Let me start off with this: past performance is not a guarantee of future results. We’ll be discussing ETFs in this post instead of indexes, but nothing contained here should be misconstrued as advice or a solicitation to buy or sell any securities.

Many investors and media outlets begin and end the conversation about portfolio construction with a ratio of how much stocks versus how much bonds people should hold. Sometimes cash is mentioned. Sometimes alternatives or gold or commodities get brought into the discussion, too.

You very rarely hear people discuss the role of publicly traded real estate in their portfolio mix. Usually, this piece gets lumped into the equity side or neglected outright. Standard & Poor’s has historically included REITs in the Financial sector, alongside banks, insurers and brokerages. Investors take their exposure to the group for granted.

This step-child status is about to change. In a long overdue move, MSCI and S&P will begin categorizing REITs as their own sector of the benchmark index on September 16th. REITs now make up 20% of the S&P Financials and are valued at a combined $609 billion as of the end of June.

In our core client portfolios, we allocate to real estate separately from our equity exposure. Many managers aren’t there yet, but I believe this September’s catalyst will change the way REITs are included and thought of.

Going back to the year 2000, REITs are the best performing asset class in the market, according to JP Morgan, up 12% on an average annual basis. Compare this with the runner-up, high-yield bonds, at just under 8% and large cap US stocks at just over 4% and it’s weird that people generally don’t focus on them.

And you don’t need to go back quite that far to see this dominance – off the March 2009 bear market low, REITs have literally demolished the returns for both US bonds and stocks. Here’s the Vanguard REIT ETF, VNQ, vs the S&P 500 and the Barclays Aggregate Bond index ETFs (total return):

Perhaps, to all of a sudden be taking more of an interest in the asset class now, after this incredible period of falling rates and high demand from income-seeking investors is not such great behavior.

But their performance is impossible to ignore and the new sector designation is going to give them the spotlight nevertheless.

A few more charts I think worth looking at…

Here’s VNQ year-to-date, in percentage terms. Not bad for a “low-return environment”:

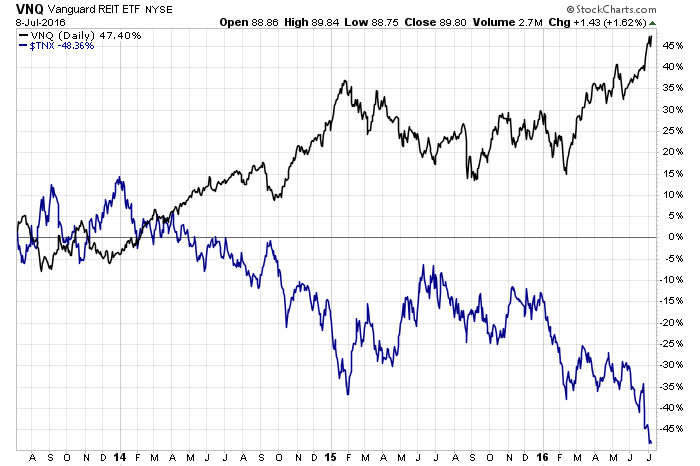

It’s not hard to understand what’s driving this. In the chart below, I plot VNQ’s performance against the yield on the 10-year Treasury bond (in blue). It’s a mirror image:

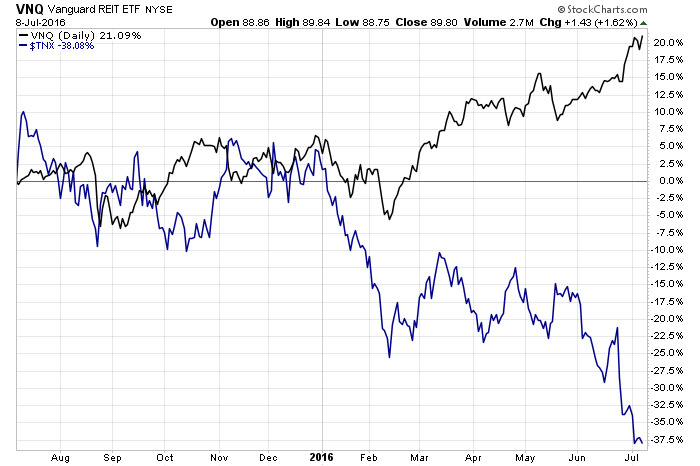

Here’s a close-up of what’s gone on year-to-date when this trend really kicked into overdrive. Bond yields broke down in February, and they’ve been rocked ever since. Investors have responded by bidding up every high-yielding US asset they could find, REITs chief among them.

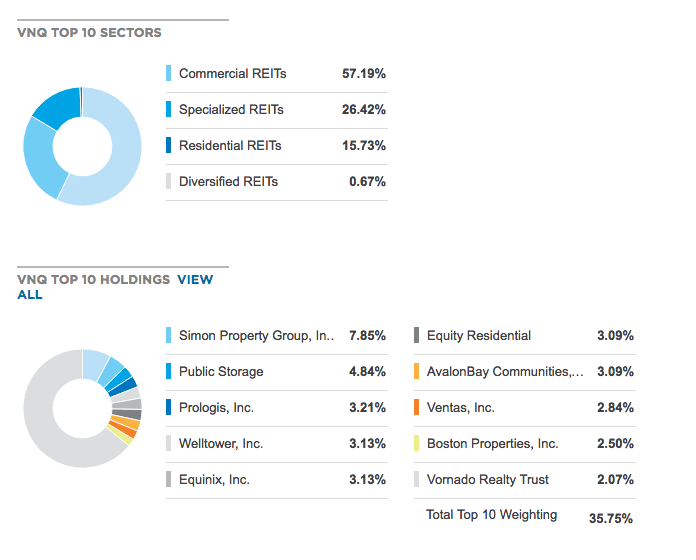

Just to give you a sense of what an ETF like VNQ is composed of, I’ve got a table below. There’s as much variety within the REIT sector – from hospitals to malls to data centers – as there is in the broad economy. Which I believe makes it worthy of getting its own sector designation, distinct from the Financials.

The last thing on this topic I want you to read about is how the split will work, mechanically. Not all mutual funds and index ETFs will be handling the transition the same way. There are portfolio construction issues and tax issues that come into play.

The best discussion I’ve found on the ramifications is at the Wall Street Journal:

Given its outsized share of the sector, the fund’s managers are working for a smooth transition, says Dave Mazza, head of exchange-traded fund research at SSGA. They plan to split the fund proportionally for holders of record as of Sept. 21. Investors will wind up with two holdings, each mirroring the new S&P benchmarks, and perhaps a small amount of taxable income.

The REIT assets will be paid out via a special dividend consisting of shares in the new REIT ETF on Sept. 22, and this distribution could be largely nontaxable because it counts as a return of capital to investors. The income payment, which will be determined closer to the breakup date and is due to fractional shares and other issues, will be taxable at ordinary rates.

What happens to the investor’s cost basis—the starting point for measuring taxable gain? For the REIT shares, it will be the value on the date they are paid out. Investors’ basis in the financial-sector ETF shares will be reduced by that value to account for the distribution of the REIT shares.

Other financial-sector funds, including those sponsored by Vanguard Group, Guggenheim Investments, and Fidelity Investments, will be selling their REITs before the index’s September change—so investors who want to maintain REIT exposure will need to replace it with a separate purchase.

You should be speaking with a qualified financial advisor to figure out what the impact might be on your own situation. If you don’t have an advisor, or your guy is out to lunch, you can talk to us.

My colleague Bill Sweet is a Certified Financial Planner and a tax accountant, he has these discussions with our clients all the time.

And if REITs haven’t been a part of your portfolio mix, or are not on your radar, it’s probably not a great time to first begin overweighting them. However, it is an excellent opportunity to consider what other asset classes you may be neglecting, because you never know where the next REITs-like rampage is going to come from.

[…] Brown, posted this on his blog about REITs. If you don’t want to read the whole thing, Brown basically suggests […]

[…] The best performing asset class no one talks about (thereformedbroker) […]

[…] his July 2016 column, “The best performing asset class no one talks about,” Reformed Broker Josh Brown observes that, “Going back to the year 2000, REITs are the best […]

[…] Going back to the year 2000, REITs are the best performing asset class in the market, according to JP Morgan, up 12% on an average annual basis. Compare this with the runner-up, high-yield bonds, at just under 8% and large cap US stocks at just over 4% and it’s weird that people generally don’t focus on them. –Joshua Brown (Reformed Broker) […]

[…] his July 2016 column, “The best performing asset class no one talks about,” Reformed Broker Josh Brown observes that, “Going back to the year 2000, REITs are the best […]

[…] his July 2016 column, “The best performing asset class no one talks about,” Reformed Broker Josh Brown observes that, “Going back to the year 2000, REITs are the best […]

[…] And if you have any doubt about the performance of real estate, listen to Josh Brown: […]

[…] what they could receive from fixed income. This seems certainly to be the case in the U.S. where REITs, consumer staples, and especially utilities have been the beneficiaries of this trend. […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]

… [Trackback]

[…] Here you will find 91670 more Info on that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2016/07/10/the-best-performing-asset-class-no-one-talks-about/ […]