My friend Jon Krinsky notes that the outperformance among foreign stocks vs US stocks – something we’ve been screaming about since last fall – is becoming more and more apparent. Vanguard says that the typical US investor’s portfolio is weighted 80% to US stocks (vs their 52% weight within the global market cap benchmark), which means that the vast majority are not positioned for what’s going on right now.

And it’s long overdue. Here’s Jon:

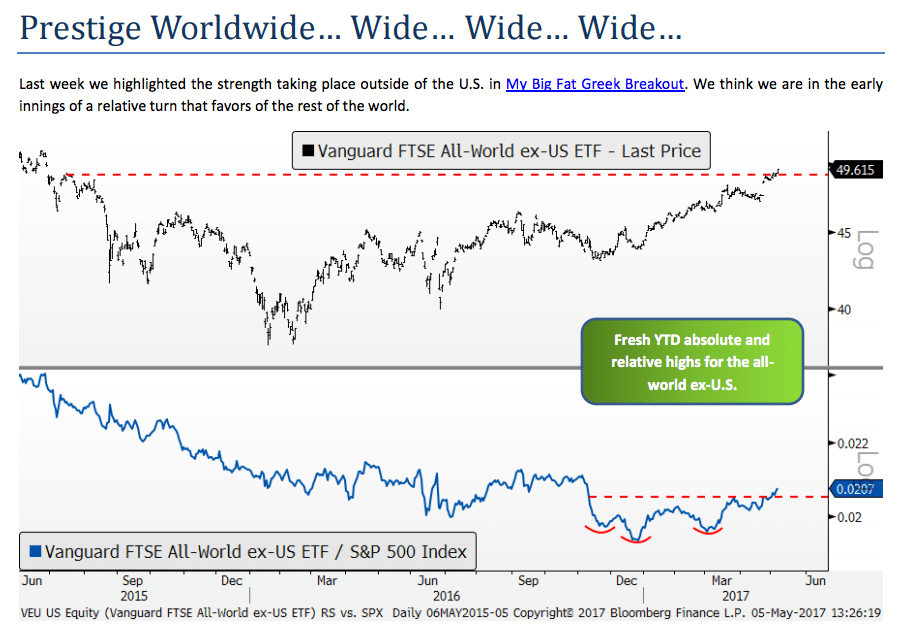

Equities continued to move higher last week, with global markets outperforming the U.S. markets for the second straight week. After seven years of U.S. outperformance, we think this rotation is in the very early innings. Should the global markets continue to breakout, we think U.S. stocks will continue to make upside progress, albeit at a slower pace…We think we are still in the very early innings of a shift that favors the rest of the world over the U.S. There are at least 25 global markets up 10% or more YTD, with many emerging from multi-year bases and downtrends.

And his chart, depicting rest-of-world stocks along with a relative chart vs the S&P 500 – the index that everyone currently worships because of what’s gone on since 2010 (you may click to embiggen, as always):

Source:

Prestige Worldwide

MKM Partners – May 7th 2017

And because I know you have it stuck in your head now…Prestige Worldwide:

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2017/05/08/chart-o-the-day-prestige-worldwide/ […]