I’m making my way through the Sanford C. Bernstein research piece that everyone is talking about today, in which the sell-side brokerage compares passive investing to a combination of Nihilism and Marxism. To be clear, the author does not make the case that passive is bad or active is better – he’s just saying that there are policy considerations that should be thought about before regulators and government officials proclaim the shift to low-cost passive as universally beneficial for society.

So far, it’s very thought-provoking. I’m not sure how much of it I agree or disagree with yet, I like to stew on these things a bit before reacting.

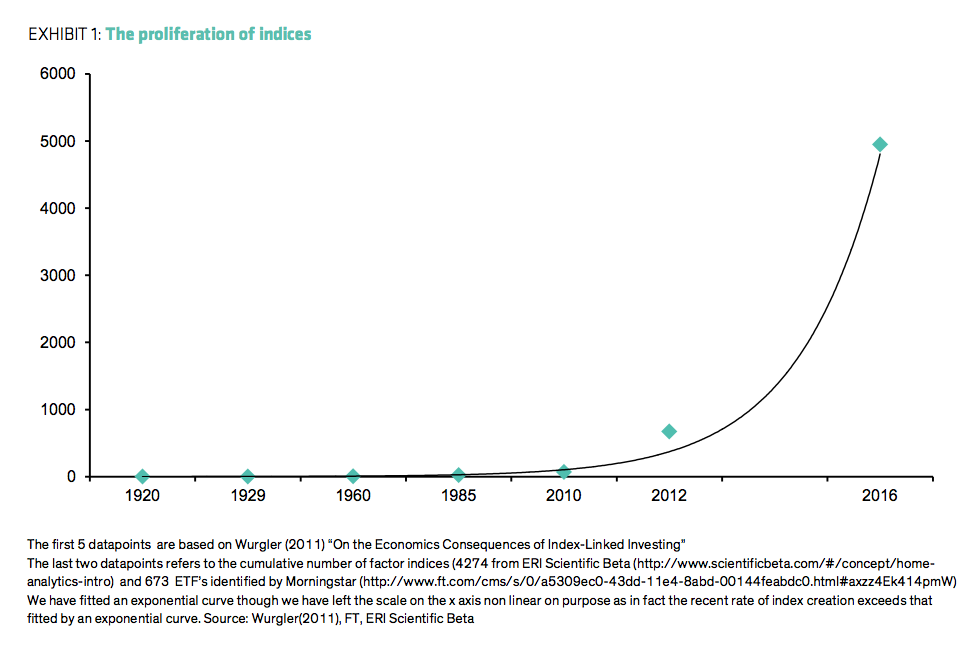

Here’s one part I whole-heartedly agree with, however – there is a bubble in indexes. Bernstein plots the rise of man-made indexes in the chart below, and talks about how factors have become the new active management. I think this is true.

A lot of what used to be looked at as the alpha of a stock-picking manager can now be reduced to the beta factors that have paid off. Even Buffett’s portfolio has been given the beta distillation treatment (he likes wide moats and consistent cash flow and looks more like a growth-at-a-reasonable-price afficianado than a Ben Graham-esque deep value hawk).

If we’re systematizing stock-picking via factor investing (and we are, to a large degree), then it follows that we will all take it too far. The way things work now is that index companies (Solactive, MSCI, Russell, SPDJ etc) are being asked to create more indexes by ETF sponsors, who then pay a licensing fee and create new products based on them. This is how a formerly active strategy – “I want all high quality companies that have raised dividends in the last 10 years and have CEOs of Hawaiian ancestry” – becomes an “index” strategy. We’re playing games with words here. It’s led to a proliferation in new indexes that has gotten very carried away.

Here’s Inigo Fraser-Jenkins:

Before we start our discussion proper we should say what we mean by active and passive. It is becoming increasingly hard to tell the difference between active and passive. More than a decade ago things were easier as passive meant market cap weighted indices, although even then the number of indices was growing. The proliferation of indices has been greater since then as smart beta indices increasingly offer exposures that cover part of what was known as active before. We now have the bizarre situation that there are more indices than there are large cap stocks, this is not at all helpful for investors.

I can’t link to the whole piece, but I suggest you contact whomever covers you at Bernstein and get a copy of it. Definitely worth the read. As the author states – and we can all agree on this – the issue of active management’s value to society is a complex one and will not be satisfied with easy answers.

Source:

The Silent Road to Serfdom: Why Passive Investing is Worse Than Marxism

Bernstein Research – August 23rd

[…] Source: Reformed Broker […]

[…] Source: Reformed Broker […]

[…] chosen and weighted based on some set of factors that have historically determined performance. Fraser-Jenkins et al. note “the bizarre situation that there are more indices than there are large cap stocks.” […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] There you will find 98522 more Info on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Here you can find 70096 additional Information on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2016/08/24/the-index-bubble/ […]