The current liberal fantasy: Special Counsel Robert Mueller will present a series of reports to Congress about the activities of the Trump campaign during and after the election along with some indictments, including one for the President for obstruction of justice. Congress will then begin impeachment proceedings and remove the President from office, ushering in the Pence administration, followed in short order by a Blue Wave in the 2018 midterms that renders Mr. Pence impotent (legislatively speaking).

Okay. Maybe.

Or…and I’m just thinking out loud here…we have another Saturday Night Massacre, wherein Rosenstein and Wray are removed from office, the new appointee at the top of the Justice Department ends the investigation with the stroke of a pen and everyone freaks out for a week, followed by some other distraction, like a surprise Kardashian pregnancy or another Hollywood star being outed as a abuser of women. Then we all gear up for the new NFL season and President Trump cruises into a third chaotic year in office.

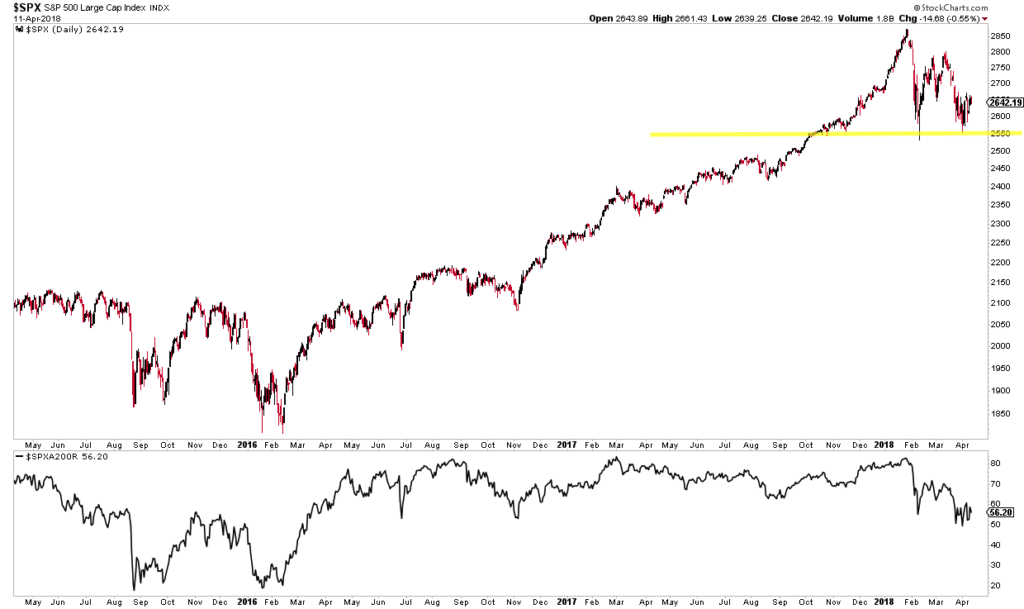

Which one of these outcomes is better for the mental health of the investor class? Maybe neither. Maybe the Constitutional Crisis brinksmanship pushes us through the floor established this past winter at around 2550 and then permanently puts risk appetites on a downward slope for the cycle.

I don’t think a rational person could believe they possibly know which of these things will happen but I do think it’s rational to say neither is good for sentiment.

Is it too hopeful to expect a third attempt on the support level in this market to resolve in a bounce? Is it more reasonable to believe that a third attempt will be the straw that breaks the camel’s back and takes us out of a trendless consolidation and firmly into a downtrend?

As you can see in the chart above, we’re down from the highs. In the bottom pane you’re looking at the percentage of S&P 500 stocks that are currently above the 200-day moving average – 56% of them are, meaning more than half of the market’s stocks are still in an uptrend. I’m not saying that’s bullish – in fact, until we’re closer to 30% or even 20%, where this measure of internals bottomed in the summer and then the winter of 2016, it’s too hard to say we’ve had enough pain to reset.

This is time when Wall Street’s Greek Chorus chimes in with “But earnings are going to be good” and “The economy is still strong.” If they still think that stocks trade on fundamentals or economics in the short-term by this point in time, these people are hopeless, lost causes.

So the question is, if (when?) we revisit support, will it hold? And what will (most) people do if it doesn’t?

[…] The current liberal fantasy: Special Counsel Robert Mueller will present a series of reports to Congress about the activities of the Trump campaign during and after the election along with some indictments, including one for the President for obstruction of justice. Congress will then begin impeachment proceedings and remove the President from office, ushering in the Pence administration, followed in short order by a Blue… Source: http://thereformedbroker.com/2018/04/12/will-it-hold/ […]

[…] Will it hold? (The Reformed Broker) […]

[…] Broker” Brown doesn’t sound like he’s willing to call any sort of bottom for the S&P. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do […]

[…] willing to call any sort of bottom for the S&P, even as he sees a floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) […]

[…] keen to name any kind of bottom for the S&P, whilst he sees a contemporary ground round 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do […]

[…] willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do […]

[…] the question is, if (when?) we revisit support, will it hold?” Brown wrote at his Reformed Broker blog. “And what will (most) people do if it […]

[…] the question is, if (when?) we revisit support, will it hold?” Brown wrote at his Reformed Broker blog. “And what will (most) people do if it […]

[…] the question is, if (when?) we revisit support, will it hold?” Brown wrote at his Reformed Broker blog. “And what will (most) people do if it […]