Another year in the books and I’ve updated my Investing Fads and Themes by Year guide accordingly.

Another year in the books and I’ve updated my Investing Fads and Themes by Year guide accordingly.

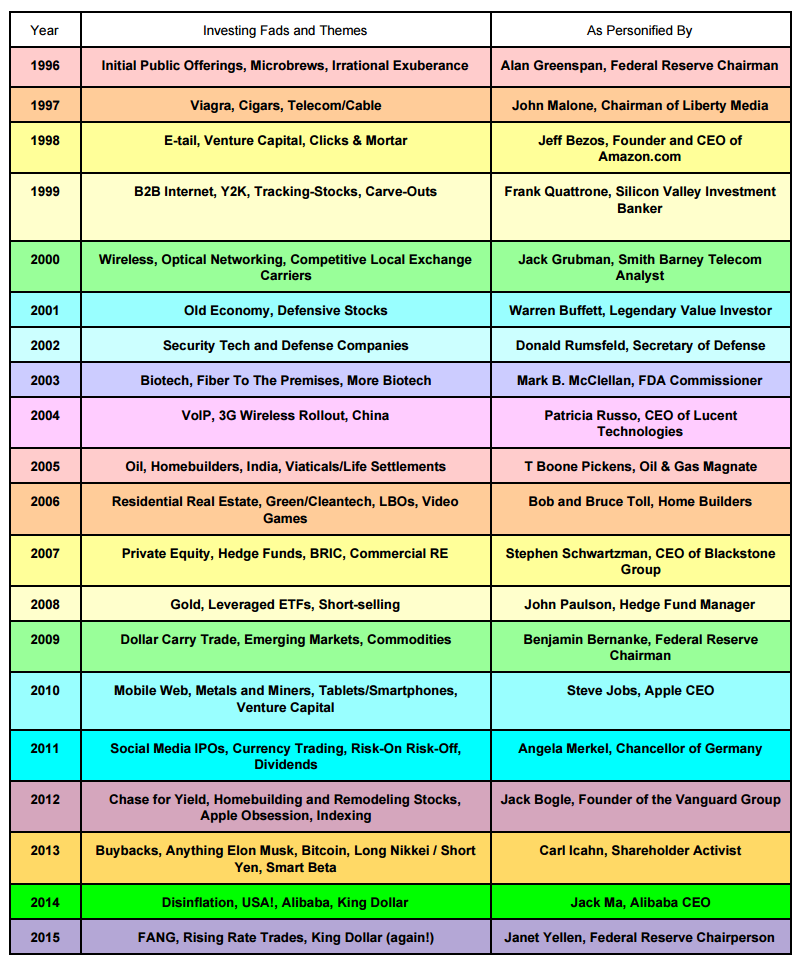

It begins with 1996 because that was my first summer working on The Street and my earliest exposure to the market. I do this every December because I agree with the eminent philosopher Bob Marley in that “If you know your history, then you would know where you’re coming from.” If we don’t document and learn from the lunacy that grips us from year to year, how can we truly say that we’ve grown as investors?

By documenting this stuff, it becomes a permanent part of my knowledge base, a reference to draw from in times to come as similar trends play out and the great wheel spins past an endless parade of fear and greed.

So what was 2015 about?

I would point out that there were very few things that worked for investors this year compared to recent years – the lone asset class bright spot is muni bonds! But there were three fads worth highlighting this year, here we go…

FANG

One of the biggest themes of the year was the narrowing leadership among stocks. A very small group of names posted outized gains, which helped keep the index near the flat-line. Meanwhile, the median stock in the Russell 3000 had a rough year, down more than 5%. Among the winners was an even smaller subset of major winners that, sometime around mid-year, had been formed into an acronym known as F.A.N.G. – Facebook, Amazon, Netflix, Google. The returns for these names, through mid-December, were as follows: Facebook +36%, Amazon +116%, Netflix +151%, Google +45%. Bears spent much of the fall pointing to this divergence as evidence of a market top. We shall see.

Rising Rate Trades

This one was one of the more hilarious investor fads over all the years I’ve been covering them. Investors spent the entire year focusing on, freaking out about and preparing for the onset of rising rates, which was supposed to happen in 2015 for the first time in 9 years. And when the Fed finally got around to lifting off of the zero-bound at the end of the year, a funny thing happened: rates actually fell. And all of the trades that were supposedly going to be beneficiaries of slightly higher rates (*cough* the banks *cough*) actually fell apart within a day after the FOMC policy statement. The yield on the 10-year Treasury is unchanged from January 1st as of this late-December writing. The lesson is that nothing could be dumber than “preparing” for an event that everyone agrees is coming.

King Dollar (again!)

For the first time ever, I am including a holdover from the prior year because the dollar’s influence on every aspect of 2015 was so undeniably influential. Whether we’re talking about the billions of dollars that swamped the white-hot currency-hedging ETFs, the emerging market bludgeoning or the continuing crash of commodities, the dollar’s 9% rise this year seemed to have impacted investors across all asset classes. Diverging monetary policy – with Europe, China and Japan continuing or beginning massive stimulus programs while the US pushed toward tightening – was the biggest market story of the year, in my opinion.

***

So those were the big stories of the year that investors and traders bought into. Below is my updated guide to the Investing Fads and Themes by Year, 1996 – 2015. Enjoy!

See previous years below!

[…] Investment Fads and Themes 1996 – 2015 (The Reformed Broker) […]

[…] Fads and Themes, 1996-2015 (thereformedbroker) • Big losers mask net gains in hedge fund assets (Reuters) see also Hedge funds and […]

[…] Investment Fads and Themes, 1996-2015 (thereformedbroker) […]

[…] Ah! It is updated again! http://thereformedbroker.com/2015/12/21/investment-fads-and-themes-1996-2015/ […]

[…] Investment Fads & Themes, 1996 – 2015. This is just awesome! […]

[…] generations (and centuries!). It’s because human nature doesn’t change much, though the investment fads and trends of the moment have different names or rationales. And truth is truth. Any student of the market […]

[…] Investment Fads and Themes, 1996-2015 (TRB) […]

[…] Investment Fads and Themes, 1996-2015 (TRB) […]

[…] beleggersmanies van 2015Laat het aan the Reformed Broker om het jaar in een paar rake observaties samen te vatten. Over de drukte rondom stijgende rentes: “The lesson is that nothing could be […]

[…] FANG, one of the investment themes for 2015. (The Reformed Broker) […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/12/21/investment-fads-and-themes-1996-2015/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2015/12/21/investment-fads-and-themes-1996-2015/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/12/21/investment-fads-and-themes-1996-2015/ […]

… [Trackback]

[…] Here you can find 5875 more Information to that Topic: thereformedbroker.com/2015/12/21/investment-fads-and-themes-1996-2015/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/12/21/investment-fads-and-themes-1996-2015/ […]