Wow.

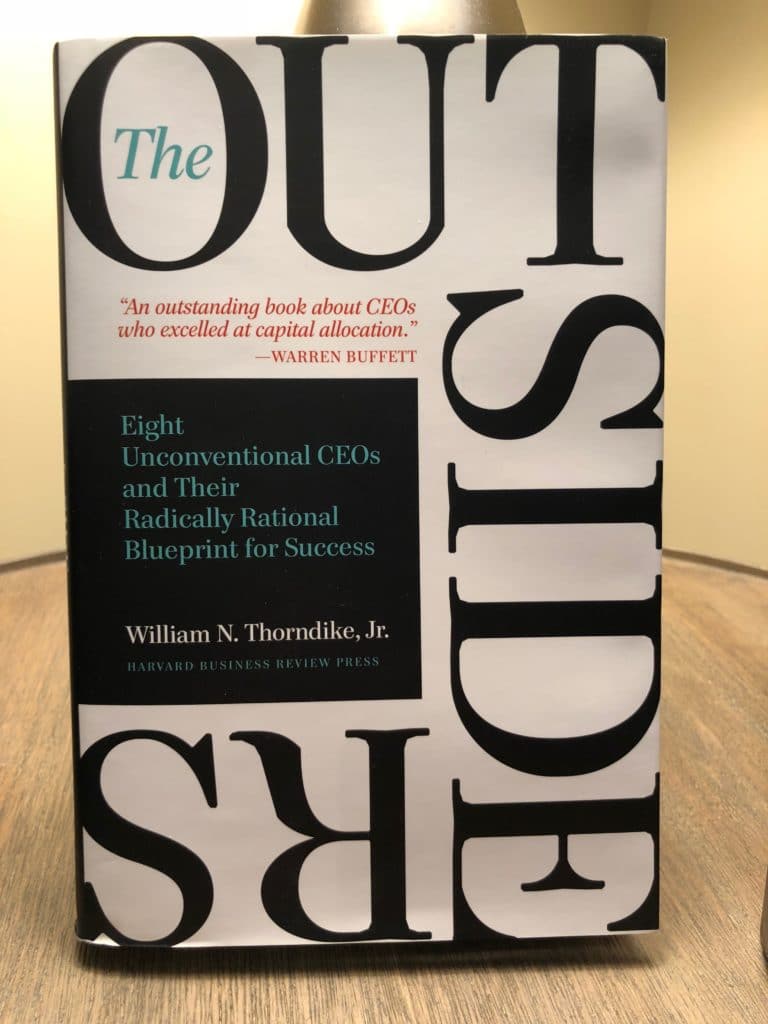

That’s all I have to say about William Thorndike’s The Outsiders, the fourth and final book in my first quarter curriculum. If you’ve been reading along with me, or have picked at least one of the four business books I read this quarter, then I truly hope you got to this one.

Okay, that’s not all I have to say 🙂

Written over the course of eight years with the research assistance of a group of Harvard Business School students, Thorndike set out to prove that Jack Welch was very far from being the best CEO, despite being perhaps the most famous at the time. In 2003, he began researching and by 2012, the book was published.

Let’s talk about the concept of being an outsider CEO – Thorndike selected people who had gained control of companies from out of nowhere, with non-traditional backgrounds and idiosyncratic ideas about how to build shareholder wealth, and then went on to absolutely destroy their peers and the S&P 500. With one or two exceptions, you’ve probably never heard of them and even their company names will only faintly ring a bell for you. But the returns on a dollar invested, in all cases, have been mindblowing.

There aren’t any tech visionaries or brilliant inventors on this list. The idea of the book is to take people who ran companies in ordinary industries show how they made their businesses extraordinary.

Achieving monumental returns through the use of capital allocation, decentralized decision-making, patience, sporadic risk-taking and ignoring Wall Street is a brilliance all its own.

“I’ve been thinking about it and our stock is simply too cheap. I think we can earn a better return buying our shares at these levels than by doing almost anything else. I’d like to announce a tender…”

There’s a lot of talk about buybacks these days. Not many people know that the practice has been behind some of the greatest stock market success stories of all time. And Henry Singleton practically invented the buyback as we know it today back in the early 1970’s. It was the tail-end of a secular bull market and any potential acquisitions his conglomerate Teledyne could have made would have been highly expensive and unprofitable. His peers kept buying, however, while Singleton embarked on a very different course with his growing cash pile.

Starting with that 1972 tender and continuing for the next twelve years, Singleton went on an unprecedented share repurchasing spree that had a galvanic effect on Teledyne’s stock price while also almost single-handedly overturning long-held Wall Street beliefs.

To say Singleton was a pioneer in the field of share repurchases is to dramatically understate the case. It is perhaps more accurate to describe him as the Babe Ruth of repurchases, the towering, Olympian figure from the early history of this branch of corporate finance. Prior to the early 1970’s, buybacks were uncommon and controversial. The conventional wisdom was that repurchases signaled a lack of internal investment opportunity, and they were thus regarded by Wall Street as a sign of weakness. Singleton ignored this orthodoxy, and between 1972 and 1984, in eight separate tender offers, he bought back an astonishing 90 percent of Teledyne’s outstanding shares. As Munger says, “No one has ever bought in shares more aggressively.”

These days, Jeff Bezos is widely regarded, deservingly, as a genius – both for the innovations of Amazon and for the way in which he’s managed the company’s investments and investors. He seemingly figured out that building the company’s sales and influence and competitive moat should take precedence over focusing on profitability. In the internet realm, scale and market share were the most important thing, and Bezos knew it 20 years ago. But this master stroke had been conceived of before…

Let’s talk about John Malone for a moment – another genius and quite possibly the originator of what Jeff Bezos would later come along and do with Amazon. Malone, the CEO of cable giant TCI, figured out that never showing a cash profit meant never having to pay taxes, and that continued investment was superior for long-term shareholders versus producing the quarter-by-quarter earnings per share magic number than analysts and market commentators tended to favor. Through his use of buybacks and leverage, coupled with a focus on cash flow (he invented the term EBITDA, now in common use), Malone was able to turn every dollar of shareholder capital into 933 dollars between 1973 and 1998. “Better to pay interest than taxes.”

His empire was created by saving a struggling business using financial acumen and innovative capital allocation…

The company Malone decided to join had a long history of aggressive growth and would soon be flirting with bankruptcy. Bob Magness had founded TCI in 1956, mortgaging his home to pay for the first cable system in Memphis, Texas. Magness, a peripatetic cottonseed salesman and rancher, had learned about the cable business while hitchhiking, and like Malone fifteen years later, had immediately recognized its compelling economic characteristics. Magness was particularly quick to grasp the industry’s favorable tax characteristics.

Prudent cable operators could successfully shelter their cash flow from taxes by using debt to build new systems and by aggressively depreciating the costs of construction. These substantial depreciation charges reduced taxable income as did the interest expense on the debt, with the result that well-run cable companies rarely showed net income, and as a result, rarely paid taxes, despite very healthy cash flows. If an operator then used debt to buy or build additional systems and depreciated the newly acquired assets, he could continue to shelter his cash flow indefinitely.

You should recognize the model Jeff Bezos employed, except he primarily using a rising equity price in place of debt. Malone was doing this in the 1970’s as the cable industry took off. Getting investors to accept a business model that put net income off for many years in order to focus on growth and cash flow was not an Amazon invention.

Growth was essential for cable operators because their biggest ongoing cost was programming fees. The more systems a cable company had, the more subscribers it could spread those costs out among – and Malone saw it early, allocating capital accordingly rather than paying dividends out and demonstrating profitability.

Malone used the cash flows shielded from taxes to continue expanding his cable systems across the country, focusing on rural systems as opposed to bidding high for systems in the big cities. When he finally sold out to AT&T, it was for record multiples on just about every metric.

The Malone and Singleton chapters are just two of eight amazing stories in the book. When these outsider CEOs had their profound realization about their business’s unique characteristics, they exploited it to build massive value for shareholders. In each chapter, we learn these lessons from the tenures of Tom Murphy (Capital Cities / ABC), Bill Stiritz (Ralston Purina), Warren Buffett (Berkshire Hathaway), Katherine Graham (Washington Post), Dick Smith (General Cinemas) and Bill Anders (General Dynamics). There are takeaways for entrepreneurs, investors and business managers on every page.

It’s interesting to see what they all had in common…

With the exception of Warren Buffett, all of Thorndike’s subjects bought back over 30 percent of the shares available over the course of their time as CEO (although Buffett encouraged buybacks at the companies he was investing in). None of the outsider CEOs paid high dividends and some of them paid none at all, in contrast with the conventional wisdom that dividends were among the most important features of an equity investment.

All of them were patient and spent long stretches of time being inactive – but then when the time came and opportunity arose, they’d each done a gigantic acquisition worth more than 25 percent of their own market cap.

None of them spent any time courting Wall Street, many of them said nothing at all to analysts, fund managers or the press about guidance.

Every one of them favored a small core team and built companies on the premise of radical decentralization, allowing managers in the field the autonomy to make good decisions. But when it came to capital allocation, this was handled by the CEO and one or two trusted lieutenants personally.

My big takeaway was how important the allocation of cash is – in the case of these outsiders, it trumped charisma, innovation, branding, public appearances, popularity on The Street, people skills or any of the other supposed virtues of the modern CEO. It even trumped revenue growth – the genius of Anders at General Dynamic was in his post-Cold War decision to build the company’s value by shrinking it. This was something no one else in the defense sector had even considered as they gleefully bought his assets from him, while he plowed the cash back into his own shares.

I recommend this book to anyone running a business or managing any kind of capital allocation process. I also think it’s a crucial read for investors because it gives you some idea of the attributes you should be looking for in a CEO or a well-run company. Of all the books about CEOs I’ve read, I think this one is probably the best.

Get it here:

The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success (Amazon)

The rest of the books below, in case you haven’t gotten to them yet:

You Are Remembered for the Rules You Break (Shoe Dog by Phil Knight)

Discipline Equals Freedom (Extreme Ownership by Jocko Willink)

Nine Rules for Managing a Creative Culture (Creativity, Inc. by Ed Catmull)

Bvlgari

[…]Here are a few of the websites we advise for our visitors[…]

Chloe

[…]just beneath, are several entirely not associated websites to ours, nonetheless, they’re certainly worth going over[…]

1 million website visitors

[…]we like to honor quite a few other internet web sites on the web, even when they arent linked to us, by linking to them. Underneath are some webpages really worth checking out[…]

123klussers.nl/klustips

[…]The data talked about in the write-up are a few of the best readily available […]

how to clone a willy

[…]Every as soon as inside a while we opt for blogs that we study. Listed below are the most up-to-date web sites that we select […]

how to use sex toys

[…]we like to honor quite a few other online sites on the internet, even when they arent linked to us, by linking to them. Beneath are some webpages really worth checking out[…]

interracial porn online

[…]that would be the finish of this write-up. Right here youll locate some web-sites that we feel youll appreciate, just click the links over[…]

ben wa balls

[…]Wonderful story, reckoned we could combine a few unrelated data, nonetheless genuinely worth taking a appear, whoa did 1 discover about Mid East has got more problerms at the same time […]

romanticismo inglese

[…]Wonderful story, reckoned we could combine a couple of unrelated information, nevertheless actually really worth taking a look, whoa did a single understand about Mid East has got much more problerms too […]

http://www.hunnitbrand.com

[…]Here are some of the websites we suggest for our visitors[…]

sexawy

[…]Here are a few of the sites we advocate for our visitors[…]

FS19 mods

[…]we came across a cool web page that you simply may well enjoy. Take a search in case you want[…]

farming simulator 2019 mods

[…]below youll uncover the link to some web pages that we assume you need to visit[…]

porn stories

[…]one of our visitors recently suggested the following website[…]

Stepfamily Porn Online

[…]Sites of interest we’ve a link to[…]