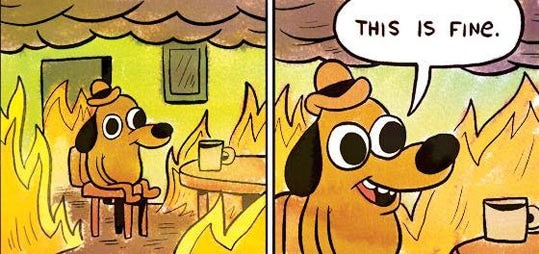

The below cartoon will go down as one of the preeminent pieces of iconography of the current era. You see it attached to social media posts at every revelation of the President Trump saga:

It’s a pretty good heuristic in terms of the way investors inure themselves during times of stressful headline blitzkriegs.

First they sell, and then they begin discounting worst case scenarios and, finally, having been sitting with piles of cash, they begin to look for silver linings or finding other things to invest in.

This is fine.

We watched it play out during the debt ceiling debate, the European debt crisis (still ongoing, btw) and lots of other big, scary events.

This is a sentiment cycle as old as time. The difference, in the modern era, is in how fast it plays out.

Last night, 72 year old former FBI Director Robert Mueller was appointed as the special prosecutor to look into Russian involvement with Trump’s campaign, including the possibility of collusion. Mueller is, how shall I say this…not a p***y. He was the guy who had to hold things together during all the inquiries about the FBI’s failings surrounding the 9/11 attacks. He’s a former Marine and is said to be fiercely independent. Everyone respects him. There won’t be a whitewash here.

I don’t know anything more than any of you about the investigation he’s been appointed to lead. We all read the same newspapers and see the same newscasts. You may have one opinion and I may have another. But at the end of the day, if there was collusion or influence or there were payments being made of any kind, it’s going to come out.

But I want to focus on the market angle of this, and leave the societal angle to the usual columnists.

Wall Streeters are already saying things like “It’s actually a good thing, because there’s a much better possibility that President Pence gets the tax reforms through once the circus leaves town.” They’re arriving at this point in record time. I’m impressed with how fast we (the royal we) went from “the markets need the Trump agenda to justify the rally” to “the Trump agenda is just a cherry on top, if it ever happens.” Magnificent.

On the whole, professional investors are pragmatic, not ideological. Look at how many of them have been able to work with both Democratic and Republican administrations. It’s having the seat at the table that counts, not what color the napkins are.

This is the important thing, for our purposes here (via Politico):

The wide scope suggests an inquiry that is almost certain to last for years, given the history of these sorts of investigations, and will have an unpredictable impact on near year’s congressional midterm elections and the early jockeying in the 2020 presidential campaign. There are likely to be strains between Mueller’s inquiry and those being conducted on Capitol Hill, especially if congressional investigators want to give immunity to targets of Mueller’s investigation in exchange for their testimony, which would complicate the former FBI director hopes of ever obtaining criminal convictions.

“almost certain to last for years.”

What that means is that the headlines, which will be spurted across Twitter feeds and Bloomberg Terminals and news apps by the dozen, during every hour of every day, will lose their shock value fairly quickly. We will go from overreaction to each development to resigned apathy fairly quickly. We always do.

This is fine.

[…] Josh Brown: This Will Never End, But We’ll Get Used To It […]

[…] The Washington brouhaha hasn’t gone away and neither have traders’ nerves, says David Madden at CMC Markets UK. He warns that “going long too soon could prove to be costly,” though Josh “The Reformed Broker” Brown argues the market is getting used to D.C.’s never-ending story. […]

… [Trackback]

[…] Here you can find 79367 more Information on that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] There you will find 55423 additional Information on that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] There you can find 60282 additional Info on that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] There you will find 52784 additional Info to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/18/this-will-never-end-but-markets-will-get-used-to-it/ […]