I keep up to speed with fund flows – specifically ETF flows – because I think they give me a good sense of what my colleagues in the profession are doing and how investors are feeling about various asset classes / investment themes on a general basis. In the last month, it would appear that they have finally rediscovered the potential for international equities.

If you’re a regular investor, of course, the trick is to find an advisor who talks you into this sort of thing before it becomes cool and popular, not afterwards. That’s where the gains are. Easier said than done. Advisors who are afraid to lose clients can never fully do what needs to be done for their clients. And advisors without a fully fleshed out investment process can easily find themselves adrift, flitting between this popular idea and that in a vain attempt to mollify the most outspoken among their accounts.

Vanguard estimates that the typical investor is holding an 80% allocation to US stocks in the equity portion of his or her portfolio, which means the typical investor is substantially underweight international stocks, as they make up about 50% of the world’s total equity market cap. A truly representative portfolio would be 50% US and 50% ex-US. In January, we went beyond that and actually underweighted US stocks, as I discuss here. It was not an easy trade to make at the time, given the way the recency bias influences us and messes with all of our minds – why buy anything other than the S&P 500?

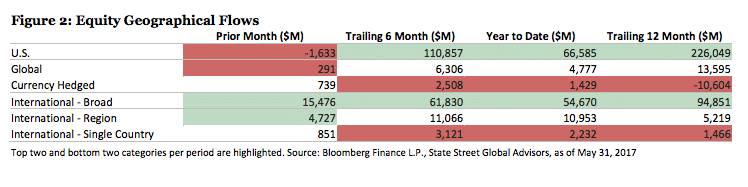

But May flows offer a sign that attitudes are changing. Global stock ETFs are seeing inbound money flows that are significantly greater than US ETF flows. State Street Global Advisors illustrates what has just happened in May:

As mentioned above, $10 billion was deposited into equities over the last five days, and US focused funds were the beneficiary of 99% of that total. Regardless, flows for US funds were still negative for May. Even as positivity abounded with earnings season drawing closer to its end, a season that resulted in a 4.9% increase in Q1 earnings per share growth relative to the consensus analyst estimates at the start of the quarter. The S&P 500 also notched its 19th and 20th new all-time high over that period. So, while FANG may be the acronym du jour, it may just be the FOMO (fear of missing out) that had propelled such a seismic shift in flow totals over the last week.

But May flows are not a US story; rather the protagonist comes from across the pond. International exposures have been all the rage in 2017, taking in over $60 billion to date, or essentially half of the year’s totals for the equity category, even though those funds only equate to just 26% of overall assets. But the real story is where on the international scale those flows are going. Europe has been of interest, with over $9 billion deposited in just the last three months alone. And this extends beyond just ETFs. Per Morningstar, emerging market focused ETFs and mutual funds have recorded inflows for 21 consecutive weeks – their best run since 2012 when they eclipsed 25 straight weeks.

The outlook for emerging markets, where valuations are attractive and ‘greenshoots’ of growth are visible, suggests this streak may continue, as even the latest political scandal in Brazil did not slow this trend.

Now, you might be saying, “gee, I wonder why this is happening all of a sudden!”

Let me alleviate your concerns that something about the human psyche may have dramatically changed overnight. It hasn’t. The same old performance chase is now at work. Animal spirits are shifting their focus from the S&P 500 to Europe, Japan and the Emerging Markets, where the gains are becoming larger and more rapid. Same thing we always see.

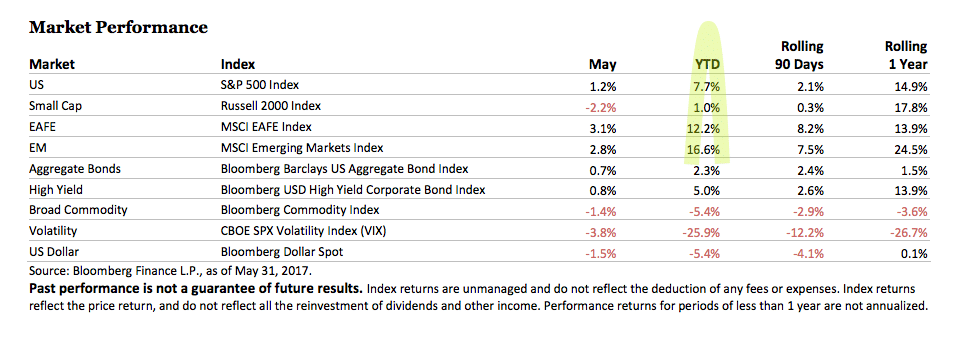

Have a look at that YTD column, with international stocks blowing the doors off US large caps and (especially) small caps:

Never changes.

Source:

The Uncertainty Principle

State Street SPDRs – May 31st 2017

Read Also:

What We’re Telling Clients About European Stocks (TRB)

[…] ‘Same Old Performance Chase’ – Josh Brown – The Reformed Broker […]

[…] Josh Brown, CEO of Ritholtz Wealth Management, just wrote a great piece on performance chasing. To read his article, follow this link! […]

[…] Markets, where the gains are becoming larger and more rapid. Same thing we always see,” said The Reformed Broker Josh […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Here you will find 51642 additional Info on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Here you will find 2056 more Info to that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

… [Trackback]

[…] Here you will find 98974 additional Information on that Topic: thereformedbroker.com/2017/06/02/same-old-performance-chase/ […]

[…] emerging markets, which are getting bigger and faster. We always see the same things,” said Reformed Broker Josh […]