The drama over whether or not the economy (just kidding, the stock market) is strong enough for the Federal Reserve to pull off its second rate hike in ten years is going to heat up into September. That’s the month strategists and traders believe is the best opportunity the Fed has to do something far enough from the election so as to be seen as non-partisan.

Okay, fine, whatever. We’re “data-dependent” and also optics-aware. Good.

One of my favorite macro writers, Christopher Wood of the GREED & Fear report at CLSA, points out something about how inflation is calculated that could serve to throw a monkey wrench into the will-they-or-won’t-they debate.

Rents, which are included in CPI calculation in the shelter component, might have already peaked. Multi-family home construction has exploded as the demand for rentals has increased post-crisis. Wood notes that “Multi-family housing units under construction have surged from a low of 153,100 units in 2010 to an annualised 573,000 units in June, the highest level since 1974.”

At some point, the demand gets satiated. In the 3rd quarter of 2009, rental vacancies were 11.1% and today they’re down to 7%.

With all this supply of new rental units coming online, it’s only a matter of time before rental prices flatten out or even drop. And when this happens, it’s going to look like there’s even more deflation hitting the economy, because the shelter component of CPI has been so strong.

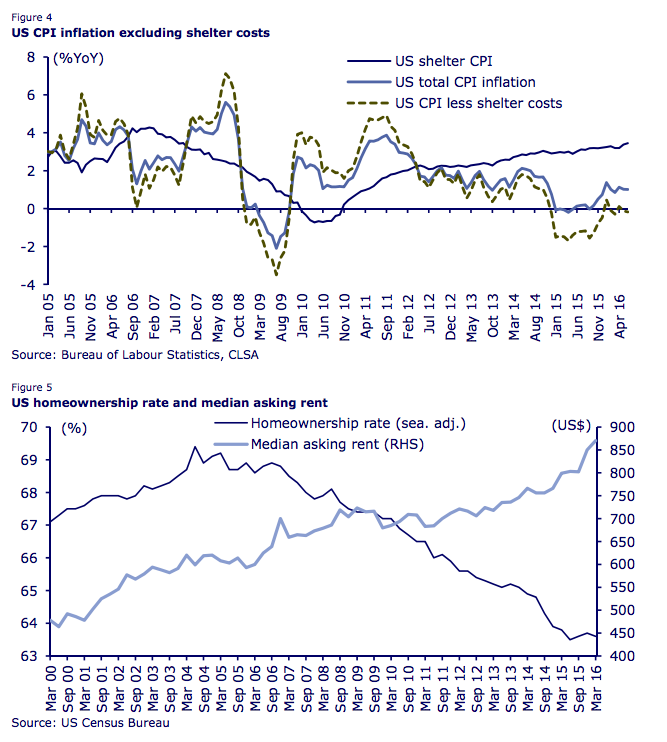

Here’s what happens when we lose the benefit of rising rents in the CPI data:

It is also worth highlighting that the risks for officially reported inflation measures are to the downside. This is because of the extent to which currently inflation readings in America are increased by the shelter component, which is a measure of rent inflation. This accounts for 33% of the CPI basket and 42% of core CPI, and is rising at 3.5%YoY. The interesting point is that if the shelter component is excluded the CPI inflation rate in June declines from 1.0%YoY to a negative 0.2%YoY.

This raises the question of what happens to reported inflation data if the increase in rents starts to slow in coming quarters. This is a growing possibility given that rents have been soaring during this economic recovery which began in mid-2009 reflecting the fact that many households have been priced out of the housing market not having the equity required to qualify for a mortgage in the post financial crisis world. The US median asking rent has risen from US$680 in 4Q09 to US$870 in 1Q16.

Here’s what that looks like:

Josh here – so if and when rental prices moderate, and should home ownership merely bump along the bottom, they will point to the headline inflation gauge and say “disinflation is accelerating! Look at CPI!”. Rather than attributing it to a supply-demand rebalance in the housing sector because of building, occupancy and availability, they’ll use it to paint a more dire picture about global growth and deflation taking hold in the US.

It’s important to ignore this. Like the “oil scare”, what appears in the official inflation statistics does not exactly represent what’s going on in our real lives. Only economists, energy executives and traders had a problem with falling oil and gas prices this past two years. For everyone else, it’s helped them pay off debt, save more money, do more travel and even drive more miles in a new car.

Lower rent prices will have a similar effect. The positives may not show up in official spending statistics – “where is all the money going that renters are saving?!?” – but it’s helping someone, somewhere.

Regardless, they’ll use this as one more cudgel over our heads, as one more reason that “the Fed is trapped!” Stay woke for when it begins.

Source:

Amnesties, recaps and conventions

CLSA – July 28th 2016

[…] Bloomberg Weekly Initial Unemployment Claims Increased to 269,000 – Calculated Risk Here’s How They’ll Scare You Next – The Reformed […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]

… [Trackback]

[…] Here you can find 86696 additional Information on that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]

… [Trackback]

[…] There you can find 46536 additional Information on that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2016/08/04/heres-how-theyll-scare-you-next/ […]