Providing historical context is one of the roles we play on behalf of our clients.

And that’s a good thing, because for an investor who just began paying attention to markets in the last ten years, the extent of their context is that the S&P 500 is the only game in town worth playing, it always goes up, and dollars invested in anything else are wasted.

Looking out past this period, however, and you see that this is plainly not the truth. It’s our job to not only make sure that clients understand this, empirically, but that they’re invested in such a way so as to take advantage of the myopia of others.

In 13 of the last 16 months, US investors have pulled money from European stock ETFs while simultaneously adding money to US stock ETFs – the most expensive developed market in the world. Vanguard estimates that the average US investor is now 80% allocated to US stocks, despite the fact that the US is only around 50% of the global equity market cap.

We can further assume that European stocks do not comprise all of the remaining 20% of investors’ exposure. This should give you a sense of just how underweight Europe our compatriots are. Here’s another way to look at it: According to iShares data, U.S. investors have poured $725 billion into U.S. exchange-traded products since 2010, 14.5 times the $51 billion they invested in Europe.

This January, we made a shift in our clients’ portfolios to overweight European stocks and underweight US stocks relative to the global benchmarks. We’re not talking about a jaw-dropping deviation, but certainly a noticeable enough tilt. So far, so good, as European stocks are handily outperforming the S&P 500 YTD, although we’re thinking in terms of years and decades – not months – when we put money to work for people.

Michael Batnick, our Director of Research, put a note out to our wealth management clients last week that gets into some of the reasons why investors are underweight Europe and why we think they’re all about to miss out on a period of good performance. Please understand that when I share things like this, it is for information purposes only and nothing you read on this site should be considered as advice or a solicitation to buy or sell any security…

Below, I excerpt a small part of what Michael had to say:

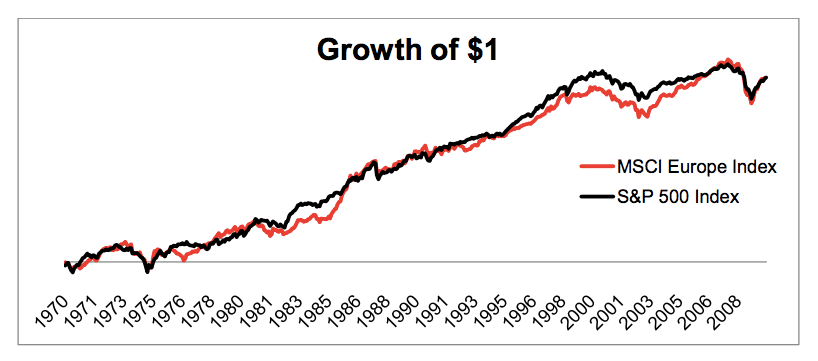

U.S. investors could look at past performance, even long-term performance, and conclude that there is no point investing in European equities. One dollar invested in MSCI Europe (USD) in 1970 is now worth $56. One dollar in the S&P 500 over the same period would have grown to $106 today. Yet on closer examination, this is a perfect example of statistics reporting the facts but hiding the truth. Thanks to the power of compounding, performance over the last few years has had a huge effect on long-term returns. From 1970 to 2009, the S&P 500 compounded at 9.87%, and MSCI Europe at 9.88%. The entire outperformance of the last 47 years occurred during the last seven years.

That underperformance, combined with investors’ attitudes toward European stocks — which are apathetic at best — has caused the valuation gap between U.S. and European equities to widen into a gulf. The cyclically adjusted price-to-earnings ratio, or CAPE, measures the price to real earnings over the last ten years. The ratio for the United States is 30 and for European equities it’s just 17.

Josh here…

Now, as an investor (or an advisor to investors), you can do one of two things. You can say that what’s gone on for the last seven years is a new permanent thing and that we can safely ignore the real historical data. Or, you can go the other way and recognize that, while European and US stock performance have largely ended up in the same place, the benefits of diversification have had a habit of showing up at very opportune times in the past – such as during the lost decade from 2000-2009, when the S&P 500 was flat (no returns at all) and European stocks rewarded investors handsomely.

If you believe that valuation matters, that trends don’t persist forever, that sentiment shifts can serve as powerful catalysts and that mean reversion is the gravity of the investment world, then it’s not such a difficult choice at all.

The trick is in accepting that you cannot know when the next ten-year period of outperformance will begin. It may have begun already, but only time will tell. Sit down. Be humble. Diversify.

***

If you’d like to talk to us about your asset allocation or financial plan, CFPs are standing by. Get in touch with us here:

[…] Josh Brown: What We’re Telling Clients About European Stocks […]

[…] Josh Brown: What We’re Telling Clients About European Stocks […]

[…] European stocks…what do you think? The Reformed Broker […]

[…] Fellow blogger and financial advisor Josh Brown at Ritholtz Wealth Management posted the below excerpt from a research report produced by his […]

[…] in den USA sprechen derzeit sehr laut und viel von europäischen Aktien. Hier weiterlesen: http://thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/. Nur um es klarzustellen: das ist kein passives Investieren sondern taktisches Übergewichten von […]

[…] Zdroj: Josh Brown […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Here you will find 86518 more Information on that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] There you will find 74289 more Information on that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2017/05/24/what-were-telling-clients-about-european-stocks/ […]