My friend Larry McDonald put out a note to subscribers of his Bear Traps Report last night about the “game changer” that has happened in the interplay between bonds and stocks this past week.

He notes that, unlike previous spikes in volatility for the stock market, this time around bonds did not act as a great diversifier, having shown investors a drawdown of their own as yields rose.

And I can tell that Larry is concerned about this development because the font sizes in his note range from normal 11pt to 24pt to 36pt IN BOLD.

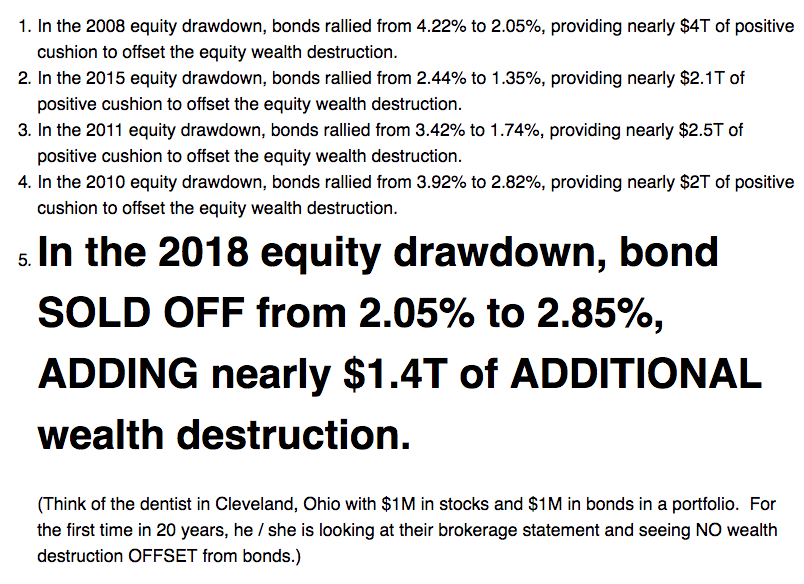

Some stats he shares:

(you can subscribe to his stuff here, btw)

Anyway, one of the most interesting things going on right now is the fact that bonds and stocks have indeed become correlated on this very short-term time horizon. As of Friday, the Barclays Aggregate Bond Index ETF, AGG, was in almost a 5% drawdown from its high as US stocks had fallen about 10% at their lowest levels. Diversification between the two major asset classes did not do anyone any favors.

But I want to mention a few things that are worth pointing out for investors…

The first is that one or two weeks worth of intermarket analysis do not much help anyone with a twenty year time horizon for their portfolio. Correlations are like Kristen Stewart – moody and unfaithful. Just when you think you’ve got a relationship nailed between two asset classes, they go and do whatever they want, up to and including making out with some sonofabitch director while Robert Pattinson, who deserved so much better and is a perfect angel of a man, hears about it from those heartless orcs on TMZ.

Sorry, I’m still not over it. #TeamEdward 4 Eva.

Anyway, we have no reason to suspect that Treasury bonds and stocks will continue to fall together for any meaningful length of time. As my colleague Ben Carlson has noted, the correlation between 10-year Treasurys and the S&P 500 over the last 89 years has been .03, meaning there is almost no relationship between the asset classes at all.

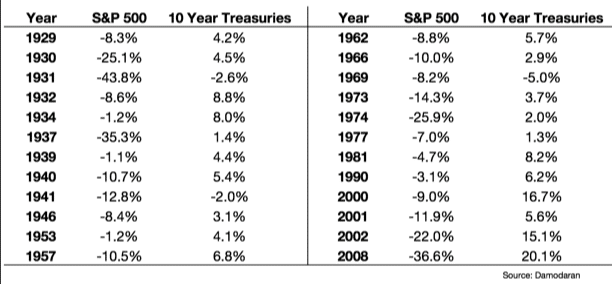

Ben goes on to point out that even in “rising rate environments” of the past, bonds have mostly gotten the job done in cushioning the blow to portfolios when stocks have fallen. Note that some of the below episodes have taken place during good years for stocks and some occurred in bad years:

Stocks experienced a down year roughly once every four years during this period. Bonds had positive returns 21 out of 24 times. This means that over the past 90 years or so, stocks and bonds have only fallen during the same calendar year on three separate occasions.

Josh here – My firm’s director of research, Michael Batnick takes it a step further:

Stocks and bonds (S&P 500/Barclays Agg) have never had a negative return in the same year (inception 1976).

The last time stocks and the ten-year both had a negative annual return was 1969.

Stocks diversify bonds- going back to 1928- there were 16 years that the 10-year had a negative calendar return. The average return for stocks during those years was 12.7%.

Could 2018 be the first year in almost five decades where both bonds and stocks end up with negative returns? Of course. Anything can happen. But historically, it’s a low probability bet. Which brings me to my next point…

One of the reasons bond yields are rising is because the global economy has improved far beyond the point where “emergency” overnight rates are necessary. The Fed has been hiking and overseas there is talk of tapering the multitude of stimulus programs that had been necessary to repair balance sheets and keep moribund economies on life support.

They’re no longer necessary. So bond yields are rising to account for this fact. I thought we wanted faster economic growth, rising wages and increased productivity. Did I miss a memo?

You can argue that the speed at which this is happening is alarming – in fact, this is the argument the stock market has just put forth in its somewhat violent adjustment since the end of January. But if rising rates begin to produce a level of instability and uncertainty in the markets and the general business climate, then it’s a fair assumption to make that rates will ultimately cease to rise – the “problem” ends up becoming its own cure. Look at where the futures market is now pricing the certainty of a third hike later in 2018 – now under a 50% likelihood according to traders.

Another point – in order for investors to ever make any money on their bonds, rates have to rise. I mentioned that relationships in financial markets are tenuous and unreliable, but there is one relationship that’s been as close to perfect as any you can find: The starting interest rate on a 10-year Treasury bond and its subsequent return over the next ten years. Starting yields almost perfectly predict the total return an investor gets back, through a mixture of income and capital gain (loss). So a starting yield on a 10-year bond of nearly 3% gives investors a better chance to earn an annualized 3% over ten years than does a starting yield of 2%. Of course, then inflation must be factored in to determine the real return, but this is true of all investments. Higher yields ultimately mean higher returns as old bonds mature and investors systematically allocate to new ones.

The real risk is not higher yields, but an inverted yield curve, which is a negative signifier for the economy and, by extension, potentially the stock market. Negative yield curves show up when investors are paid more in interest on short-term bonds than long-term bonds. Inverted yield curves suggest a pessimism about future economic conditions and they’ve shown up prior to all historical recessions. You can read more about this thing, which is not currently happening, right here.

My last point is….so what? Where is it written in stone that long-term investors with a strategic asset allocation deserve to make money in every single calendar year? That’s why they call it long-term. Short-term outcomes are not the thing that decides the success or failure of financial plan for most US households. The possibility of a losing year for both stocks and bonds is an issue for hedge fund managers and consultants and chief strategists and the media, not for investors. If you’ve got a plan so fragile that a single negative year for a diversified portfolio would cause it to collapse, then you’ve got no real plan at all, my friend.

Soundtrack:

Links:

- Morgan Stanley: Workers will barely get any of the Trump corporate tax cut (The Hill)

- An Unprecedented Decline (The Irrelevant Investor)

- Some Random Observations On The Market Correction (A Wealth Of Common Sense)

- Record $23 Billion Flees World's Largest ETF (Bloomberg)

- Liberals Wanted Fiscal Stimulus. Conservatives Delivered It. (The Upshot)

- Fidelity vs Vanguard: Why now? (RIA Biz)

- Why Competitive Advantages Die (CollabFund)

[…] My friend Larry McDonald put out a note to subscribers of his Bear Traps Report last night about the “game changer” that has happened in the interplay between bonds and stocks this past week. He notes that, unlike previous spikes in volatility for the stock market, this time around bonds did not act as a great diversifier, having shown investors a drawdown of their own as yields rose. And I can tell that Larry… Source: http://thereformedbroker.com/2018/02/12/larry-bonds/ […]

[…] Joshua Brown: Larry Bonds & Passive My A** […]

[…] Joshua Brown: Larry Bonds & Passive My A** […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2018/02/12/larry-bonds/ […]