The Wall Street Journal documents an interesting meeting that took place last month in New York City…

About 60 rival mutual fund executives gathered inside OppenheimerFunds’ Manhattan office tower in early November to discuss a problem many of them can’t shake: persistent client withdrawals.

The Nov. 2 summit, dubbed “The Seismic Shift Senior Leadership Forum,” was a day-long brainstorming session about the mass movement of investors away from money managers that try to beat the market. Clients are flocking to index-tracking funds that offer simplicity, lower fees and the assurance of matching the market.

If this sounds familiar, perhaps it’s because there are echoes of the Apalachin Mafia Summit of 1957, minus the killings of course.

In 1957, two members of the Mob – Frank Costello and Vito Genovese – were competing for the position of boss of bosses. On May 2, 1957, Genovese ordered a hit on Costello, who walked away from the attempt when the bullet merely grazed his head. Genovese feared revenge from Costello, who was now in alliance with Albert Anastasia. On October 25, 1957, Anastasia was assassinated in a barbershop in the Park Sheraton Hotel in Manhattan.

Vito Genovese summoned the leaders of organized crime throughout the country…On the summit’s agenda were the fate of Anastasia’s territory, plans for dealing with the Bureau of Narcotics, the banning of drug trafficking in the organization, and the annointing of Genovese as the new boss of bosses.

I love the idea of a besuited OppenheimerFunds exec intoning “Today we settle all family business…” as his cohorts pack branded tote bags with weapons, ammunition, explosive stress toys, golf umbrellas with blades in the handles, etc.

By the way, I hope there was tight security at the “Seismic Shift Senior Leadership Forum” – wouldn’t want anyone to steal all the alpha in that room.

Okay, but really, the purpose of this post is to save the mutual fund industry.

Five years ago, I joked around about the industry dying and making its final stand. In a Miami 2017-esque fantasy I wrote up for Fortune Magazine, I talked about what that might look like. I didn’t think it would happen so soon. According to WSJ’s Sarah Krouse, “Over the past year, investors have pulled $242.7 billion from funds that bet on U.S. individual stocks, while placing $185.9 billion into U.S. mutual funds and ETFs that track stock indexes, according to Morningstar.”

Cray.

So what can the industry do to reset the situation, change the conversation and stop the bleeding?

I have some ideas. Probably only a combination of all of these things will do the trick…

Idea One: Don’t play no game that you can’t win. The late Adam Yauch taught me this. The idea that a manager picking 300 or 400 large cap stocks can reliably beat the S&P 500 over any meaningful stretch of time – including high internal expenses and taxable events – is laughable at this point. Amazingly, this doesn’t stop thousands of them from trying. There should be an industry-wide moratorium on new large cap US stock funds and a voluntary shrinking of existing products that are going nowhere. All these funds are doing at this point is mucking up the SPIVA Scorecard stats.

Stop offering vanilla. No one needs it, wants it or benefits from it.

Idea Two: Exclusivity sells. When I started in the retail brokerage business, one of the first things I was taught was how to take “indications of interest” – IOI’s – from clients for new issues coming to market. The key to a good IOI pitch was to explain to clients that initial public offering shares were “first come, first serve” and that we couldn’t guarantee that any client would get the full amount of stock they were requesting – or any at all, in some cases. It worked. The mere mention of the fact that there was a finite quantity drove oversubscribed deals and voracious client appetites. The scarcity sales pitch had the added benefit of the fact that it was true.

Everyone wants what they can’t have, it’s human nature. New fund launches should start out with a cap, in advance, and there ought to be a velvet rope in front of them of some sort. Smaller funds perform better, so investors ought to be put through some hoops to get in. Having a waiting list will make people think twice about selling.

Good funds should be marketed like luxury products. Hedge funds and private equity funds know this formula very well.

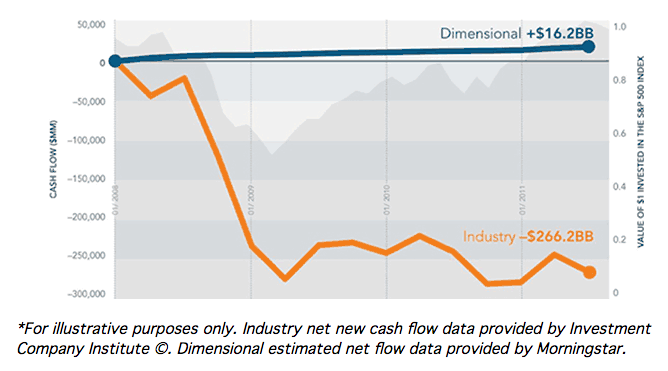

Idea Three: Ask more of your investors. At my shop, we use a few Dimensional FundAdvisors products in our asset allocation models. We had to go through DFA’s training and education program out at their headquarters in Austin, Texas in order to be eligible. One of the key sources of DFA’s potential alpha is the fact that they act as a liquidity provider when other funds are puking up positions and need a buyer. DFA is able to do that only because it has a more stable investor base than its counterparties. The advisors using DFA funds are better informed, the thinking goes, and so they themselves (along with their clients) aren’t panicking or switching money in and out in volatile markets.

Watch as DFA’s flows remain positive through the financial crisis while the fund industry as a whole endures massive selling:

I’m not suggesting that every fund family can make the kinds of investments in advisor education and selection that Dimensional has, but can you imagine if they actually even tried? Skip the full page ads in Kiplinger’s and focus some attention on the behavior of the end-users of your product. Behavior, after all, is the single biggest determinant of investor success – not manager tenure or how many analysts you have or how many Morningstar stars you accumulate. The empirical data is unambiguous and uncompromisingly clear on this point.

Idea Four: Benchmarks are bullsh*t. The greatest trick the Bogle ever pulled was convincing the world that there are passive benchmarks. My seven year old son asked me the other day, “Daddy, where do benchmarks come from?” I got down on one knee like Danny Tanner and explained, Well, son, when an index provider and an asset class love each other very much, the stork comes and drops off a way to measure the performance of that asset class that everyone can agree upon. That measure becomes a benchmark.

The modern obsession with benchmarks and index funds stems from the aftermath of the financial crisis. The investor mindset became, “Well, in a market crash, I’m going to get killed no matter who the manager of my fund is, so I may as well not bother paying a manager.” My colleague Ben Carlson notes that this has happened before. Prior to the ’73-’74 bear market, no one cared about benchmarks because there weren’t any. People just looked at the Dow Jones Industrial Average. Even for bond funds! After the crash, everyone got serious about benchmarks. After this last crash, that’s pretty much all they care about.

Here’s the problem – benchmarks are not handed down from God on Mount Sinai and they do not appear in nature. The S&P 500 is not a periodic table of elements. It’s created by a very human, very flawed committee. The Dow Jones too. And the Russell indices. Sorry, they’re not passive, they’re man-made and prone to all the same issues that anything man-made would be. The committee makes decisions about composition all the time. They add stocks at major tops and remove them at major bottoms. Framed this way, the S&P 500 can be described as “the world’s most popular momentum strategy.”

The deification of benchmarks has been driven by consultants and amplified by the media. It’s a false idol.

The industry needs to explain that THERE IS NO SUCH THING AS PURE PASSIVE. The sooner people accept that index is not divine, the sooner they’ll stop worshipping it. Smart Beta indices, themselves obviously man-made but incredibly popular, are proof that we can break the spell.

Idea Five: Be creative! My friend Eddy Elfenbein, working with Noah Hamman and the gang at AdvisorShares may have just invented the future of the fund industry. They did it with an active ETF that is designed to be so concentrated (25 stocks or less) that tracking error will be deliberately high. Tracking error is seen as a dirty word among consultants and advisors and uninformed journalists. It’s not. It’s a positive. It means you’re actually getting something for your money. The big innovation of Eddy’s CWS product is that it’s the first ever ETF with a variable compensation scheme built in. Eddy will be paid less by investors in CWS if he underperforms the market. He’ll make more if he beats it. Holy sh*t, imagine that – a manager that gets paid for alpha and not just beta, and pays a price for not succeeding. Don’t fall out of your chair if you see the industry start to move in that direction. It’s decades overdue. (full disclosure, I bought some of Eddy’s fund when it launched).

Idea Six: Shrink! There’s been some consolidation among the big asset management firms and fund families. There should be more. The next Seismic Shift Forum should only include 40 “rival mutual fund executives”. The one after that should include like 25. There’s too much product, too much competition, too little differentiation and the passive market share gains we’ve seen are not going to subside. Bill Miller, perhaps the most legendary active mutual fund manager of all time behind Peter Lynch agrees with this assessment. He told my partner Barry Ritholtz recently that 70 percent of all managers are essentially benchmark-huggers. Hence, the shift from active to passive is not what it’s made out to be. It’s really just a shift from expensive passive to cheap passive.

Fund families need to discourage low “active share” strategies and to reward risk-taking managers, even when what they’re trying to do isn’t being rewarded by the markets. You can’t win if you’re not even trying. If 70% of the fund managers were fighting the benchmarks rather than making love to them, there’d be a lot more dynamism and many more success stories. There’d be some horror shows too – regulators and intermediaries need to accept that there will be well-meaning losers and not crack down on underperforming funds with good intentions. A steady stream of big winners and losers is better than a lukewarm piss-pool filled with high-cost, mediocre products.

***

Anyway, that’s my two cents. Stop fighting unwinnable battles, be creative, amp up the exclusivity, shrink the industry, educate the investor base and change the conversation about benchmarks. All of these things are doable and worth doing.

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/12/14/in-which-downtown-josh-brown-saves-the-mutual-fund-industry/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2016/12/14/in-which-downtown-josh-brown-saves-the-mutual-fund-industry/ […]