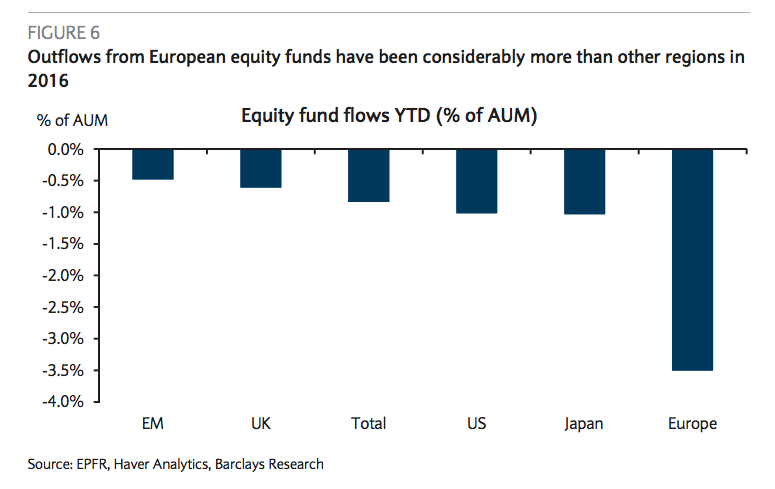

Outflows from equity funds have been vicious this year.

It’s been particularly pronounced when looking at Europe-focused ETFs and mutual funds as well as the FTSE-benchmarked UK stock funds. This is being driven, most acutely, by Brexit fears, as opposed to the belief that the Fed is up to an imminent rate hike.

The macro strategy team at Barclays tallies up the Brexit-related outflows, net of inflows, at approximately $140 billion. Then it asks the question: What happens to this money after the Remain vote comes through? Good question.

Here’s Keith Parker:

In line with the typical pattern, we see the UK Referendum as a binary risk event that will keep risk appetite in check the next 2 weeks as the outcome is still uncertain. Equity positioning in aggregate is near neutral, though Europe-dedicated equity MFs are very underweight. With the market expecting the Fed to be on hold until at least September, lower expected policy rates suggest some of the remaining cash on the sidelines ($140bn) will likely make its way into markets on a “Remain” vote; after outflows of $111bn YTD, equities should be the main beneficiary, particularly Europe, with bond yields already near the lows after big inflows.

Cash on the sidelines ($140bn) should go to equities on a “Remain” vote if the Fed is “patient”. Nearly half of the cash that went into money markets from July to February has come out and gone into bonds. Equity outflows of $111bn YTD versus bond inflows of $97bn suggest cash will return to equities on a “Remain” vote, particularly European equities.

Josh here – About a week and a half til we find out. Depending on whom you’re reading, odds of a remain vote seem high to quite high. Betting markets and investment markets seem to pricing the “leave” risk as somewhere between 25% and 40%. I’m not including social media polls in this survey, because life is to short and the most vocal people are not representative of the main body of people who will participate in the referendum.

Here’s the thing, though, about it being binary – I don’t quite see it that way. A “remain” vote will not provide nearly as much upside as a “leave” vote will provide downside risk, even if we’re thinking hat a good chunk of the $140 billion will come rushing back to stocks if the Brexiteers are defeated. The outcome may be binary (yes or no) but the gains / losses potential is not at all symmetrical.

Two good charts from the report…

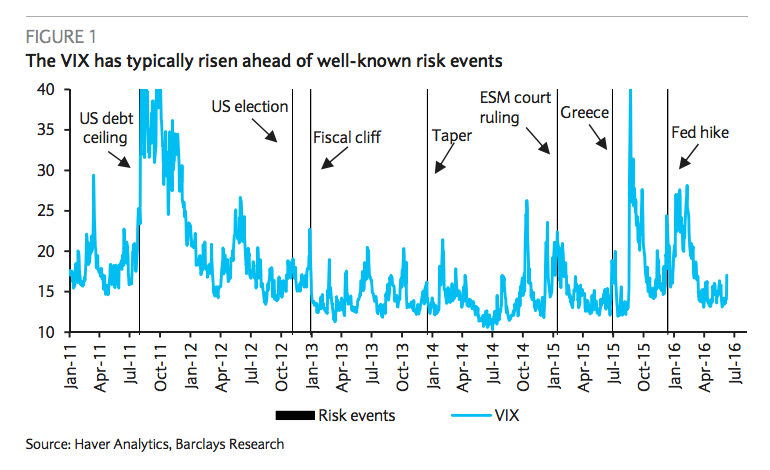

Here’s the Vix, which has probably not finished ascending into the “well-known risk event”:

…and here’s the flows – everyone is already pre-panicking in European stock funds. Which is actually a good thing…

Source:

Positioning into the UK Referendum

Barclays – June 13th 2016

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/06/13/brexit-remain-vote-as-market-catalyst/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2016/06/13/brexit-remain-vote-as-market-catalyst/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/06/13/brexit-remain-vote-as-market-catalyst/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2016/06/13/brexit-remain-vote-as-market-catalyst/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/06/13/brexit-remain-vote-as-market-catalyst/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2016/06/13/brexit-remain-vote-as-market-catalyst/ […]