“The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.”

– F. Scott Fitzgerald

This weekend, over 100,000 new Coinbase accounts were opened, presumably by people who had an overzealous nephew at their Thanksgiving dinner on Thursday, telling tales of unbridled riches and the wholesale changing of the world that is most assuredly imminent thanks to crypto currency. According to one source, there are now more open accounts on the Coinbase platform than there are brokerage accounts at Charles Schwab (although the Schwab accounts are undoubtedly bigger, for now).

Bitcoin, having soared above $9,000 over the weekend with year-to-date gains of nearly 800%, is now officially an investor mania. Like all manias, when it turns people are going to be wiped out.

You must balance this thought in your mind while simultaneously juggling a few other ones…

The first opposing thought you must hold is that Bitcoin has already crashed by 80% on five separate occasions over the last few years. But each crash has brought in a cavalcade of media attention, which in turn has brought in new interest from the public and, as a result, fresh record highs in the ensuing recoveries. Do you really think the sixth major crash is going to be the one that does the trick? The seventh?

I’m operating under the assumption that this whole thing is not going away right now. The crashes have only strengthened it by setting up positive feedback loops for the faithful who’ve held on or bought the panic. Let that sink in.

Another opposing thought you must accommodate is the fact that Bitcoin players can make an awful lot of money while the mania grows, before the comeuppance.

You must also contend with the fact that we already have a crypto billionaire – the young founder of Ethereum is said to be worth between $5 and $10 billion as of now. Stories of teenage multi-millionaires have begun to pop up in the mainstream press. There will be more of these stories. This is how the mania sucks in more evangelists.

The first thing one does upon buying in is informing their family and friends while posting to social media. I’m in the club now because I get it. They want to be in the club too. There is some social signaling going on here. I get it too. I’m one of you. I’ve got a reserved seat for the future. The transmission mechanism is flawless. We didn’t have social media during the dot com bubble, so message boards at Yahoo Finance and Raging Bull filled the void.

Speaking of the dot com boom, I think this is the same thing. The people who are buying into this mania most heavily, in an emotional sense, were in elementary school for that. The frame of reference just isn’t there, even if they’d read about it. They can no more fully appreciate the ways in which this is similar to that than I can countenance the parallels between the 1970’s crashes and the stagnation of the aught’s decade. I understand the way in which price action looks similar, but not how it felt. Market manias and depressions are visceral, they must be felt.

Seventeen years ago, companies were adding the suffix “.com” to their corporations’ names, seeing an immediate burst of interest (and market cap) for having done so. Today’s crypto enthusiasts are at somewhat of a disadvantage if their money is predominantly held in IRAs or brokerage accounts they cannot withdraw from. They cannot simply “buy Bitcoin” in its purest form. So they’ve come up with proxies for trading in – flawed fund products and microcaps that have exploded from the sudden and probably misbegotten interest.

There is the Grayscale Bitcoin Investment Trust, which acts like a closed-end fund holding coins, verifying their authenticity and arranging storage and security. How much should these services be worth for investors? Three percent? Five percent? How about between 40 and 80 percent? Insane? Well that’s the recent range of the premium at which investors have been valuing the fund above and beyond its actual holdings in BTC. If you wanted “exposure” to crypto through a retirement account, it’s been the only show in town.

You’re welcome to mock them for paying this premium, but if they’d been doing so over the last two years, they’ve got 2700% in gains to show for it.

Still laughing?

And because familiarity breeds content, investors in the throes of a speculative mania are always in search of the next way to play. They’ve found an island of misfit toys in the course of their search.

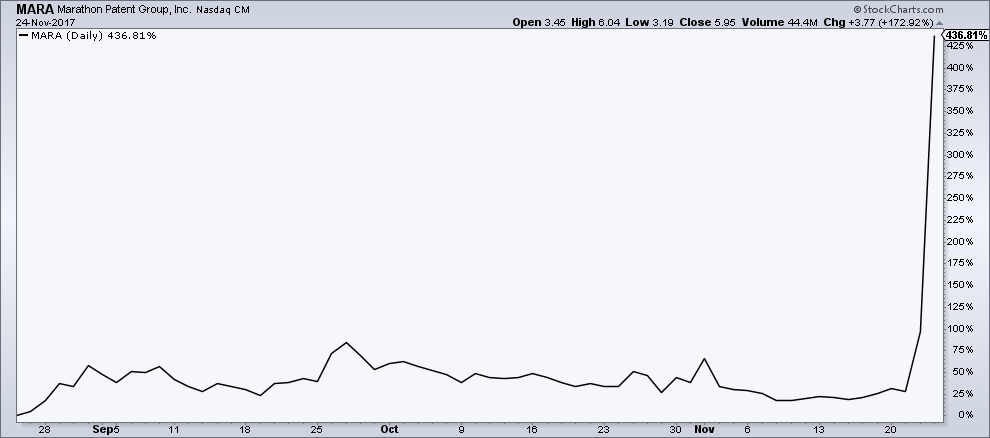

Consider Marathon Patent Group, a publicly traded patent troll whose share price has jumped from 50 cents to 8 and half dollars in just a few months. On November 2nd it announced the acquisition of a Bitcoin mining operation and from there the stock went absolutely ballistic.

Then there’s my personal favorite, Riot Blockchain, which changed it’s name and its business entirely from biotech to digital currencies. The stock market had rewarded it for having done so, to say the least. Bloomberg story from October:

Usually when a company rebrands itself by diving into the digital currency space, the stock waits until after the announcement to take off. In the case of Bioptix Inc., a maker of diagnostic machinery for the biotech industry, it didn’t bother waiting.

The penny stock nearly doubled in value in the days leading up to the company’s announcement Wednesday that it’s renaming itself Riot Blockchain Inc. to reflect a new focus on buying cryptocurrency and blockchain businesses. After the Castle Rock, Colorado-based firm formally unveiled the change in direction, the shares extended their rally, gaining as much as 17 percent to $9.50, the highest intraday level since January 2015.

Sounded ridiculous in early October. Look what’s happened since:

I saw this movie already. This sort of thing happened all the time when dot coms were all the rage. Minor league companies that were going nowhere had a chance to reinvent themselves (or, at least pretend to) and they jumped at it. It ended badly for just about everyone. Just because you believe in the future of blockchain, that doesn’t mean you have to simultaneously believe in everything barked at you from the carnival we now find ourselves attending.

I saw the investment bank Donaldson Lufkin & Jenrette repackage its small online brokerage and spin it off as a “tracking stock” trading as DLJ Direct under its own ticker symbol. There were numerous examples of this sort of thing in the early days of the web. Should the price move higher, you’ll see more of this sort of thing. Watch for it in the payments technology / credit card / lending space. Mastercard just announced a blockchain patent to great fanfare while Square is launching a Bitcoin payment system under the Square Cash umbrella.

In many ways, Bitcoin represents the perfect mania – as there are zero cashflows or dividends or earnings involved with this asset class, there is literally no traditional way in which to value it. Chris Burniske has a new book coming out that frames Bitcoin as both a currency and an asset class, and he’s attempting to use monetarist math and the velocity of use as the building blocks. I’ve seen attempts being made at valuation by everyone from NYU professor Aswath Damodoran to famed Wall Street strategist Tom Lee (formerly of JP Morgan). Some make the case that BTC should rightfully command a piece of gold’s market share, and use their estimate as to what percentage as their starting point to calculate its value. With all due respect, if there is no way to come up with a value for gold itself aside from where it’s currently trading, you’re on shaky ground using its valuation to fundamentally measure some other thing that is only vaguely analogous.

The coin seems to trade on the speed at which it is adopted, mainly by speculators as opposed to users at this point. Consider commentary like this, which attempts to understand whether or not its current price can be maintained.

For the Bitcoin price to remain at $9,250 it requires approximately US$16,650,000 per day of capital inflow from new hodlers.

Bitcoin is both a Giffen good and a Veblen good.

A Giffen good is a product that people consume more of as the price rises and vice versa — seemingly in violation of basic laws of demand in microeconomics such as with substitute goods and the income effect.

Veblen goods are types of luxury goods for which the quantity demanded increases as the price increases in an apparent contradiction of the law of demand.

There are approximately 16.5m bitcoins of which ~4m are lost, ~4-6m are in deep cold storage, ~4m are in cold storage and ~2-4m are salable.

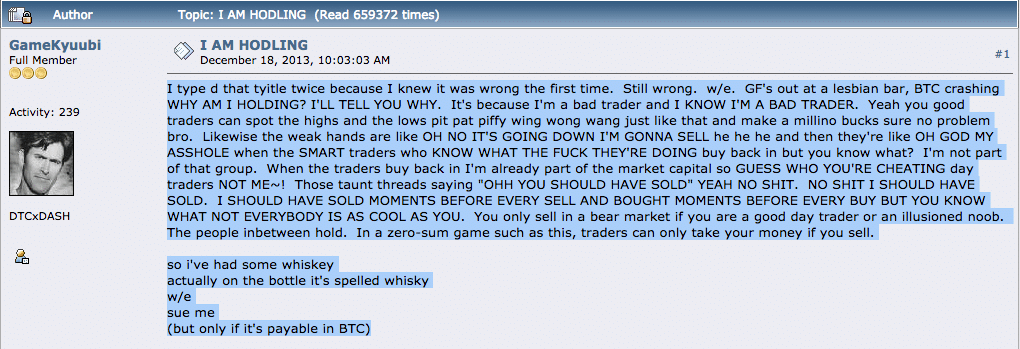

But in a more prosaic sense, we’re witnessing a whole new subculture take shape around the nascent asset class. The community has its own customs, experts and colloquialisms, the most famous of which is HODL. When you see crypto people tell each other to hodl or make hodl jokes, they’re referencing this apocryphal posting to the Bitcoin Forum way back in December 2013:

Yes, it’s insane, but at this moment the first true Bitcoin meme was born. And maybe this guy is now worth a hundred million dollars, who knows. You can see the term hodl in crypto discussions everywhere.

One other thing worth mentioning – one of the hallmarks of every real investment mania is the degree to which it makes its participants feel like geniuses. This mania is no different, and everyone is susceptible, myself included. I recently shared this chart with some friends, half-joking that I singlehandedly sparked the massive recent rally in Bitcoin.

I say “half-joking” but if people start believing it, I’ll skip the joking part and start taking credit. Get your rose petals ready for my path. I sardonically remark that my post about buying into Bitcoin, which went viral within the traditional financial media real, may have been the moment where it became non-embarrassing for financial professionals to admit being interested or involved.

Consider the coverage of my initial purchase:

From Bear to Bull: Bitcoin Just Won’t Die (So Josh Brown Buys) (Coindesk)

Bitcoin may have reached a tipping point, now that ‘Downtown’ Josh Brown just invested (MarketWatch)

Josh Brown: I Bought My First Bitcoin (Mutual Fund Observer)

Bill Miller, Josh Brown are the latest Wall Street pros to test the bitcoin waters (CNBC)

‘Downtown’ Josh Brown Invests in Bitcoin (WealthManagement.com)

Bitcoin Exchanges Struggle to Win Investor Confidence (Bloomberg)

How To Actually Buy Bitcoin Or Ethereum (Benzinga)

There are more but you get the idea.

So, how much credit do I deserve? Probably none, this was going to happen anyway. But I think just the fact that I would even entertain this idea says a lot about how similar this is to other manias. It’s never been enough for investors to just make money – we always want the props as well.

Over the coming weeks and months, several things are probably going to happen that could serve to bolster the bulls even more so than the price action alone has already. CME is going to launch their futures trading service for BTC and possibly other cryptocurrencies. Bears would argue that this will lead to a two-way market and more price discovery, which will force some sanity into the price. We shall see. Out on the horizon, I think you’ll see the custody issue get solved, which will bring more traditional money managers and institutions in. A major brokerage firm (the rumor is Goldman) will begin crypto market making activities for its clients, unashamed and in all seriousness.

And then of course, there is the white whale – the first ever Bitcoin index ETF. You just know it’s on the way. This could unlock the speculative fervor of pretty much everyone for whom the prospect of transacting outside of a brokerage account had kept them out of the pool. As I mentioned the other day, the new regulator in charge of speeding up the ETF approval process was formerly the lawyer for the Winkelvii twins, whose failed bid to launch a Bitcoin ETF has become a watershed non-moment for the faithful.

So it appears as though it just got real. The post-crisis environment finally has its first true blue investment mania and we are literally witnessing history in the making. You’ll tell the kids these stories for sure someday, even if you’re not sure about how the stories will end.

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] sourced from Joshua Brown, a New York financial advisor, on his private blog, that Bitcoin needs $17 mln a day to carry on without crashing. As more and more interest flows towards Bitcoin then, it is argued that that […]

[…] de Joshua Brown, um novo York financial adviser, em seu blog privado, que Bitcoin precisa $ 17 milhões por dia para continuar sem bater. À medida que mais e mais interesse flui para Bitcoin, argumenta-se que esse número […]

[…] data sourced from Joshua Brown, a New York money advisor, on his private site, that Bitcoin wants $17 mln a working day to have on without the need of crashing. As a lot more and a lot more curiosity flows toward Bitcoin then, it […]