Last night, in the season finale of Game of Thrones, Jon Snow finally got to sleep with his sister or his aunt or whatever their relationship is. I was very happy for him.

This morning, blazing through some charts from the Wall Street Journal’s Daily Shot, I was reminded of Jon’s former girlfriend’s admonition to him from his days North of the Wall.

We are all Jon Snow when it comes to the macro implications of everything. There are two types of investors out there – those who understand how unknowable the system is and those who are kidding themselves / selling something.

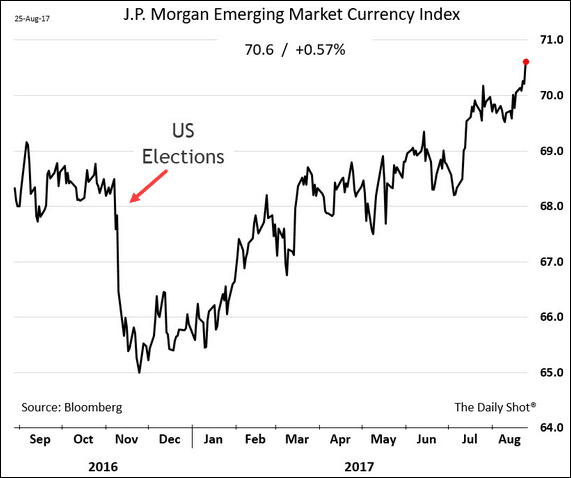

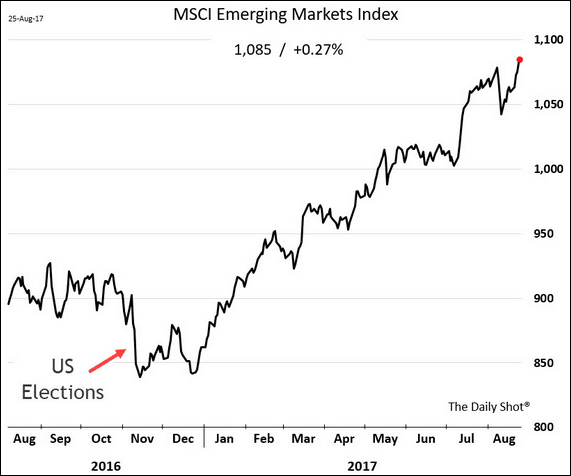

The common refrain last winter was that Trump would mean a strong dollar and a threat to international currencies / stocks because of the policy spaghetti he was flinging at the wall – everything from border adjusted taxes to trade renegotiations to a return of the gold standard. He obviously doesn’t really understand or care about any of these issues beyond the rally stage lectern, but this of course didn’t stop institutional investors from attempting to position on his remarks.

Here’s what actually happened, in two charts:

Some asset allocators got it right – buy EM on the selloff as markets had overestimated the impact Trump’s “policies.” Some got it very wrong. Here’s the FT in February, talking about how portfolio managers began the year:

The monthly survey of global fund managers by Bank of America Merrill Lynch in early January showed investors were underweight in emerging market equities for the first time in nine months.

And then, of course, the psychology shifted because of price. EM started to “work” again so people changed their minds. It looks like EM stocks bottomed last December (hooray for hindsight!). I had been writing optimistically about the bottom being at hand last fall, without actually knowing, of course:

My attitude is that it doesn’t matter whether they’ve bottomed or not for the purposes of a long-term portfolio.

No one is going to tap you on the shoulder to give you the head’s up when they do bottom and markets move very fast. A bottom may not be obvious until they’ve made a 50% move off of multi-year lows. It is true that these countries are mostly in awful condition and that they face major risks. With the current valuation discount between developed market equities and emerging market equities, you are being compensated for this reality. Maybe not compensated enough or maybe compensated more than enough, only time will tell.

One of the things we did in January was overweight EM stocks relative to US stocks in our core strategic portfolios. Not because we thought we had any sort of macro edge whatsoever. Rather, because of our awareness of the historic behavior of asset classes. They rise and they fall against each other, without a schedule or a signal. But mean reversion is real. Trends persist, but not forever. And they reverse fast. We looked at the dramatic outperformance of US vs international stocks, headed into its seventh straight year. We looked at relative valuation, sentiment, dividend yield, etc.

And then we made a decision based on all of the evidence.

I know it’s become unpopular to make investment decisions these days, and that it’s easier to merely tow the line of whatever the index committees at MSCI and SPDJI dictate. But scofflaws that we are, we decided to act. The fact that the benefits accrued so quickly is an accident and not at all one that we were expecting. In fact, our EM holdings through the prior few years had been more of a drag than a tailwind, so if we had actually been able to see the future, like the three-eyed raven, we’d never have been there in the first place.

But we do know one big thing – it’s that diversification works on many levels over time, even if it doesn’t work during every day, month or year. It is the only free lunch in town. Paradoxically, it simultaneously means always having to say you’re sorry and never having to say you’re sorry.

I know of no more humble forms of investing than dollar-cost averaging for the young and diversification for the old(er). If you know nothing other than this one thing, you’ll be just fine.

***

I don’t know what you’re doing with your investments these days, but if you’re not talking to me, Michael Batnick, Ben Carlson and Barry Ritholtz, maybe it’s time you did. Hit us up here.

[…] Joshua Brown: You Know Nothing, Jon Snow […]

[…] By Josh Brown […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]

… [Trackback]

[…] There you will find 17789 additional Info to that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]

… [Trackback]

[…] There you will find 5421 more Information to that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2017/08/28/you-know-nothing-jon-snow/ […]