The Consumer Financial Protection Bureau has undergone a bit of a makeover. It’s no longer actually meant to regulate the financial services industry as it pertains to the treatment of Main Street – it has been transformed into an advocacy for the banks, credit card issuers, insurance companies, mortgage originators and brokerage firms against what it sees as overzealous regulation and job-killing oversight.

Here’s Politico:

“Trump budget director Mick Mulvaney, a month into his job moonlighting as head the CFPB, has rewritten the consumer watchdog’s mission statement. In a nutshell, the regulatory agency is now a deregulatory agency. Here’s the before and after:

Then: “The CFPB is a 21st century agency that helps consumer finance markets work by making rules more effective, by consistently and fairly enforcing those rules, and by empowering consumers to take more control over their economic lives.”

Now: “The Consumer Financial Protection Bureau is a 21st century agency that helps consumer finance markets work by regularly identifying and addressing outdated, unnecessary, or unduly burdensome regulations, by making rules more effective, by consistently enforcing federal consumer financial law, and by empowering consumers to take more control over their economic lives.”

Josh here – That new language in the mission statement – the stuff about “outdated, unnecessary, or unduly burdensome regulations” – could have been written by the corporate counsel of a large Wall Street bank. In fact, I’m almost certain it was. It’s a skeleton key that will unlock every cage in the zoo and unleash all manner of beastliness into the aether. The restraints are coming off and human nature / industry incentives will do the rest. Do you think it’s an accident that the financial products with the highest embedded compensation for the sellers are the products that do the most damage to the customer?

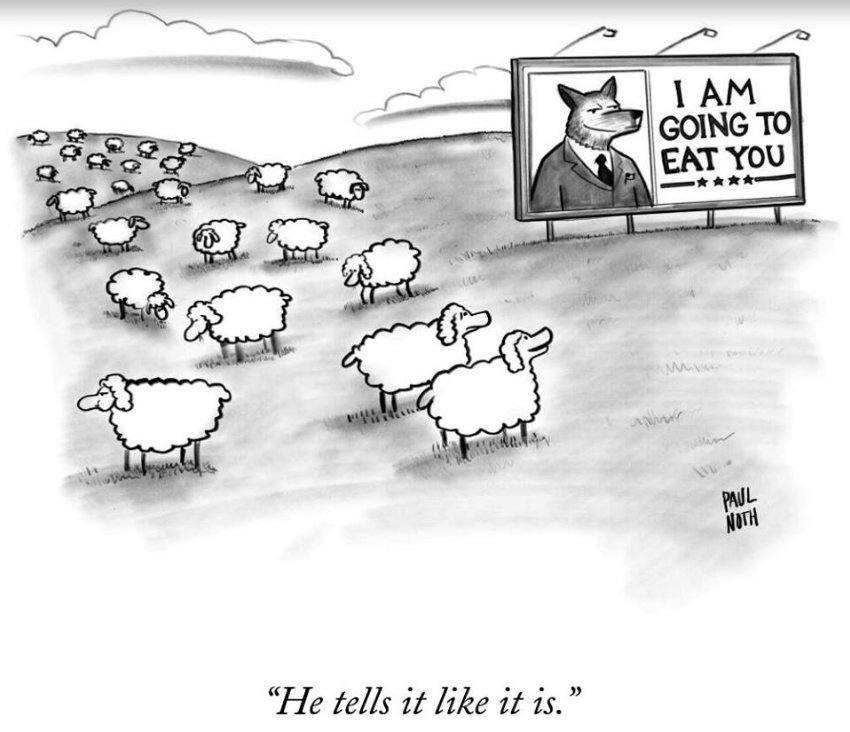

The irony is that the people who asked for this with their votes are the people who are most susceptible to the abuses to come – the financially illiterate, the indebted, the desperate and the uninformed.

The current GOP regime is not on the side of regular people; even its own people in the big, red flyover country. It’s on the side of the insurance companies and banks, thanks in part to Citizens United and the swamp on K Street that was supposedly being drained. No such thing is taking place. Protecting consumers of financial services, especially those most vulnerable due to financial illiteracy or socioeconomic pressures, ought to be a non-partisan issue.

But it’s not.

Under Paul Ryan’s stewardship of the House, the Fiduciary Standard that the Labor Department fought for is being delayed and will be ultimately degraded before it ever takes effect. The story being told is that forcing investment professionals to act in the best interests of their customers and remove obvious conflicts is somehow antithetical to “choice” or will shut people out from getting advice. This is, of course, the most horrendous lie on Wall Street.

Meanwhile, there is even talk that perhaps the government has been too harsh on Wells Fargo for enabling the biggest white collar crime wave in American history. In case you’ve forgotten about that one, it’s the episode where 3.1 million Americans had their identities stolen in a systematic fashion so that rank and file employees across the country could reach absurd sales goals set by bank executives. Supposedly, there is an administration effort afoot to reduce the penalties being exacted.

Just after the inauguration, the President of the United States was settling a lawsuit and paying off the students of his for-profit education scam. Who do you think were the enrollees of that particular “university”? Private school kids from New England? The honor roll?

I’m not making a political point, these are just facts. You don’t have to like them, but that doesn’t negate their existence.

In a twisted sort of way, the wholesale shearing of the US consumer of financial services, which will soon undoubtedly be under way, will be good for fiduciary advisors. We’ll be the ones pointing out abuses in real-time on our blogs and social media timelines. We’ll be the ones talking folks out of the worst options and safeguarding their futures.

And then, when the next economic collapse drags these abuses out into the harsh light of day, we’ll be there to say “I told you so.”

When industry lobbying groups put phrases into bought-and-paid-for politicians’ mouths like “freedom of choice”, what’s actually happening is that consumers are being given the “freedom” to choose solutions that are marketed inappropriately and designed to transfer their wealth into the pockets of others. They’re being “empowered” to inadvertently act against their own self-interest with the help of unscrupulous salespeople and deceptive advertising practices.

Regulations aren’t always the answer to everything – people need to take responsibility for their own understanding of how the world works too. But there ought to be a reasonable balance and a baseline of what’s acceptable on the part of the industry’s practitioners. Not even ten years past the biggest financial crisis in almost a century and we’re already blurring that baseline, obscuring its purpose and kicking dirt over it. This 180-degree shift in sentiment toward consumer protection happened way faster than anyone would have thought possible.

Guess who’s going to suffer in the end, regardless of economic growth or shareholder returns in the short-term…

Never forget that the ideological heroine of the No Regulations crowd, Ayn Rand, died living on public assistance. Educate yourself about money and investing so you can avoid the same fate.

You’re on your own now.

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] There you will find 57728 additional Info to that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Here you will find 9290 additional Information to that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]

… [Trackback]

[…] Here you can find 35656 more Info on that Topic: thereformedbroker.com/2017/12/24/youre-on-your-own-now/ […]