Today’s chart comes from my pal Ari Wald, one of my fave technicians who does great work every week at Oppenheimer.

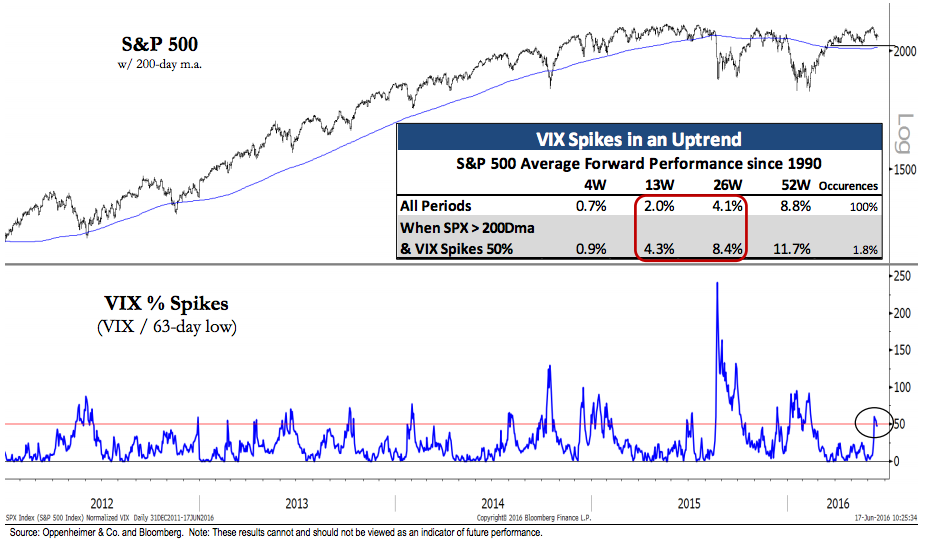

Ari takes a look at last week’s spike in the Vix, which signals a jump in short-term market fear as participants scramble for protection via options trades. Going back 25 years or so, it’s paid off to be a contrarian at moments where fear rips to the upside as quickly as it just did. Returns looking out a few weeks / months have been shown to be double the average.

Here’s Ari:

Last week’s VIX spike triggered a trading buy signal because it occurred in an uptrend, by our analysis. We define a VIX spike as a reading that is 50% higher than its 63-day low, this helps normalize for different volatility environments, and we consider the S&P 500 in an uptrend when the index is above its 200-day m.a. Spikes in the VIX typically occur around short-term market lows and we’ve found it’s a more compelling signal when trend is positive. Since 1990, the S&P 500 has averaged an 8.4% gain in the next six months when this signal of selling exhaustion is triggered vs. a 4.1% gain during any six-month period.

Source:

Technical Analysis: Inflection Points

Oppenheimer & Co – June 18th, 2016

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows that for the […]

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows […]

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows […]

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows that for the […]

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows that for the […]

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows […]

[…] The recent $VIX spike kicked off a buy signal. (thereformedbroker) […]

[…] Brown of the Reformed Broker blog highlighted this chart from Oppenheimer’s Ari Wald, one of his “fave” technicians. Basically, it shows that for the […]

[…] Josh Brown explains how to use the VIX in your trading. There are very good results from watching VIX spikes during an uptrend. (See also Dana Lyons ). Many investors take the opposite viewpoint about the “fear gauge.” Maybe that is why it works so well. Maybe it is related to what Dr. Brett is saying! […]

[…] Josh Brown explains how to use the VIX in your trading. There are very good results from watching VIX spikes during an uptrend. (See also Dana Lyons ). Many investors take the opposite viewpoint about the “fear gauge.” Maybe that is why it works so well. Maybe it is related to what Dr. Brett is saying! […]

[…] Josh Brown explains how to use the VIX in your trading. There are very good results from watching VIX spikes during an uptrend. (See also Dana Lyons). Many investors take the opposite viewpoint about the “fear gauge.” Maybe that is why it works so well. Maybe it is related to what Dr. Brett is saying! […]

[…] Josh Brown explains how to use the VIX in your trading. There are very good results from watching VIX spikes during an uptrend. (See also Dana Lyons). Many investors take the opposite viewpoint about the “fear gauge.” Maybe that is why it works so well. Maybe it is related to what Dr. Brett is saying! […]

[…] Josh Brown explains how to use the VIX in your trading. There are very good results from watching VIX spikes during an uptrend. (See also Dana Lyons ). Many investors take the opposite viewpoint about the “fear gauge.” Maybe that is why it works so well. Maybe it is related to what Dr. Brett is saying! […]

[…] Josh Brown explains how to use the VIX in your trading. There are very good results from watching VIX spikes during an uptrend. (See also Dana Lyons). Many investors take the opposite viewpoint about the “fear gauge.” Maybe that is why it works so well. Maybe it is related to what Dr. Brett is saying! […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2016/06/19/chart-o-the-day-buying-on-vix-spikes/ […]