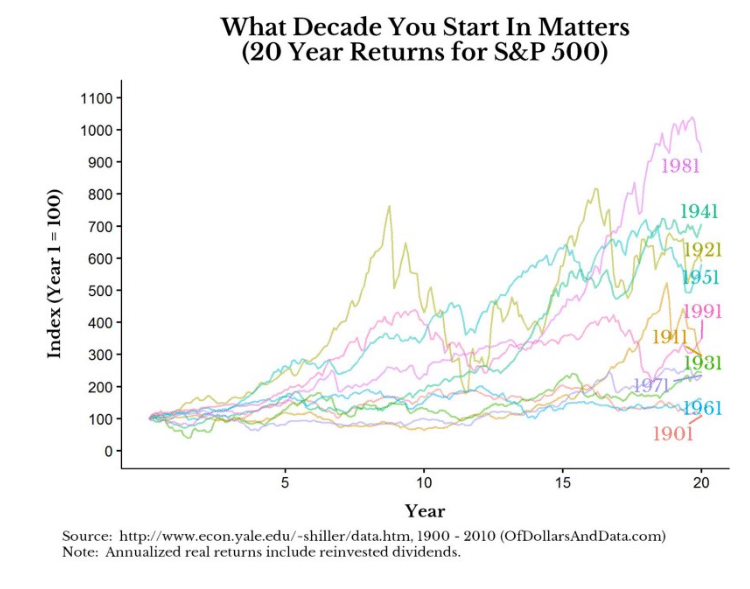

I loved this visualization from my new favorite blogger at Of Dollars and Data – he looks at the year in which people began investing and plots out how their investment returns might have worked out, by decade.

So, for instance, if you were a born in the 50’s, began investing in the 80’s (in your 30’s), you did better than all other cohorts of investors.

It’s oversimplified, because obviously people are investing varying amounts at different stages of their lives, and in different investment vehicles, but it’s a good backward-looking frame of reference for what would have been an idealized experience.

Let’s consider the S&P 500 returns from 1901 to 2010. If we were to examine the 20 year returns starting in each decade from 1901 to 1981 (i.e. 1901–1920, 1911–1930, etc.), we could see how different starting periods affected your total returns. For this next plot I do this exact exercise by starting each decade at the same point (i.e. an index of 100) and seeing the returns unfold over time. Note that the year label you see on the far right side of the plot is the starting year for that 20 year period. More importantly, you will see quite a divergence in outcomes based on the starting year:

As you can see, the 20 year period with the best returns was 1981–2000 and the 20 year period with the worst returns was 1901–1920. The more important point is that there is no general pattern across the decades.

Reading this, I was reminded of something Warren Buffett once said about the extraordinarily lucky circumstances of his own birth. Buffett thinks about his luck more in terms of the fact that he was born in America, and as a a male child. Check this out:

My political views were formed by this process. Just imagine that it is 24 hours before you are born. A genie comes and says to you in the womb, “You look like an extraordinarily responsible, intelligent, potential human being. [You’re] going to emerge in 24 hours and it is an enormous responsibility I am going to assign to you — determination of the political, economic and social system into which you are going to emerge. You set the rules, any political system, democracy, parliamentary, anything you wish — you can set the economic structure, communistic, capitalistic, set anything in motion and I guarantee you that when you emerge this world will exist for you, your children and grandchildren.

What’s the catch? One catch — just before you emerge you have to go through a huge bucket with 7 billion slips, one for each human. Dip your hand in and that is what you get — you could be born intelligent or not intelligent, born healthy or disabled, born black or white, born in the US or in Bangladesh, etc. You have no idea which slip you will get. Not knowing which slip you are going to get, how would you design the world? Do you want men to push around females? It’s a 50/50 chance you get female. If you think about the political world, you want a system that gets what people want. You want more and more output because you’ll have more wealth to share around.

The US is a great system, turns out $50,000 GDP per capita, 6 times the amount when I was born in just one lifetime. But not knowing what slip you get, you want a system that once it produces output, you don’t want anyone to be left behind. You want to incentivize the top performers, don’t want equality in results, but do want something that those who get the bad tickets still have a decent life. You also don’t want fear in people’s minds — fear of lack of money in old age, fear of cost of health care. I call this the “Ovarian Lottery.”

My sisters didn’t get the same ticket. Expectations for them were that they would marry well, or if they work, would work as a nurse, teacher, etc. If you are designing the world knowing 50/50 male or female, you don’t want this type of world for women — you could get female. Design your world this way; this should be your philosophy. I look at Forbes 400, look at their figures and see how it’s gone up in the last 30 years. Americans at the bottom are also improving, and that is great, but we don’t want that degree of inequality. Only governments can correct that. Right way to look at it is the standpoint of how you would view the world if you didn’t know who you would be. If you’re not willing to gamble with your slip out of 100 random slips, you are lucky! The top 1% of 7 billion people. Everyone is wired differently. You can’t say you do everything yourself. We all have teachers, and people before us who led us to where we are. We can’t let people fall too far behind. You all definitely got good slips.

Josh here – so what if you happen to begin investing for the long term at the wrong time – say, at a moment in which valuations are high and volatility is under-priced, like now – what do you do?

Two things – one, there is no way to know, in advance, how a 20 year period is going to play out in the prices of stocks, so slow your roll.

And the other thing – this should make it clear to you just how important it is to maximize the opportunities you do have, and to do this stuff correctly. I’ll let Of Dollars and Data have the final word here:

Yes, there is some luck in your outcomes, but your investments are more in your control than you can imagine. As an investor you get to decide:

- Which assets you invest in

- Which proportions to invest in each asset

- When/how often to buy

- How much to save

All of these things will likely influence your investment success more than your birth year. However, luck still plays a role.

Amen, brother.

Sources:

Bad Investment Results? Your Birth Year May Be to Blame (Of Dollars and Data)

Warren Buffett’s Meeting with University of Maryland MBA Students (UofMD)

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] There you will find 95542 more Info to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/05/11/feelin-lucky/ […]