If you’re a millennial, your definition of financial risk should be based entirely on the likelihood of losing your job or heading down the wrong career path. Stock market volatility should literally be the last thing on your mind.

Rob Arnott has made the case that the odds of you losing your job go up substantially when the stock market goes down, but it’s important that you separate the two things in your mind when putting away pre-tax money into a retirement account.

In fact, I would argue that stock market volatility should be embraced for the under 35 set. Ostensibly, you’ve got years (decades) of future accumulation ahead of you – why on earth would you be rooting for higher and higher investment markets when you’re a guaranteed buyer for the foreseeable future? Expected returns for an asset class generally rise when prices stagnate or fall. The big open secret of the investment business is that a know-nothing investor with time on his side is in a better position for gains than a brilliant investor, armed with all the tools under the sun, with near-term liabilities to fund.

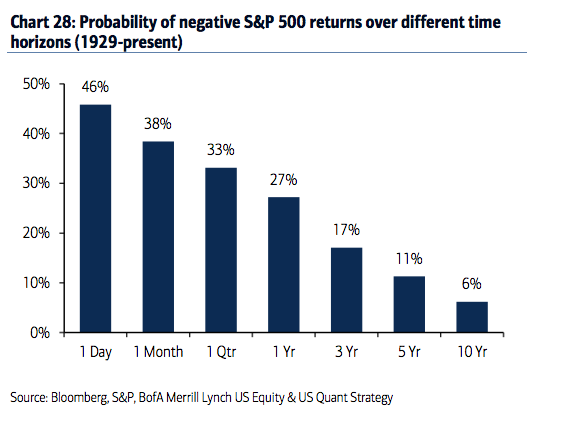

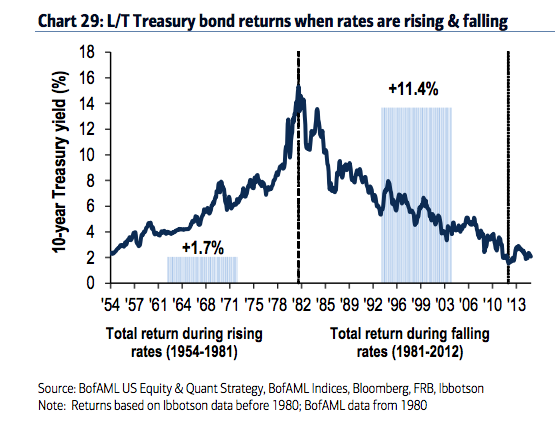

In this morning’s incredibly helpful BAML US Equity Year Ahead Strategy report, Savita Subramanian & Co tuck in a pair of important charts for younger investors to wrap their heads around. Below, a contrast between the probability of losing money in stocks over the next decade versus the likelihood of negative returns in the bond market. People in their 20’s should only concern themselves with the fixed income portion of their portfolios in terms of having dry powder for strategic rebalances.

Let’s take a look:

The Millennial: stocks for the long term

While Millennials may be a more risk-averse generation, having witnessed the carnage of the global financial crisis and its impact on their parents, this generation has the benefit of long time horizons. As Chart 28 shows, the probability of losing money in the S&P 500 declines markedly as one’s time horizon increases. By contrast, the probability of losing money in bonds as rates rise has been far higher.

Josh here – This is not groundbreaking news for avid investors, but its a critical concept for those who are just getting started. Turkey shooting down a Russian plane is not the big risk for your investments. Neither is ISIS or the Federal Reserve’s next rate hike. Ditto for picking the wrong large cap growth fund or missing out on the next Facebook IPO. In the end, it’s all pretty irrelevant.

Outliving your money’s purchasing power is your true long-term risk – and if you’re decades from retirement, it’s the only investment risk that counts.

Source:

US Equity Strategy Year Ahead

Bank of America Merrill Lynch – November 24th 2015

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/11/24/the-only-risk-that-counts/ […]