The environment has been changing but it’s only really become part of the investor consciousness within the last two weeks: Suddenly, cash has a cost. Money isn’t free. Not every business model makes sense. Not every hurdle for investment is sitting an inch or so off the ground.

It’s this normalization of interest rates which, despite it being in effect for three years now, that has all of a sudden gotten some attention.

The yield on a 10-year Treasury now stands above 3%, and seems to want to stay there for the time being. This you’ve heard about.

What you may not have heard about is the fact that 1 to 3 month T-Bills are now yielding almost 2% (TWO PERCENT)! This is not a negative development, money ought not be free in a normal economic environment, only in an emergency should zero even be in the vernacular. But the realization that this is the case is only suddenly dawning upon people. As a result, businesses are rethinking their plans and their capital structure. They may be changing some assumptions about the return on investment of certain projects they’re planning.

This rethinking is also going on in the asset allocation realm. Last week, we rebalanced thousands of client accounts and these higher rates on short-term “risk-free” assets played a big role in our decision making. Once a hopeless drag on performance with expected returns of zero, short-term yielding instruments available to our wealth management clients can now play an expanded role in each client’s portfolio.

In real terms (adjusted for inflation), earning 2% on cash is nothing spectacular. But it’s very different that earning nothing or even losing to inflation. This condition ricochets up and down the asset class ladder, forcing new thinking about all levels of expected returns and risk. It’s a sudden shift in thinking, thinking that had been utterly unnecessary for years and years since the Great Recession.

Last week a bank in Arkansas blew up after reporting earnings that contained two shockingly large writeoffs that The Street had unprepared for. These were writeoffs related to commercial loans for construction projects – the kind of projects you see underway in cities and states all over America, skylines filled with cranes revitalizing downtowns, business districts and millennial-friendly urbanspaces everywhere.

The FT (via PYMNTS.com) had this to say about it…

“You do hear talk in the market that some banks have become really aggressive on some deals.” The FT reported banks with assets under $100 billion have significantly increased their commercial real estate exposure during the past few years, with it accounting for about 20 percent of the assets at these small banks as of the second quarter. The loans also include construction ones, noted the report. Five years ago that stood at 15 percent.

The stock lost 25% of its value instantly.

Will other regional and smaller banks have similar issues to report this winter, as the free money era draws to a close? How about the shadow banking complex of private equity and hedge fund direct lending, a relatively newer industry that’s probably taken on more risk than most of us could know about at this stage (they’re not deposit institutions so how would we know?).

Who else has gotten over their skis? If you’re pointing to the federally-mandated fortress balance sheets at JPMorgan or US Bancorp as evidence showing “all is well”, you’re looking in the wrong place.

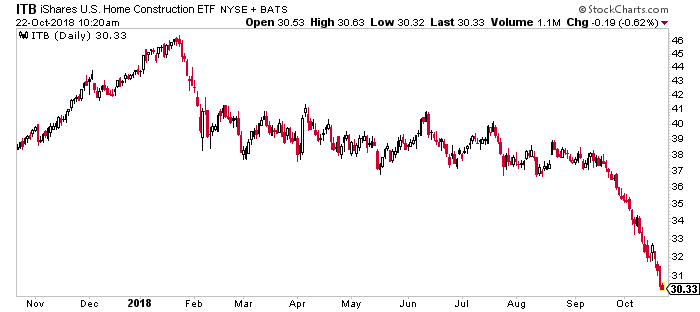

The automakers are screaming “top”, thanks to the end of ultra-cheap financing and the consequence of years of blockbuster sales (if you wanted a new car, you probably have gotten one by now). The collapse in the homebuilder stocks is screaming as well.

Finally, consider all of the equity-funded business models that have gotten off the ground in the post-crisis era, in virtually every industry – entertainment, consumer products, pay-as-you-go office space, financial services, etc. The predominant investing ethos has been “Get to scale, get all the users possible, don’t worry about profits – they’ll come when you’re the biggest player because of network effects.” Amazon did it, Netflix did it, Uber did it, AirBnB did it, WeWork did it, Tesla is trying to do it. It’s a real thing. And there was plenty of investor capital expecting nothing in the short term in terms of ROI, dividends, interest payments – just pure growth. Monthly Active Users don’t pay interest on a loan.

Will the appetites that supported this empire building be as insatiable going forward, when there is a cost to raising cash? When cash itself presents a higher hurdle in the form of competition for flows?

Hopefully these businesses have raised enough money for when investor tastes have changed. Not a single stock in the XLK (S&P 500 technology sector SPDR ETF) recorded a gain in the last month. Netflix just announced a $2 billion junk bond offering this morning to fund even more programming (raise money while you can, not when you have to).

At the end of 2013, the slow road to tapering stimulus began, very quietly. Despite the end of Quantitative Easing and the beginning of the rate hike cycle in ’14 and ’15, 10-year treasury yields had not yet made their ultimate low (that wouldn’t happen until ’16, right around Brexit and the run-up to our own elections).

Things changed more quickly with the accelerated economy served up to us thanks to soft deregulation, hard deregulation, the soaring confidence of aging white business owners and then, as a big, plump cherry on top, the massive tax cuts that took effect in 2017. And then suddenly, the market for money took notice.

The topping (or pausing) of the US stock market nearly perfectly captured this realization in January of this year. The echo-topping (or echo-pausing) we’ve just experienced in September nearly perfectly coincided with the next leg higher in bond yields. Assumptions are being re-assumed. Spreadsheets are being tweaked. Decisions are being re-decided.

As with the way Ernest Hemingway described bankruptcy, it happens slowly…and then all at once.

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2018/10/22/suddenly/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/10/22/suddenly/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/10/22/suddenly/ […]

buy cialis ebay

Health

order original cialis online

SPA