Any additional comment here might be superfluous because the stories I’m about to share speak for themselves.

Convincing yourself that you need a perfect answer for market outcomes with a probability of under 5% of occurring is a recipe for sloppy portfolios and big losses. Take a look for yourself…

First, the Wall Street Journal on tail risk or “Black Swan” funds, which I’ve talked about a lot over the years (I’m not a fan):

The patience of many investors has run out after losing money during the intervening years of mainly benign market conditions. According to data by CBOE Eurekahedge, those who invested in tail-risk funds when their performance peaked in September 2011 would have by now lost 55% of their money…

Those results have hit these investors hard. Tail-risk funds are down 6.3% this year through July, according to data group eVestment, and have lost money in four of the five preceding years.

You know what’s easier than paying an arm or a leg for the type of insurance that murders you the majority of the time? How about just having less exposure to the assets you’re nervous about? How about having less to hedge instead of worrying about doing more hedging?

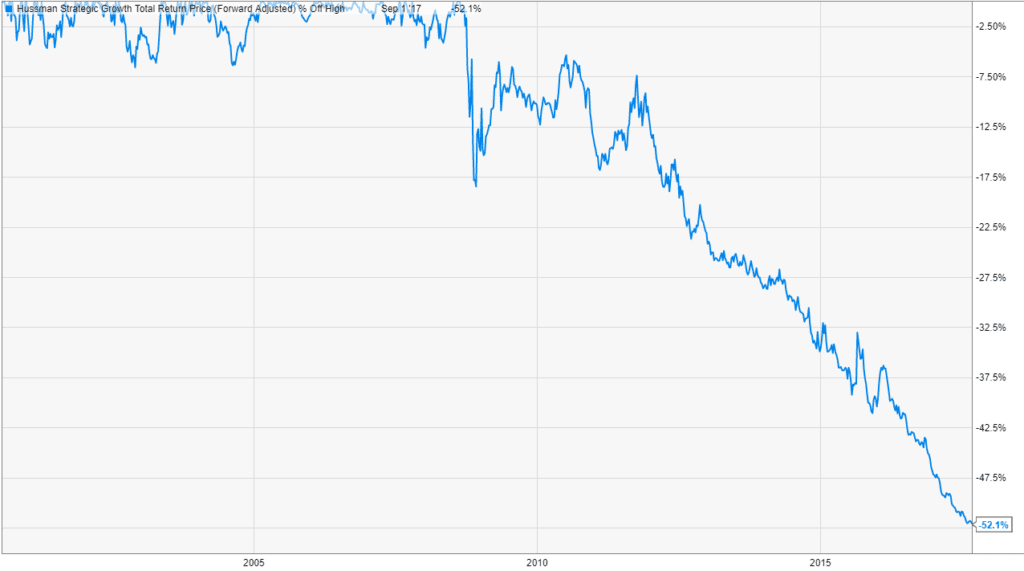

Here’s another beauty, also at the Journal, about a fund manager who is currently in a 52% drawdown from the peak and still has the chutzpah to be lecturing others:

Dr. Hussman’s hedging strategy cushioned investors in market drops in the first decade of the 2000s, resulting in large inflows to the fund. But it hasn’t helped through the long bull market. The fund shed nearly 10% this year through August while the average market-neutral fund gained 0.9%, says Morningstar Inc. Over 15 years, the fund has declined nearly 2.1% on average each year, while its average peer has gained 2.3%.

The resulting investor exodus has been dramatic. The fund, launched in 2000, has contracted to $360.5 million from its peak of $6.7 billion in September 2010. Outflows began in earnest in 2011, picked up in 2012 and have been steady since. Investors pulled a net $4.8 billion from the fund from January 2011 through June of this year, according to Morningstar. “Having lost money each year since 2011 and charging more than 100 basis points [1 percentage point] to do so tends to cause investors to ask for their money back,” says Todd Rosenbluth, director of ETF and mutual-fund research at financial data and analysis provider CFRA.

Here’s what would look like if you were one of the investors still left in this fund after all this time:

If your big theory is about how stocks are overvalued relative to some historic relationship that may or may not be relevant anymore, then you invalidate it by being equally bearish at Dow 8,000 as you are at Dow 24,000. What do you need to have happen to want to be invested in stocks, an alien invasion?

Permabear funds and Black Swan funds have their place in a portfolio, as long as that portfolio isn’t mine or anyone’s I care about.

So what’s the answer? I’ll give it to you as plainly as possible:

First – The best way to protect yourself from the historically rare, yet inevitable market crashes that show up from time to time is to have the appropriate amount of money invested in the first place. What is the appropriate amount? Do a financial plan and then you’ll have a good idea.

Second – Once you know, then the portfolio construction phase will inform you about where your risks are and what you can use to diversify yourself. This won’t remove the risk of volatility entirely, but it will dampen it and help to save your psyche.

Third – Finally, there are tactical strategies for those closer to retirement that don’t cost you half of your capital or make big bets on imminent market crashes. Lean toward rules-based approaches where possible (because human beings can’t see the future) and understand that in a bull market these will likely be a drag in the form of trading costs, taxes and whipsaws – minimizing that drag is the art form.

Now, of course, the market will begin to crash at the very moment I hit publish on this post. Fine. That’s not the point.

I mean no disrespect to the managers running these funds. They tell you, up front, exactly what they’re doing with your capital and exactly what their belief system is. It’s on you (or your financial advisor) if you had read their materials and still thought that this would be a good idea to allocate toward.

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/09/05/when-the-hedge-is-worse-than-the-thing-being-hedged/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2017/09/05/when-the-hedge-is-worse-than-the-thing-being-hedged/ […]