and rules-based investing as a default setting has been some sort of coincidental thing, you’re not paying close enough attention.

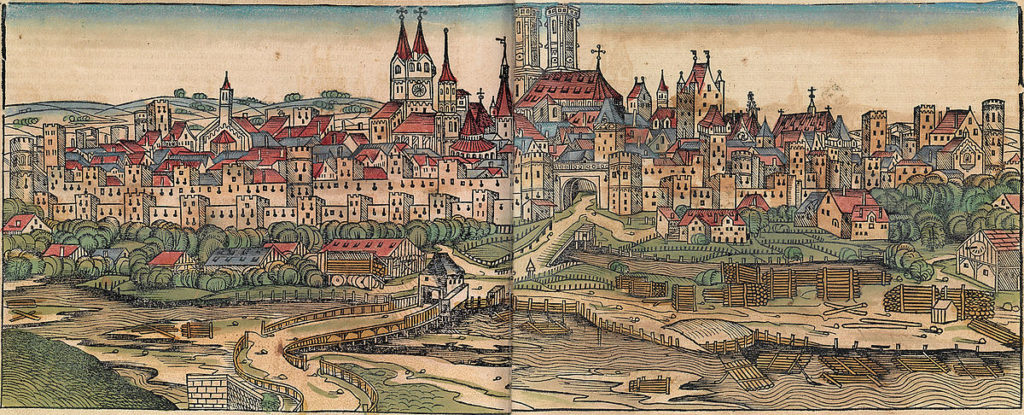

Johann Gensfleisch Gutenberg published his famed 42-line bible, on his newly invented movable-type printing press, in 1455. Within just a few generations, million of books are printed and distributed throughout the Germanic world and the Holy Roman Empire – including a multitude of German-language treatises by fiery reformer Martin Luther, who was the first to put the word of god into the everyday language of regular people. This led to an explosion in reformation movements beyond Lutheranism – in every country across Europe. Giving lay people a chance to discuss organized religion in their own tongue and to debate the worship of god separately from the dictates of faraway Rome’s corrupt and decadent Catholic Church opened the floodgates.

The monopoly on Christianity had been broken for the first time in fifteen centuries, and all of a sudden a multitude of belief systems and interpretations had a chance to flourish and do battle for the hearts and souls of millions. This sounds more high-minded and romantic than it actually was on the ground – an ocean of bloodshed and suffering was the price of this debate, for hundreds of years right up until modern times. In comparison, the flourishing debate over investment concepts has merely been paid for in the form of mutual fund redemptions and broker-dealer market share.

Now of course, the Reformation movements that swept across Christian Europe produced all sorts of destructive delusions and erratic conclusions as well, just as the chaos on the financial web has burbled up its share of false prophets, investing manias and dead-end belief systems.

Dan Carlin did an incredible one-off episode of his Hardcore History podcast called Prophets of Doom, which looked at what happened when an entire town went crazy once exposed to the power of German-language religious texts. “Murderous millennial preachers and prophets take over the German city of Munster after Martin Luther unleashes a Pandora’s box of religious anarchy with the Protestant reformation.” If you have a few hours of listening time, this shit will blow your mind.

But on FinTwit, these Prophets of Doom get exposed to the crucible and are soon discarded. James Altucher’s Triple Crown of horrible financial advice: “Don’t buy a home, don’t invest in a 401(k), don’t go to college” didn’t quite do him in, but the relentless flogging of tokens and crypto coins eventually did the trick. He went from being a lovable, quirky guy with an alternative point of view to a living punchline, the object of derision and nearly universal eye-rolling in short order as his off-kilter ideas were inevitably broken down, demolished by the crowd. Which is a shame, because James is one of the most interesting people I’ve ever met in this industry. I miss the old James.

Now imagine you are 30 years old, have been funding a 401(k) for eight years and are on the cusp of buying a home and establishing your first non-retirement brokerage account for the investing of your excess savings. You have been successful and are now engaging in what your peers refer to as “adulting.” Terrific! You come across an advisor who’s a friend of an older brother’s friend or an alumnus of the college you attended. He’s got investment ideas for you. He’s got recommended strategies and products.

Well, have any of his ideas been tested? Has he himself been vetted, by someone other than the firm that hired him? Is there any social proof anywhere online that he’s been deemed credible by a large group of people? No? No record of his thoughts on the markets being debated? No forum in which the things he believes about the right way to invest have been challenged?

He might as well not even exist, regardless of the glass and steel office tower he works out of or the 20th century brand name emblazoned across his business card. Who even are you? You have branded golf balls?

We may not quite be fully in the moment I’m describing – but do you have any doubt that this is where things are headed? Can you possibly not see that this is happening every day?

Just because someone shares their ideas on Twitter, or has a blog, or has engaged in some online debate about their philosophy, this does not automatically render them worthy of your trust and confidence in their ability to help you. Finance Twitter has a lunatic fringe all its own, which is part of the charm.

But can you imagine trusting someone who has never been actually’d and forced to change their mind? Who has never had the conviction in his or her own ideas to put them out in front of the world? Who has never been forced to come up with the research backing any of their claims? Who has gotten by, all this time, stating their beliefs in the shadowed safety of a phone conversation with the uninformed, and has never had to defend a single word of it?

Never? No record of any of this? No wins, no losses?

Not in 2019. And definitely not in the future. Why would anyone do such a thing?

***

This post originally ran here on July 13th, 2018

Talk to us about your portfolio or financial plan here. Certified Financial Planners are standing by!

[…] I don’t think I would ever invest money with someone who isn’t on Twitter. Let me take a step back before you totally lose your mind over this statement. My friend JC Parets sent this picture to me from 2010 – it’s me, him, Brian Shannon (@AlphaTrends) and Dr. Phil Pearlman (one of the founders of StockTwits). We invented Finance Twitter, talking about markets and investing and trading on the site … Source: https://thereformedbroker.com/2019/04/22/the-crucible-2/ […]

[…] Joshua Brown: The Crucible […]

… [Trackback]

[…] There you can find 31631 more Info to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] There you will find 72081 additional Information on that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] There you can find 88255 additional Information to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] There you will find 96713 additional Information to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] There you will find 77687 more Information to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]

… [Trackback]

[…] Here you can find 83851 more Information to that Topic: thereformedbroker.com/2019/04/22/the-crucible-2/ […]