This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

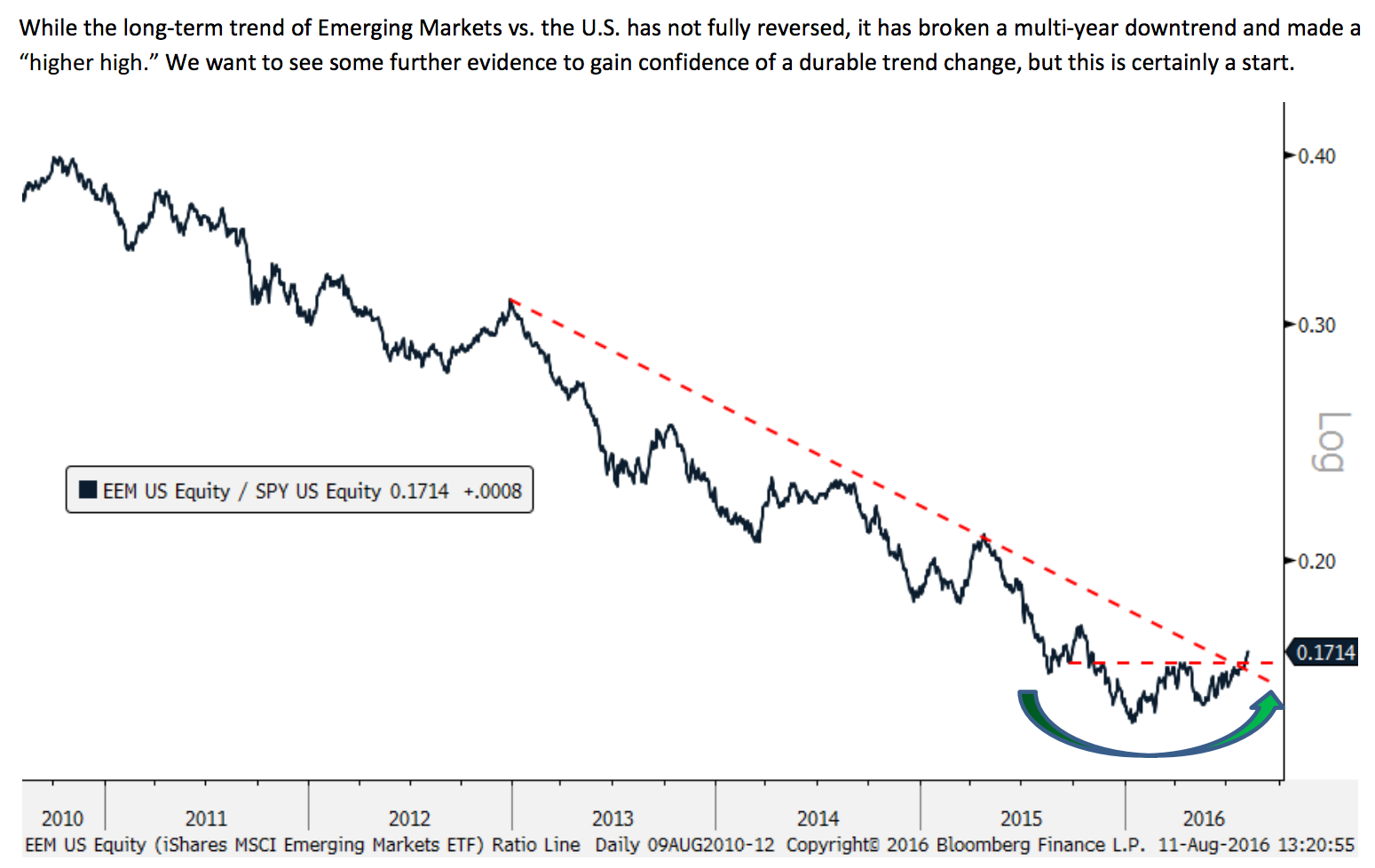

[…] Emerging market equities are finally outperforming. (thereformedbroker) […]

[…] Chart o’ the Day: Emerging Emerging “Nothing Recedes Like Success” Simple vs Complex This would be not good The Paradox of Quant Rules-based tactical vs wizardry and witchcraft Reaction: Jesse Livermore – Boy Plunger Most Popular Smart Beta Fixed Income ETFs | ETF.com Swedroe: Declining Or Rising Equity Strategy In Retirement? | ETF.com Single Factor Focus: Ranking The Top Momentum ETFs | ETF.com Swedroe: Investors Should Re-Examine Annuity Aversion | ETF.com Research Affiliates: Death Of The Risk-Free Rate | ETF.com IndexIQ: Bringing Momentum To Bond Investing: Part 2 | ETF.com Single Factor Focus: Ranking The Top Value ETFs | ETF.com The Worst ETFs You Can Own Seeking Alternatives Do Stocks Diversify Bonds? What It Takes to Retire Early Being Process-Oriented Means… How Progress Occurs Disrupting Your Own Happiness What’s the Right Asset Allocation For Young Investors? How They’ll Sell you Higher Fees | Pragmatic Capitalism Ten Attributes of Great Fundamental Investors | Pragmatic Capitalism Can Investors Replicate the Dorsey Wright Focus 5 ETF Strategy? – Alpha ArchitectAlpha Architect Taming the Momentum Investing Roller Coaster: Fact or Fiction? – Alpha ArchitectAlpha Architect Evidence-Based Investing Requires Less Religion and More Reason – Alpha ArchitectAlpha Architect Stale Performance Chasing: Beware of Horizon Effects – Alpha ArchitectAlpha Architect EconomPic: What Drives Momentum Performance? How Much Would Hillary Clinton Be Worth Today If She Continued Trading Cattle Futures? | Meb Faber Research – Stock Market and Investing Blog Few Bargains? Depends Upon Where You Look – The Big Picture When is a “Value” Company not a Value? – Investing Research GMO: the-duration-connection.pdf […]

… [Trackback]

[…] Here you will find 2136 more Information on that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]

… [Trackback]

[…] Here you can find 50888 more Info to that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2016/08/15/chart-o-the-day-emerging-emerging/ […]