Poland, 1503: A young man named Nicolaus Copernicus returns home after years spent studying Catholicism and astrology among the priests and clerics of Italy. He is schooled in the ideas of Ptolemy, the Ancient Greek who had originally popularized the idea that the planets, sun and moon revolved around the earth. This idea had become accepted as fact and had been taught that way for over a thousand years.

But something bothered Copernicus about the movements in the sky he witnessed from the observatory atop his church. Specifically, the retrograde courses he saw the planets take, switching direction and seemingly traveling backwards on some nights. He begins to hand out his own booklet to friends, in which he claims it is the sun, and not the earth, that serves as the centripetal point in the universe. This upends the broadly understood Ptolemaic model and is even considered a form of heresy among his colleagues in the church.

***

In the early 1950’s, Harry Markowitz introduced his Modern Portfolio Theory as an explanation for how, by diversifying one’s investments, an “efficient frontier” of risk versus reward could be achieved and optimized. A decade later, William Sharpe and his colleagues took the concept a step further and introduced the Capital Asset Pricing Model, which sought to explain the sources of investment returns and lay out a framework for allocation decision-making. These are Nobel-prize winning theories. Many researchers have taken shots at them over the years and flaws have been discovered, but neither have been replaced or bested, despite the incessant attempts of thousands of academicians.

It is now commonly thought that the risk-free rate is the center of the financial universe and that the prices of all assets revolve around it. But what happens when the risk-free rate slowly ceases to exist. Or becomes a negative number?

Critics and revisionists of MPT and CAPM may have been wasting their time. Turns out, all of the potshots they’ve been taking for decades were entirely unnecessary. All it took to almost entirely subvert the laws of capitalism was a few years of zero-percent interest rates. The whole thing’s being turned on its head every day.

I bring you three examples of outright perversion in the laws of finance, now currently occurring…

All of the traditional drivers of risk-off behavior have been nullified. Everything that used to signal a correction now signals a reason to continue a rally. Urban Carmel, writing at the Fat Pitch blog, points out that the S&P 500 index has made a new all-time record high during a week in which:

a) QE had been ended 19 months prior. That popular chart depicting stock returns during the various QE programs? Throw it out. The link has just been broken.

b) Margin debt had peaked 13 months prior. Remember all those charts showing peaks in margin debt versus historic market tops? Throw those out too. The margin debt uptrend broke but stock prices haven’t.

c) Household fund flows are negative and the pace of selling has accelerated. “No one is buying.” Doesn’t seem to matter.

d) Corporate buybacks were in a blackout period. Share repurchase programs cease ahead of earnings season (starting shortly). And yet we print a new high without the CFOs leaning on the buy button, as has been popularly imagined as “the only source of inflows.”

e) GDP growth stalled to less than 2%, it’s lowest quarterly reading in years, earnings and revenue growth for the S&P’s components went negative.

…and we got a new high anyway. A new one for the Dow Jones too, why not?

Read the details here and see Urban’s charts of these discordant phenomena:

The New All-Time High in SPY That Was Considered Impossible (Fat Pitch)

Next, an unintentionally hilarious look at the way in which bonds are now used for capital gains while stocks are being used for their dividends. It’s quite amazing to see the role reversal here – and the source of returns for diversified portfolios being crossed up with each other. It inverts everything we’ve thought about traditional asset allocation.

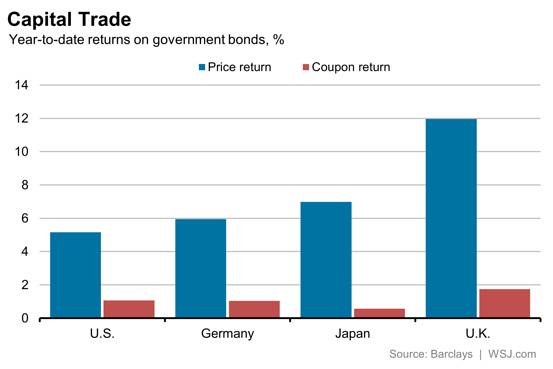

Bonds are churning out returns many equity investors would envy, led by U.K. gilts, up a startling 13.7% year to date. Remarkably, more than 80% of returns on U.S., German, Japanese and U.K. bonds are attributable to gains in price, Barclays index data show. Bondholders are no longer patient coupon-clippers accruing steady income.

Look at the below chart, depicting the stock-like returns of sovereign bonds:

The Street is responding by selling investors what they’ve always wanted – stock-like returns with bond-like volatility, in the form of high-dividend payers with minimum beta:

Tellingly, strategists at Citigroup have created a basket of stocks for what they call “bond refugees”—investors who want yield but without the big swings in prices associated with equities. To do so, they looked for stocks with high dividend yields, but that fall by relatively less in price when markets take a tumble.

This is easy to mock, until you realize how long it’s been working for. Working really well, I might add.

Source:

What To Do in the Brave New World of Bonds and Stocks (Wall Street Journal)

Finally, to demonstrate that we’ve truly entered bizarro world, Michael Batnick discusses the valuations that investors are now willing to pay for their supposedly low-risk, high-return bond proxy equities and the sheer force of the fund flows into this category:

Recently, Mondelez put in a bid to buy Hershey, which would bring together two of the biggest food/snack companies in the world. The proposed deal, at $107 a share, puts that right about 25x earnings. Not exactly a bargain for a company that has had single-digit earnings growth for each of the last three years.

This deal puts the cherry on top of a theme we’ve seen all year, low vol, expensive stocks. This chart from iShares pretty much says it all.

Source:

Bizarro World (The Irrelevant Investor)

To sum up – bonds are the new stocks, taking on their role as the primary providers of capital appreciation in a portfolio. Stocks are now the new bonds, bringing income into a portfolio in place of the bond income which no longer exists. Further, the link between lower volatility and lower potential reward has been shattered, with the allegedly lower risk stock sectors producing the type of upside that even the most daring growth manager at a Janus fund in the 1990’s would be jealous of.

It’s all gone pear-shaped. In the era of negative bond yields, which themselves seemed to be inconcievable just a few years ago, we seem to be rewriting the laws of capitalism as we go.

***

The revolutionary ideas of Copernicus begin to rankle, given the implication that the laws of the universe have been so gravely misunderstood by the Church. The local clergy hires clowns to prance about town impersonating him, ridiculing his ideas. They call him the “crazy priest” and suppress the influence his work may have had. Copernicus is unfazed by the mocking of his fellows. “Let them, the movement of the heavenly bodies will be influenced not in the slightest either by the ridicule or the respect of these foolish men.”

He won’t publish his controversial theory in book form until decades later, lying on his death bed at the age of 68. It is not until 100 years later, when Galileo Galilei suffers house arrest in order to champion the work of Copernicus, that it will become generally accepted. The earth loses its place as the center of the universe and a lot of widely accepted truths become implausible untruths in the aftermath.

Science advances one funeral at a time. Portfolio theory, however, may require a mass grave.

[…] Modern finance is being re-written before our very eyes. (thereformedbroker) […]

[…] The laws of capitalism are being rewritten (Reformed Broker) […]

[…] I wrote that The Laws of Capitalism Are Being Rewritten earlier this week, I didn’t expect it to get as big of a reaction as it did. It was cool to […]

[…] The Laws of Capitalism are Being Rewritten – Link here […]

[…] Stocks are the new bonds and bonds are the new stocks (The Reformed Broker) […]

[…] More: The laws of capitalism are being rewritten – The Reformed Broker […]

[…] There is more: http://thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

[…] The Laws of Capitalism are Being Rewritten, Joshua M Brown, thereformedbroker.com […]

… [Trackback]

[…] There you can find 89446 additional Information on that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

… [Trackback]

[…] Here you will find 3614 more Info to that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2016/07/12/the-laws-of-capitalism-are-being-rewritten/ […]