Before we get started, let me state for the record that I am not anti-active management.

I’m anti-expensive active management that doesn’t earn its keep and I’m against funds with embedded commissions so high that it takes an investor a huge chunk of time just to get back to breakeven. Unfortunately, there’s a ton of it out there.

We got a cold call at the office this week from an actively managed “liquid alt” mutual fund company. The fund being pitched was so bad, we couldn’t believe it:

Negative returns for years running

Ultra-high internal expense ratio

Insanely high selling concession on the A share version

Nonsensical description of the methodology

A ludicrous spread between the stated objective and the reality of recent performance

In Yiddish, we’d call this thing a shanda.

We looked up the fund and, inexplicably, it had like $140 million sitting in it, paying an enormous ongoing cost for a f***ing travesty of a product that demonstrably does not work.

It’s not the first time we’ve happened upon something like this. There are hundreds if not thousands of these funds, all with millions (if not billions) of dollars in them. Most of them sold by a broker or financial advisor. We get portfolios sent to us by prospective clients every day to review. When we peruse these gardens of mutual funds, there are flowers worth tending, weeds in need of pulling, and then there are the venus flytraps like this one.

In a prior era, a broker could tell the story of a fund and explain why it was a good fit for the client, and the fund would then be purchased, with few questions asked. And there it would sit in the account, for years, regardless of how much good or harm it was doing. The client forgot why they bought it in the first place and the broker was off selling something else to someone else.

And this was a good business. Even for bad funds. Especially for bad funds. Inertia is one of the most powerful forces in the asset management industry, so long as people aren’t really paying much attention after they’ve bought something.

The thing is, though, that people are paying attention now. More than ever. They’re not researching and trading individual stocks with their time spent online. Instead, they’re focused more on their funds versus a benchmark and driving the cost of their portfolios down.

The internet has done this. A relentless messaging about the negatives of high-cost investing from bloggers and the financial media has set the tone in the post-crisis world: Evidence talks and bullshit walks. Got data?

The possibility that we’re in a low-return environment has also played a role – and virtually everyone is in agreement that, at best, that’s what we’re in; a collective “pray for 5% and a 2% dividend yield” headspace.

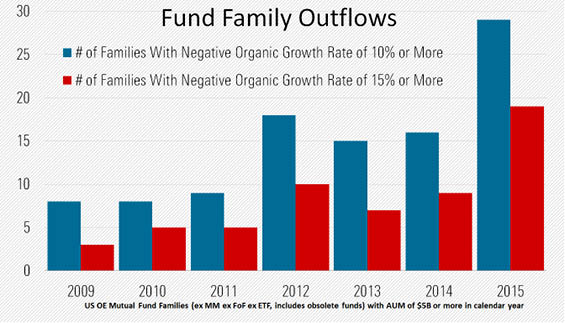

As a result, fees are coming down and fund families are seeing mass redemptions. Morningstar calls it Flowmageddon and notes that 2015 is perhaps the most extreme year on record for outflows outside of a market crash.

Here’s Russell Kinnel:

The impact of redemptions on a fund company is less obvious than at an individual fund, but still quite real. It’s a challenge that is facing more fund companies than usual. I pulled the 50 largest calendar years of outflows in percentage terms to hit any fund company in the past 20 years. Remarkably, 10 of the 50 came in 2015.

No family is immune to the death march out of high-cost active. And no equity asset class either.

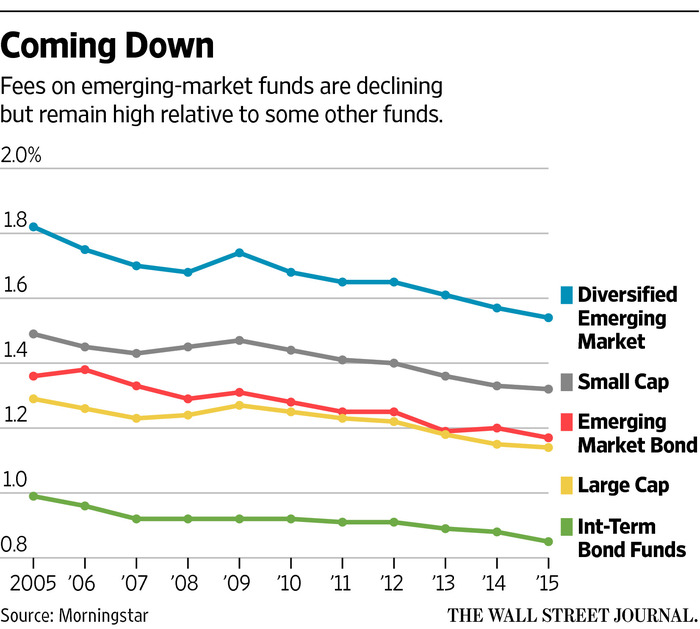

One of the last bastions of justifiably high-cost active management – emerging market stock funds – is seeing fee pressure in lockstep with the rest of the industry.

EM funds had long been able to pass on higher expense ratios to investors by virtue of the fact that transacting in these markets required more work. Transparency was limited, liquidity was more scarce and a fund’s management had to deal with numerous brokers speaking a myriad of languages under a variety of regulatory regimes. Boots on the ground across multiple continents were necessary and the research and administration were costly – hence, the higher management fees.

This conceit no longer applies, as emerging market ETFs are every bit as competitive for flows as their US counterparts are in domestic stocks.

The Wall Street Journal notes the speed with which EM stock mutual funds are cutting fees. Not helping matters is the terrible recent performance of the EM asset class, which has driven mass outflows in general:

Institutional investors pay an average fee of 0.91% to emerging-market stock managers, compared with 0.58% on U.S. large-cap stocks and 0.5% for U.S. high-yield bonds, according to research firm eVestment. Emerging-market bond managers charge 0.58%…

While those costs were largely accepted in the days when investments in nations such as China and Brazil routinely posted double-digit-percentage gains, sharp declines in emerging-market indexes have caused many investors to become more aware of the high fees of these funds. The MSCI Emerging Markets Index has lost 20% since the end of 2012 through Thursday.

Globally, emerging-market stock funds experienced a record outflow of $68 billion in 2015, according to fund tracker EPFR Global.

I’m not sure where this ends, but probably nowhere good for the asset management industry. As I’ve said previously, there’s a reason why the publicly traded mutual fund companies have stocks that look like death, even in an up-tape. The relentless online education of the investor class has done more to threaten mutual fund AUM and profit margins in the last few years than ever before.

It’s become a snowball. Good luck standing in front of it.

Sources:

As Emerging-Market Funds Drop, So Do Fees (WSJ)

The Woes of the Asset Managers (TRB)

Mediocre Asset Management is No Longer an Actual Business (TRB)

***

If you’re sitting with a portfolio you don’t understand, or could use a second opinion, talk to us here.

[…] relates a bit to what I said over the weekend about bad active management no longer being an easy business. There’s going to be a lot more […]

[…] Brown on how bad active management is being taking to task. Jake at EconomPic shows when good active management can be worth the […]

[…] mentioned earlier that the internet itself disrupted bad active management, rendering it no longer a viable business […]

… [Trackback]

[…] Here you can find 86180 more Information to that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] There you will find 13868 additional Information to that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/04/24/bad-active-management-cant-survive-the-internet/ […]