I devote an entire chapter in my book Backstage Wall Street to the research pay-to-play scandal that rocked Wall Street and led to the Global Settlement after the dot com bust. In doing the research for that chapter, I became convinced, once and for all, that sell-side stock research was useful only for its entertainment or informational value. It is not, in the aggregate, an actionable thing on a reliable basis.

I also concluded that it would never get better, so long as there was a conflict between the creator of said research and the consumers of it. And of course there are conflicts – Wall Street trading desks need research coverage in order to drum up the buy and sell orders that make them profitable. And analysts covering companies rely upon having access to executives at the companies being covered in order to stay in the know. These two aspects – the need to always be saying something and the need to keep your subject companies happy – can jeopardize the mission of producing actionable calls with integrity.

There’ve been several regulatory improvements since the Global Settlement that were designed to bring fairness to the dissemination of material information, such as Reg FD (Fair Disclosure), but none of them have gotten to the root of the problem – so long as there is upside in information asymmetry, there will be people utilizing it with a profit motive.

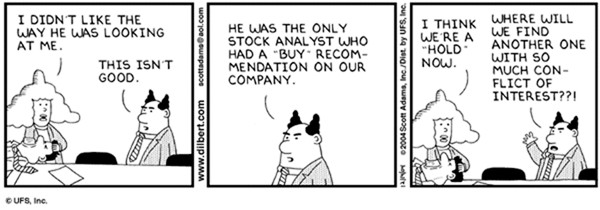

And then there’s this:

Fortunately we told many clients a few weeks back to sell the stock. . . . I think the writing was on the wall [that] we were getting concerned about it, but I was trying to maintain, you know, my relationship with them. So, that’s why we didn’t downgrade it a couple of weeks back.

Matt Levine tells the hilarious story of an analyst who lost faith in the company’s stock he was recommending, and then selectively alerted some key hedge fund clients while reiterating a buy rec publicly. The reason he cites for this conflicted act – feeling bad about upsetting the company’s execs – tells you just how hard it is to do the job of a sell-side analyst. You have so many masters to please – the firm itself, the traders you work with, the firm’s clients, the firm’s bankers, the management of the companies you cover, etc. And this is before we even get into the psychological problems with sharing one view in public, and then having to contradict yourself repeatedly as the facts change.

It’s a wreck. That’s why we pay no attention to any of it, other than for fun. Brokerage firm analysts issuing public buy and sell calls are smart and very knowledgeable about the companies and industries they cover. But there are business interests and personal issues that make their job a nearly impossible one.

Read Matt’s column here, it’s fantastic:

Deutsche Bank Analyst Kept Some Doubts to Himself (Bloomberg View)

If you haven’t read Backstage Wall Street yet, I don’t know what your deal is.

[…] The Most Impossible Job on Wall Street (TheReformedBroker) […]

[…] The Most Impossible Job on Wall Street (TheReformedBroker) […]

[…] The sell-side is hopelessly conflicted. (thereformedbroker) […]

[…] referred to the sell-side analyst gig as the most impossible job on Wall Street […]

… [Trackback]

[…] There you will find 93050 more Information to that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]

… [Trackback]

[…] Here you will find 7197 more Information on that Topic: thereformedbroker.com/2016/02/18/the-most-impossible-job-on-wall-street/ […]