We service a client base of people ranging from their 20’s to people in their 80’s. Like most wealth management firms, we find that having discussions about risk with people on the verge of retirement in their mid-60’s can be the most complicated.

This is because, under a previous generation’s paradigm, retirement often meant a severe rejiggering of a portfolio’s tolerance for volatility. Notice I said volatility and not risk. They’re not the same thing.

Volatility is not the true risk for investors preparing for retirement. It is an unavoidable permanent feature of the investing process. The true risks are the permanent loss of capital and the possibility of running out of money.

20 years ago, when a person turned 65 and retired, they had the ability to earn money on their cash and an above 5% yield on their risk-free treasury bond portfolio. This would give them a concrete chance at running ahead of inflation with very little risk to principal. This opportunity no longer exists and so more equity-heavy portfolios are necessary to make up for it. Additionally, people are living longer than ever before in their years post-retirement – which adds an even further increased need for stock exposure, long after the volatility that stocks offer is appealing.

As advisors, our job is to draw the distinction between the true risk – not having enough money to last through retirement – and the fake risk, which is short-term fluctuation in the stock market. It’s not always easy to do, but it is one of our essential functions.

One of the ways we do this is to ask a very simple question: “When do you want your risk, now or later?”

If you take your risk now, you are forced to bear down through corrections and the occasional bear market, but you’re in the running for a bigger portfolio down the road. If you choose to take little risk now, you don’t get the chance to grow your assets at a rate commensurate with your future cost of living.

Yes, this is simple to understand. But it’s not easy in practice.

It is conceivable that a person retiring at 65 will then have decades during which they’ll need to spend down their portfolio. Bonds alone, at current rates, will not get them there.

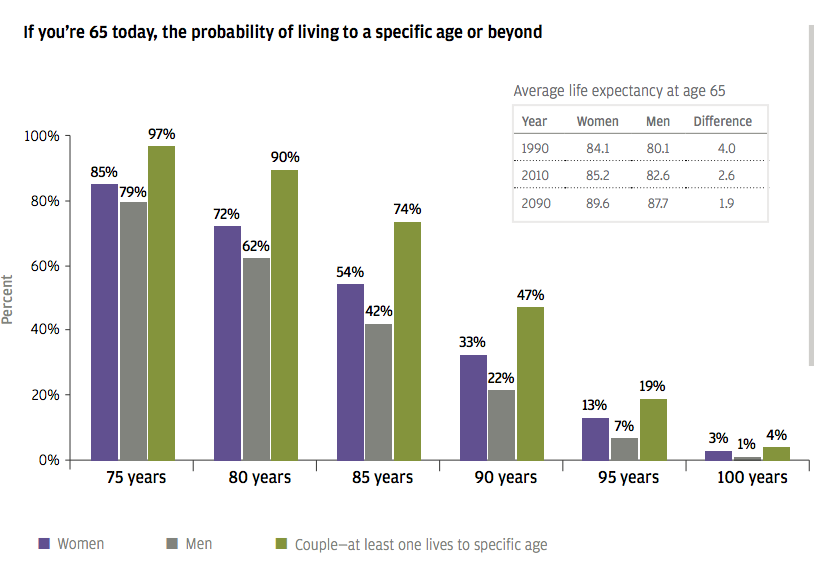

JP Morgan Asset Management put out a chart today illustrating the potential for people who are currently 65 to truly go the distance and have these types of decades’ long income needs.

There is a 47% chance that a 65 year old living today, or their spouse, will make it into their 90’s.

This is a really great visualization of something that absolutely must be in consideration when assembling a retirement portfolio.

In a perfect world, a retiree would have the ability to drastically ratchet down the amount of volatility they would have to endure in the short-term. Advisors who promise them that they can may not be doing them any favors years from now when their spending needs begin to look unrealistic, owing to a shortfall in portfolio assets.

Source:

Guide to Retirement 2016

JP Morgan Asset Management

If we can help you figure out your financial plan and portfolio, get in touch here.

[…] When do you want to take your risk, now or later? (Reformed Broker) […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2016/03/10/when-do-you-want-your-risk-now-or-later/ […]