In the 1980’s and 1990’s, private equity and hedge fund strategies were new and novel. They were the province of only the most sophisticated investors and very little understood. They were small, relative to public equity mutual funds, and their methods for making money were unique.

As such, they were incredible places to put money. The Yale Endowment’s David Swensen rode both “asset classes” to enormous gains and, as can be expected, the word got out. As Warren Buffett says, “Nothing recedes like success.” Swensen wrote a book about his “endowment model” and a revolution was triggered. Suddenly, every large pool of assets was on the hunt for alternative strategies and private funds.

The ducks were quacking and the industry met this demand with more and more product. Instead of one or two guys doing arbitrage, all of a sudden there were hundreds. A hundred funds doing long/short or event driven investing became thousands. The business schools reacted and began schooling hundreds of thousands of students to fill out the industry, which had an ocean of money raining down on it.

And then the hedge fund industry broke a trillion in assets, sometime around the Great Financial Crisis. Within a year or two, it became two trillion, and then three.

Three trillion was the limit. Last December, trying to reconcile the industry’s lacking performance with the money gushing in, I said “For awhile there, I started to doubt one of the basic tenets of capitalism and investing: Money flows to where it is treated best.” (See There is a limit for more) But that turned out to have been the peak.

This year, the industry’s assets under management will actually shrink. Because more is never better and a bigger industry doesn’t mean a bigger pie of profits, it means a slimmer slice for all consumers of the pie. Ray Dalio quipped that, “Today there are 8000 planes in the sky but maybe only a hundred good pilots.” Wes Gray thinks it’s more like 24,000 pilots. Either way, too many people all attempting to do the same thing – and really smart, well-equipped people at that.

A smart allocation of hedge fund AUM might be to buy out all the inferior hedge funds and close them. Because more research, more firepower, more talent isn’t going to be the answer.

My pal Nir Kaissar writes about the struggles the Harvard Endowment is going through in its attempt to bring back the glory days of double-digit average annual returns using the old playbook of private equity and hedge funds. It’s not going well. It’s also not Harvard’s fault.

Harvard’s ten-year returns peaked 16 years ago, and since 2009 the endowment has struggled to achieve a ten-year return that numbers in the double-digits…success breeds imitation. According to Wilshire, the median allocation to private equity and hedge funds and other alternative investments among endowments greater than $500 million was a paltry 14.6 percent in June 2005. That number swelled to 49.2 percent by June 2015.

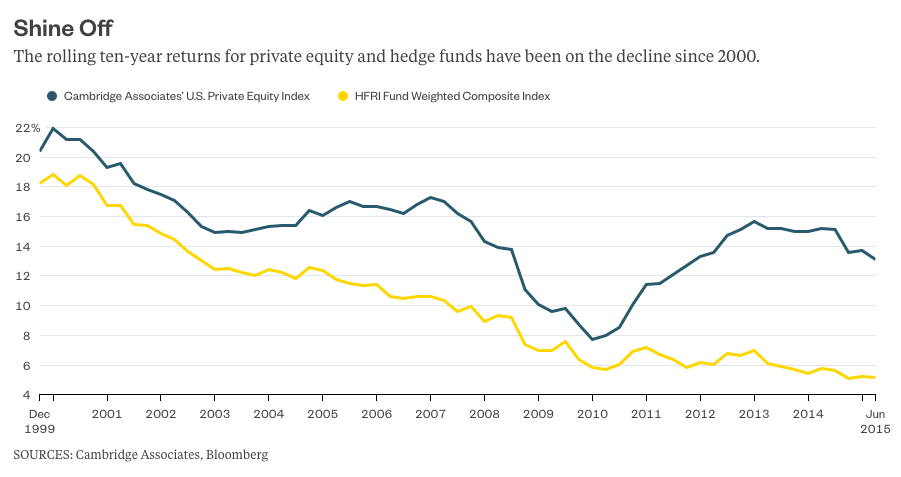

According to HFR, hedge funds grew from $39 billion under management in 1990 to nearly $3 trillion in 2015. Private equity saw similar growth…Nothing squashes investment returns like a stampeding herd of investors. The HFRI Index returned just 5.2 percent annually over ten years through June 2015, and the Private Equity Index returned 13.1 percent annually over the same period.

5.2% and 13.1% returns over 10 years are not terrible by any stretch. But they’re trending down. It’s not because, all of a sudden, the managers became worse at their jobs. In fact, it may be just the opposite – they’re too good and there are too many smart guys and gals chasing the same thing.

Here’s Nir’s chart of rolling returns for both the hedge fund index and private equity index. Please note that these indices are riddled with survivorship bias (not counting closed funds that, presumably, were bad) and so the reported numbers are probably much better than the real thing:

Perhaps things turn up. The key to this would be less wannabe Bobby Axelrods. A period of low returns and closing funds, already underway, may be just what the doctor ordered. Hedge funds have just seen three consecutive quarters of net outflows, according to the Wall Street Journal, for the first time since 2009, which wasn’t at all performance-related. As of May, more hedge funds had closed down than had opened up over the last 12 months, according to Money Magazine. Unfortunately, it was a close call – 1053 liquidated while 910 new ones rose to fill their spots.

It’s got to get worse before things get better. In this way, the pursuit of abnormally large investment returns may be similar to the dynamics of the oil market, where they say the best cure for low prices is low prices. Eventually, the less able drillers and wildcatters call it a day and abandon their rigs.

This allows the remainder to get back to business.

Source:

[…] Alternative assets are overgrazed. (thereformedbroker) […]

[…] Nothing recedes like success (Reformed Broker) […]

[…] Josh Brown: “Nothing Recedes Like Success” […]

[…] Nothing recedes like success (The Reformed Broker) […]

[…] Josh Brown: “Nothing Recedes Like Success” […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Here you will find 82747 additional Information on that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Here you can find 36733 more Info on that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/08/17/nothing-recedes-like-success/ […]