Who wants to go to a crypto currency event with me?

The market for Bitcoins, crypto-currencies and other “digital assets” has now surpassed the $100 billion mark. I sort of backed my way into it this summer after years of skepticism. Which, according to Internet Logic, officially qualifies me as an expert 😉

Anyway, the folks at Coindesk, which is rapidly shaping up into the most well-known information services company for crypto, is putting on a big investment conference this November in New York City. The focus of the event will be on how people can make investments, not mine the coins. It’s an aspect that I am interested to learn more about. I’ll be the closing keynote speaker – doing a chat on stage with my friend Howard Lindzon – about how people outside of the crypto industry are thinking about investing and trading.

What’s interesting is that the feeling of owning Bitcoin is almost exactly the same as that of owning a stock.

I bought in at like $2300 and had an immediate double on my hands. Then I started saying “I can’t buy more of it,” as it rose, even though that’s an anchored opinion based on nothing other than the price where I originally got it. Then, as it fell over the last week because of a Chinese crackdown on the exchanges, I started saying to myself, “Oh good, I hope it gets killed so I can buy more.”

It’s really funny what an idiot I am. I caught myself thinking this and then realized how perfectly transferrable all of our regular investment biases were over to this new market. As if I (or anyone else) could have even the slightest inkling of what price the thing should be held and where it should be bought. There are no cash flows or earnings or dividends so it is a market that functions 100% on speculation, sentiment and the day to day perception of scarcity or legitimacy. In that sense, it’s no different from trading internet IPOs 20 years ago – we project our hopes and beliefs onto these things and try to guess at which ones will reward us for having done so.

Regardless of whether you are a believer or a skeptic or undecided at this point, I think you can agree that the next phase of this thing will involve the serious money – the Wall Street money. It’s on its way for sure. If you’ve been in this game long enough, you can almost smell it – like a dog or a horse picking up on a coming storm. They see the gains so far, and so do their clients and the people they answer to. They can’t watch this happen without having an answer to it. Having the right answer is almost beside the point.

So then the question becomes, if the serious money is coming, where will it be treated best (if at all)? Who will be shown to have been full of shit? Where will the enduring opportunities exist for investors and what are just speculative gambles? Or is it all just a gamble on an unknowable future?

It’s worth reminding ourselves, as Marc Andreessen has, that all of the big internet ideas from the late 1990’s ended up coming true. The thing is, the companies that made them happen weren’t necessarily the original stocks we traded. For every horrible investment during the boom and crash, there was the kernel of an idea that ended up becoming precisely true.

We laughed at Peapod and Webvan, but then a generation later we saw the rise of Fresh Direct and then the purchase of Whole Foods by Amazon. We mocked the idea that people would buy cars or clothes online, but then came Tesla which has no showrooms and the ecommerce efforts by the apparel and department store chains – which, these days are the only bright spot in their earnings reports. Even the poster child of Dot Com Era stupidity – Pets.com – turned out to have been a great idea that was too soon, and incorrectly capitalized. Witness this past April’s acquisition of Chewy.com by PetSmart for an astounding $3.5 billion.

You can hear Marc explain this to my partner Barry on this summer’s Masters In Business chat between them, it’s really mindblowing stuff.

Anyway, there is a possibility that all of the online currency stuff of today will be a bust for investors, even as the idea proves too irrepressible to be killed off by a speculative crash. There is also the possibility that one of today’s Bitcoin related startups is going to be what Amazon was to the Dot Com boom / bust – the one that makes it and becomes something we never could have imagined.

I don’t have the answers to these questions, but I think the Consensus: Invest conference might be a good starting point.

A quick overview:

CoinDesk will host the world’s first digital asset investor outlook event, Consensus: Invest, on Tuesday, November 28 at the New York Marriott Marquis. At the center of this asset class, Consensus: Invest brings 600+ institutional investors, hedge funds, money managers, banks, and family offices together and offers attendees the chance to get connected with how to invest, store, trade and judge value in this new asset class. Ultimately, attendees will walk away with a richer idea of where the digital asset market is headed in 2018.

Topics to be discussed:

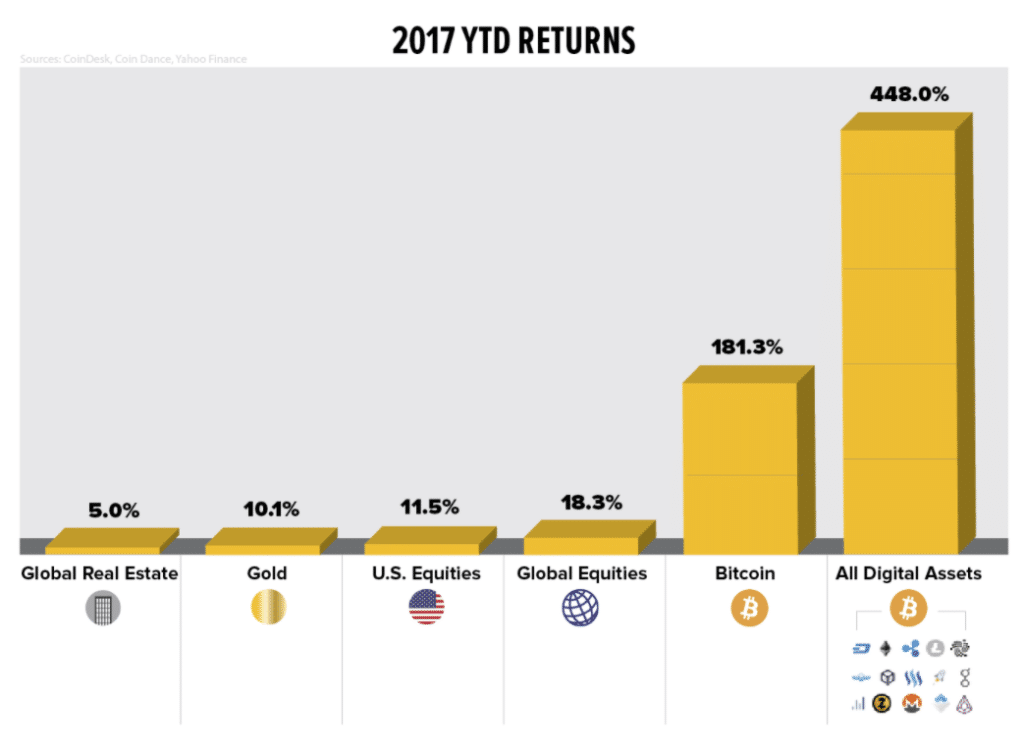

The rise in digital asset valuations in 2017

Knowledge & advice from early institutional investors

The bull & the bear on digital assets

Investment theses presented by leading digital asset investors

Upcoming ETF, derivatives, and other financial products

An approach to taxation and accounting for digital assets

The growth of digital asset focused hedge funds and investment groups

You can find out more about the event at the registration link below. And if you do end up going, make sure to register with my discount code to save $200. The code is C17JoshBrown100

[…] завишени. Зависимостта от пътя (the path dependence) на парите е ясно обяснена от добре познатият фонд мениджър на Уол Стрийт, Джош […]

[…] Kun rahahyödykkeen ostovoima kasvaa käyttöönoton lisääntyessä, markkinoiden odotuksen siitä, mikä on ”halpaa” ja ”kallista”, muuttuvat vastaavasti. Samoin kuin rahallisen preemion hinta laskee, odotukset voivat muuttua yleiseksi uskomukseksi siitä, että aiemmat hinnat olivat ”irrationaalisia” tai liian korkeita. Rahan polkuriippuvuutta havainnollistavat tunnetun Wall Streetin salkunhoitajan Josh Brownin sanat: […]

[…] were “irrational” or overly inflated. The path dependence of money is illustrated by the words of well-known Wall Street fund manager Josh […]

[…] [16] http://thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] There you can find 51140 additional Information on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Here you can find 23833 more Info to that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Here you will find 92890 additional Information on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] There you will find 59835 additional Info to that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/09/11/you-can-practically-smell-it-in-the-air/ […]