Last night we held our Q1 client-only conference call. Typically, we have our client-facing advisors solicit questions and for Michael and Barry to tackle with slides and our house view on these topics. This time around, there was a heavy emphasis on rising interest rates and the way we think about fixed income.

One of the more important points we try to make in these conversations is that rising rates are not to be feared, because quite frankly they’re the only way anyone’s going to make any money in the sort of US Treasury / high-grade corporate allocation we utilize to balance accounts.

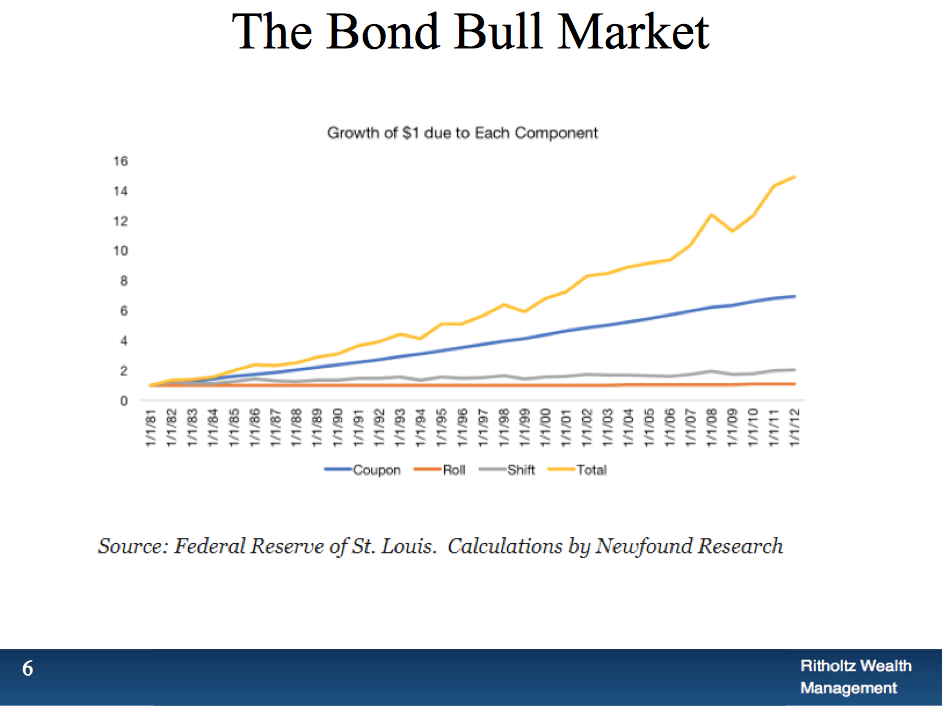

There’s a widespread misperception that bond investors owe most of their returns to the 36 year bond bull market in price – and that should bond prices now be in a bear market, that tailwind will go away. The logic follows that people should abandon bond holdings if the bull market ended and prices are going down / rates are going up.

But it’s not quite that black and white.

Yes, in a rising rate environment there would be a decline of principal for bond investors at first, but the higher yields on offer ultimately swamp that initial decline. In fact, when you look back at the source of investor returns in bonds since the inception of the bull market (early 1980’s), it turns out that almost all of the return came from the coupon or yield – and very little actually came from capital gains (bonds rising in price).

We threw in this slide via the St. Louis Fed and our friend Corey Hoffstein to illustrate the point:

Now, of course, there isn’t any earthly way to be sure of any of the following:

- will rates actually continue to rise?

- what is the terminal rate for this rally in yields?

- for how long would rates remain at higher levels?

- is the rise cyclical or secular?

- what will total returns be for Treasurys and corporates?

- would a rise be gradual or a spike?

- will bonds fulfill their purpose as ballast against equity drawdowns?

Everyone has opinions about these things, but no one has any concrete answers because the future hasn’t happened yet. That’s why they call it the future.

But one thing we know historically is that capital gains from rising bond prices have not been the reason investors have made money in fixed income. The gains came, overwhelmingly, from the yields themselves.

So rising yields, even if initially painful, are actually the key to earning future returns from fixed income – they aren’t going to be the reason for losses long term. Investors with bonds maturing at lower rates can reinvest at higher rates, systematically if using a ladder or opportunistically if actively managing a portfolio.

I also want to point you to this excellent piece at Sellwood Consulting that gets way further into the topic.

The next time you’re assaulted by people screaming about “IT’S A BOND BEAR MARKET” be sure to come armed with facts.

***

Talk to us about your portfolio or financial plan today. Certified Financial Planners are standing by.

[…] Last night we held our Q1 client-only conference call. Typically, we have our client-facing advisors solicit questions and for Michael and Barry to tackle with slides and our house view on these topics. This time around, there was a heavy emphasis on rising interest rates and the way we think about fixed income. One of the more important points we try to make in these conversations is that rising rates are not to be feare… Source: http://thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Here you will find 37423 more Info on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2018/03/29/you-oughta-know/ […]