On Friday night, I was at a giant financial media party with a thousand revelers in black tie celebrating a year’s worth of coverage of markets and the economy. I pulled an Irish Exit sometime before the entrees were brought out because I just didn’t feel much like partying.

The events that evening in Paris have really shaken me up. Not sure why I’m more affected by this latest terror episode than usual, but I am. To me, it felt the most like 9/11 of all of the attacks since.

There wasn’t any real-time Twitter feed 14 years ago and wireless networks were effectively useless in Manhattan that day. We heard about the separate crashes in Pennsylvania and at the Pentagon through word of mouth or whenever we got to a place that had a TV on as we made our way up 2nd Avenue. This time, the events happening around the city of Paris were coming at us a mile a minute, the bodycount multiplying with every refresh of the timeline.

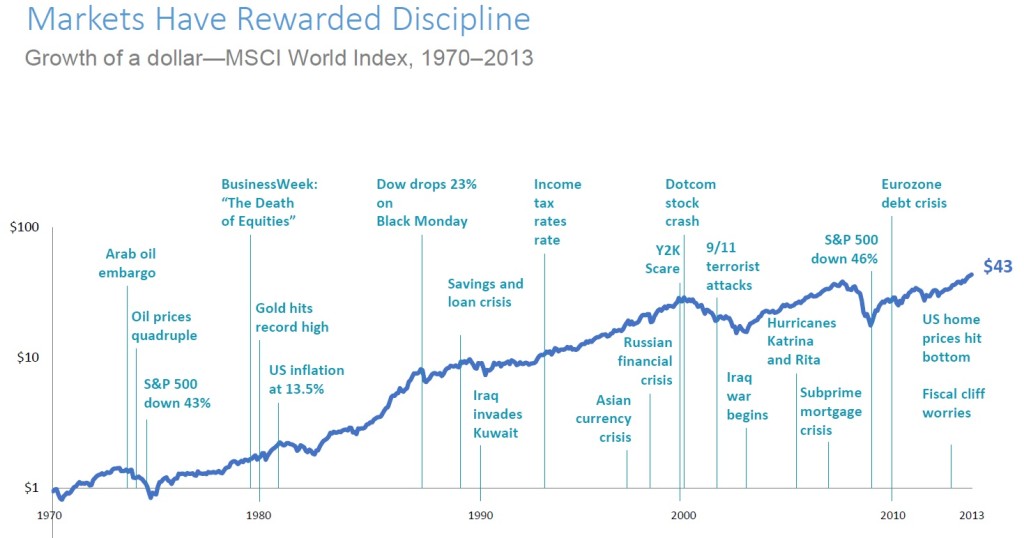

I don’t really have anything much to say today about my usual bailiwick. Instead, I’ll share a slide from the investing presentation we go over with clients of the firm. The chart comes from Dimensional Fund Advisors:

Eddy Elfenbein once looked at the market’s response to major geopolitical crises at his blog, Crossing Wall Street. He reminds us that the market rallied 4.5% on the first day it opened following JFK’s assassination and funeral in the fall of 1963. The Dow Jones actually finished up that year by 17%, despite the deep psychological wounds from the event.

Stocks were flat within a week of his brother Bobby Kennedy’s murder in 1968 and they rallied 4.5% during the week following Martin Luther King Jr’s death that same year. Two months after 9/11, the US stock market had regained its losses and had retraced back to where it was on September 10th, the last day before the world had been forever altered.

We don’t know what the fallout from the Paris attacks will be in the days and weeks to come. We don’t know what the military response will be and where this is all headed.

I’ll leave you a quote from Charles de Gaulle, the leader of the Free French government in exile during World War II, who refused to accept his country’s armistice with Nazi Germany. Upon contemplating the aftermath of the Great War and tallying up the costs in blood and treasure, de Gaulle remarked “It is not tolerable, it is not possible, that from so much death, so much sacrifice and ruin, so much heroism, a greater and better humanity shall not emerge.” He was right then, as the powers of Western Europe enjoyed a peace lasting seven decades and counting.

I believe he’ll be right again. A greater and better humanity surely must be the result on the other side of whatever is to come.

[…] there is no shortage of horrible events in history. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end […]

[…] there is no shortage of horrible events in history. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end […]

[…] How do markets react to terror. Historically, major geopolitical events like terrorist attacks have had muted long-term effects on the market. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end flat to higher within days or just a few months. Crossing Wall Street’s Eddy Elfenbein went into this in depth two years ago. Warren Buffett wrote about it in the New York Times seven years ago. In the short-run, the impacts will vary depending on sectors. Goldman Sachs’ Francesco Garzarelli told clients that activity in the French retail sector could be hurt in the near-term, while government spending is likely to increase toward security and military expenditures. […]

[…] there is no shortage of horrible events in history. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end […]

[…] How do markets react to terror. Historically, major geopolitical events like terrorist attacks have had muted long-term effects on the market. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end flat to higher within days or just a few months. Crossing Wall Street’s Eddy Elfenbein went into this in depth two years ago. Warren Buffett wrote about it in the New York Times seven years ago. In the short-run, the impacts will vary depending on sectors. Goldman Sachs’ Francesco Garzarelli told clients that activity in the French retail sector could be hurt in the near-term, while government spending is likely to increase toward security and military expenditures. […]

[…] How do markets react to terror. Historically, major geopolitical events like terrorist attacks have had muted long-term effects on the market. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end flat to higher within days or just a few months. Crossing Wall Street’s Eddy Elfenbein went into this in depth two years ago. Warren Buffett wrote about it in the New York Times seven years ago. In the short-run, the impacts will vary depending on sectors. Goldman Sachs’ Francesco Garzarelli told clients that activity in the French retail sector could be hurt in the near-term, while government spending is likely to increase toward security and military expenditures. […]

[…] How do markets react to terror. Historically, major geopolitical events like terrorist attacks have had muted long-term effects on the market. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end flat to higher within days or just a few months. Crossing Wall Street’s Eddy Elfenbein went into this in depth two years ago. Warren Buffett wrote about it in the New York Times seven years ago. In the short-run, the impacts will vary depending on sectors. Goldman Sachs’ Francesco Garzarelli told clients that activity in the French retail sector could be hurt in the near-term, while government spending is likely to increase toward security and military expenditures. […]

[…] How do markets react to terror. Historically, major geopolitical events like terrorist attacks have had muted long-term effects on the market. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end flat to higher within days or just a few months. Crossing Wall Street’s Eddy Elfenbein went into this in depth two years ago. Warren Buffett wrote about it in the New York Times seven years ago. In the short-run, the impacts will vary depending on sectors. Goldman Sachs’ Francesco Garzarelli told clients that activity in the French retail sector could be hurt in the near-term, while government spending is likely to increase toward security and military expenditures. […]

[…] there is no shortage of horrible events in history. Ritholtz Wealth Management’s Josh Brown reviews some of the worst ones that occurred in the past century and notes that stocks often end […]

[…] The market’s response to crisis (The Reformed Broker) […]

[…] Keep the longer run in mind http://thereformedbroker.com/2015/11/15/the-markets-response-to-crisis/ […]

[…] cause short term volatility in the stock market and has done so in past years. One of the first articles I read after the Paris attacks included the following graph that points out certain events in […]

[…] A version of this post first ran here in November […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2015/11/15/the-markets-response-to-crisis/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/11/15/the-markets-response-to-crisis/ […]