Just musing on the topic of when the current bull market actually began…

Some investors and many people in the media tend not to understand the concept of secular bull markets and so they date the start of this one to March of 2009. They tell you it’s “long in the tooth” and they count other bull markets that haven’t made it this many years in a row as evidence for why it should end soon.

This is so wrong for so many reasons I can’t even get into them all.

Here are a few:

- Averages are made up of extreme readings. The stock market, on average produces single-digit returns, but in any given year it almost never does the average on the nose. In fact, most positive years for the market are a double-digit gain, as Ben Carlson showed this week. So to say “bull markets are an average of 5 years and we’ve been going up for 7” totally confuses people. Sometimes, on purpose.

- It’s become likely that we are in a secular bull market for stocks. We do not measure secular bull markets from the bear market low of the prior cycle. The 1982-2000 secular bull market is measured from the day in 1982 when stocks finally took out their 1966 high. It had been a 16 year secular bear market until closing above those highs, and stocks never looked back. We do not date that bull market from the lows of 1973-1974 that were the nadir of the prior bear. Nor should we use 2009 as our starting point for the current bull market. 2009 was merely the cycle low of the prior bear, not the starting point of the current bull.

- The actual starting point of the current secular bull market is the spring of 2013, when we broke above the double-top record highs of 2000 and 2007. This means we’re only into the third year.

- I also would like to asterisk the fall of 2011 because the S&P 500 dropped 21% briefly in the depths of that panic, which would restart the count anyway if you were using 2009. This is semantics but important if we’re serious about dating. A drop into 20%+ drawdown, even if it’s brief, means a bear market and the end of the previous bull, if we’re using the generally accepted 20% (which is also meaningless, but it is what it is).

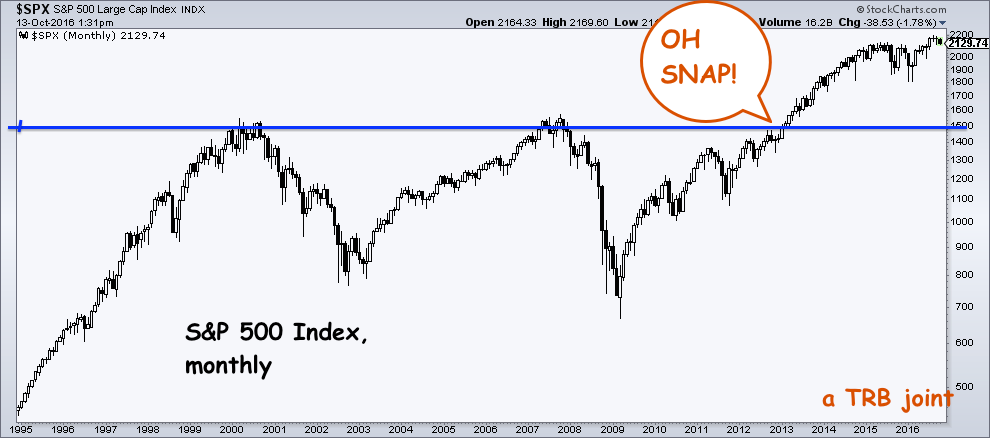

This is what the secular breakout of 2013 looks like, in relation to the breakaway from the prior two peaks between 2000-2007. By this count, the previous secular bear was 13 years (2000-2013), hence the current bull market is 3, not 7, and has a long way to go before anyone can say that it’s gone too far:

Now I want you to go read Michael Batnick’s awesome post about what it was like when the stock market broke into the secular bull market from 1982-2000.

That fall, as in the spring of 2013 when the current one began, things were awfully shaky and scary for market participants. It was only years later that the ’82 breakout could be seen for what it really was – a new dawn after a long period of lackluster returns…

This week in 1982 marked a major milestone in the history of the stock market. The Dow Jones Industrial Average closed above 1,000- its highest levels in nearly a decade- and it was on the precipice of saying sayonara to a 16-year bear market. A new secular bull market was right around the corner and the S&P 500 would go on to advance 1650% over the next 17 years, or 18.3% a year.

Go now:

Looking Back at the End of a Secular Bear Market (The Irrelevant Investor)

[…] When did the bull market begin, IRL? […]

[…] Josh Brown: When Did The Bull Market Begin, IRL? […]

[…] Josh Brown: When Did The Bull Market Begin, IRL? […]

[…] Here’s his chart showing the moment that secular bull market began in 2013. “By this count, the previous secular bear was 13 years (2000-2013), hence the current bull market is 3, not 7, and has a long way to go before anyone can say that it’s gone too far.” Read the full blog here. […]

[…] Here’s his chart showing the moment that secular bull market began in 2013. “By this count, the previous secular bear was 13 years (2000-2013), hence the current bull market is 3, not 7, and has a long way to go before anyone can say that it’s gone too far.” Read the full blog here. […]

[…] ‘When Did The Bull Market Begin, IRL?’ – Josh Brown – The Reformed Broker […]

[…] of secular bull markets and so they date the start of this one to March of 2009,” writes Downtown Josh Brown. “They tell you it’s ‘long in the tooth’ and they count other bull markets that […]

[…] Here’s his chart showing the moment that secular bull market began in 2013. “By this count, the previous secular bear was 13 years (2000-2013), hence the current bull market is 3, not 7, and has a long way to go before anyone can say that it’s gone too far.” Read the full blog here. […]

[…] When should you date the start of the current bull market? (thereformedbroker) […]

[…] Source: http://thereformedbroker.com/2016/10/13/when-did-the-bull-market-begin-irl/ […]

[…] “Some investors and many people in the media tend not to understand the concept of secular bull markets, and so they date the start of this one to March of 2009,” he said in a post at his Reformed Broker blog. […]

[…] 4 years old since a new bull begins after breaking through previous highs. Josh Brown has more here. Since I don’t time the market, it doesn’t really matter to me, but perma-bears live […]

[…] Here’s his chart showing the moment that secular bull market began in 2013. “By this count, the previous secular bear was 13 years (2000-2013), hence the current bull market is 3, not 7, and has a long way to go before anyone can say that it’s gone too far.” Read the full blog here. […]

[…] Back in 2016, he noted that a bull market starts once a new high is reached, not from the prior low, and also that a bull market is interrupted by a new bear market on a 20%+ drawdown. From The Reformed Broker: […]

[…] How is it that it sounds more or less reasonable to us that we might be a couple of years away from a third “once-in-a-lifetime” crash in 20 years? At the same time, the belief that a bull market might continue for more than 10 years sounds almost dangerously naive? They’re actually both outliers, and of the two, three generational crashes in one generation is, to me, less likely to happen than than a super long bull market (especially since some very smart people argue the US bull market actually started in 2013, not 2009: see http://thereformedbroker.com/2016/10/13/when-did-the-bull-market-begin-irl/). […]