Rick and the Alexandria group on The Walking Dead meet a new character, “Jesus”, during one of their sojourns outside the compound they’ve been holed up in and he tells them something startling – there are other communities in the area with people trying to build lives for themselves in the post-apocalypse. He’s referring to the Kingdom and Hilltop, two other walled towns that they’re destined to interact with.

“Your world’s about to get a whole lot bigger.”

In the investing context, this sort of thing can be a blessing or a curse, or both.

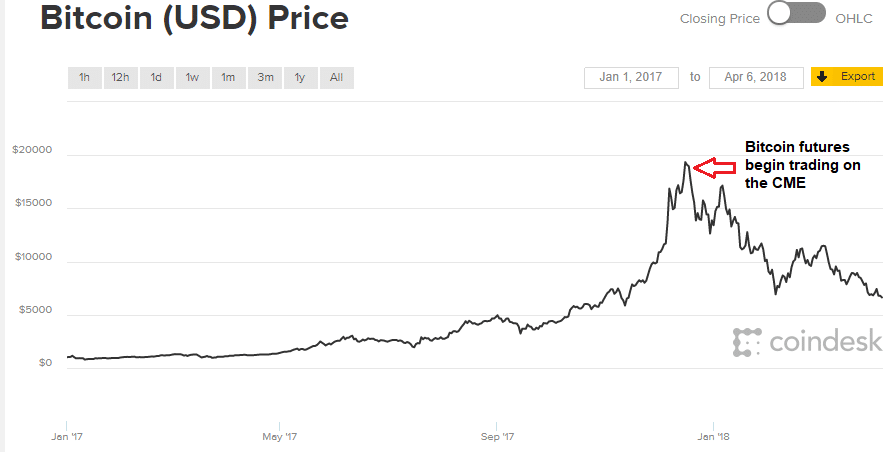

Ben’s got a piece up about how the introduction of “price discovery” may have played a role in cooling off the Bitcoin bubble. Can it be a coincidence that the moment larger institutions and short-sellers were able to make a two-way market in BTC that the price collapsed? A lot of people, myself included, thought that the introduction of futures trading in digital currencies would open up the market to even greater speculation. Nope. The opposite occurred…

The world got a whole lot bigger, and this introduced more opinions about the “value” and future direction of the asset. It was no longer a thing cosseted within the confines of the enthusiast community of HODLers and true believers. Now it was an asset accessible to much bigger crowd. I don’t think it’s had an up-month since.

The private or non-traded real estate investment trust (REIT) pitch from brokers to their clients was a deceptively seductive one – “these non-traded REITs will smooth out the volatility in your portfolio.” How exactly were they going to do that? Don’t real estate prices fluctuate just like the prices of all other investments?

What brokers were really referring to was the fact the prices of these non-traded holdings only posted NAVs – prices – to their client accounts once a quarter. Hence, less fluctuation would be apparent to the person checking their statements. This is not the same thing as saying they do not fluctuate, it’s just that the clients wouldn’t see it, just as they don’t have an updated ticker to look up the value of their house intraday or every week.

The non-traded REIT market collapsed as one of the responses to regulatory scrutiny after a wave of frauds and commission-related lawsuits was to bring ’em public and let ’em float. Absent the supposed benefit of having a non-fluctuating asset price, the investment rationale for holding them was gone. Brokers had made an astonishing amount of money (up to 10% commissions!) for putting client cash into these vehicles. And then the bigger world put an end to it as the truth came out.

The hedge fund industry used to be an obscure corner of the asset management business, with just a few dozen enterprising funds practicing the tactics and strategies that allowed them to garner huge, market-beating returns in all sorts of market environments. It worked well for investors and very well for the hedge fund managers and employees. This is the era in which virtually all of the famous hedge fund managers made their reputations and put up their best numbers ever.

After the Dot Com collapse, in which the “asset class” proved itself by making money (or not losing money) during a crash, thousands of new funds appeared out of nowhere to capitalize on the sudden popularity of “alternatives” to traditional investing. Over the next fifteen years, hedge funds went from managing a few billion dollars to over $3 trillion, with hundreds of thousands of people employed by the industry and the most successful edges, strategies and styles blunted by virtually endless competition for those big 2-and-20 incentives.

The bigger world has been disastrous for industry returns ever since. Many of the boldfaced names have retired. Those who’ve stuck around find themselves enmeshed in an endless cycle of negative headlines about underperformance, redemptions, fund closings the sort of blowups that result from straying away into new tactics and reaching for returns.

Quantitative strategies and algorithmic trading are undergoing this Bigger World phenomenon right now and many hearts will be broken. There aren’t going to be a hundred new funds that can replicate the success of Two Sigma or Renaissance Technologies. The allure of systematic trading strategies because of these success stories has led to a mass migration of dollars, effort and energy being put toward the hiring of quants and the setting up of substantial computer networks – akin to a gold rush, although the dollar amounts we’re talking about now dwarf what was going on in 19th century California. The mass adoption and ubiquitous availability of these tools and data sets and software programs will not be kind to future returns in the aggregate.

Success breeds competition and nothing attracts a crowd like a crowd. When the Bigger World intrudes, it brings in more opinions, viewpoints and data. It brings price discovery, blunts the edges of existing players and chips away at the information asymmetry that had been previously propping up the fortress walls of the incumbents. It’s good to be aware of this if only for the setting of future expectations and the management of one’s own emotions.

[…] Rick and the Alexandria group on The Walking Dead meet a new character, “Jesus”, during one of their sojourns outside the compound they’ve been holed up in and he tells them something startling – there are other communities in the area with people trying to build lives for themselves in the post-apocalypse. He’s referring to the Kingdom and Hilltop, two other walled towns that they’re … Source: http://thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

[…] By Josh Brown […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] There you can find 33860 more Info on that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Here you can find 2634 more Info on that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]

… [Trackback]

[…] There you will find 96770 additional Information to that Topic: thereformedbroker.com/2018/04/09/your-worlds-about-to-get-a-whole-lot-bigger/ […]