This week, I put out my monthly letter to clients of Ritholtz Wealth Management. Here’s a snippet on EM stocks that should set the stage for what I will show you next…

I want to point something out about emerging market investing in general: as a category, it is more despised than at any time I can remember since 1998. If you recall, that was the year of the Asian Contagion and the devaluation of the Russian ruble. Forward returns for the asset class from that moment on, were absolutely extraordinary over the next decade.

Emerging market stocks have underperformed developed markets for almost eight years now. A regime shift is inevitable, now that expectations, sentiment and valuations are so thoroughly demolished. We cannot predict the start of this new regime, but catching it requires building positions early. We are getting the job done for you.

During one week last month, the two largest emerging market exchange traded funds, Vanguard Emerging Markets Stock Fund and iShares MSCI Emerging Markets Index Fund, witnessed $6.5 billion in outflows, which represents 10% of the funds’ total assets under management! In just five days, investors ripped a tenth of every dollar allocated to the asset class through these funds.

We’re not prepared to call a bottom for the EM category, but if it turns out that this was the bottom, it would be poetic justice on a monumental scale. We’ll save the news clips just in case.

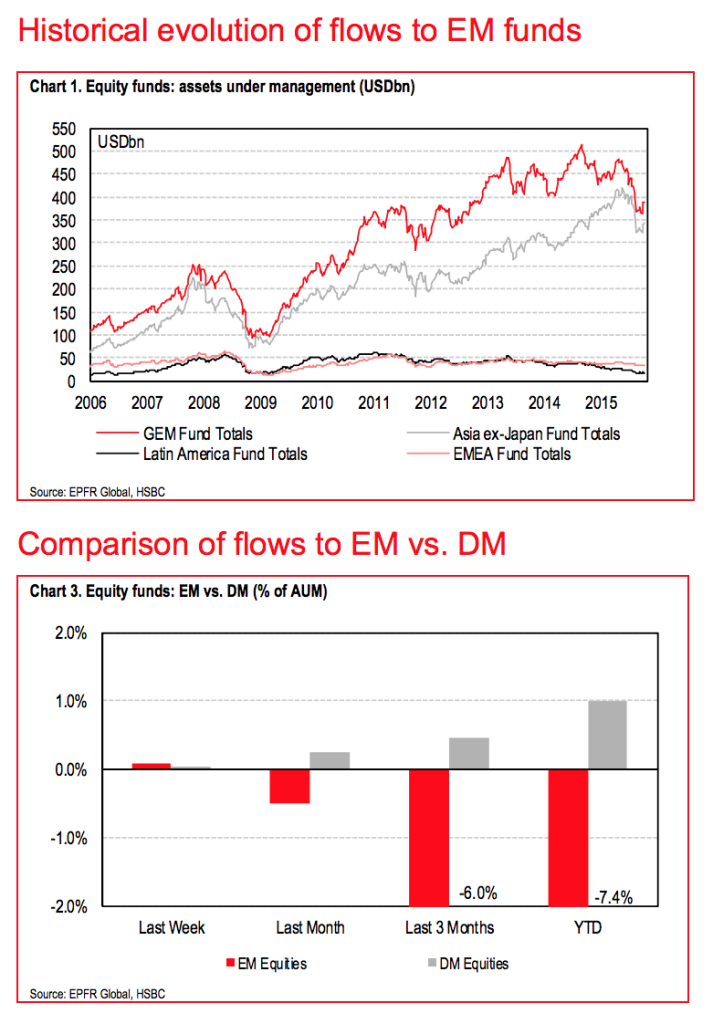

This morning, strategists at HSBC inform us that EM buying is back. This coincides with the latest commentary surrounding the Fed’s now-stymied efforts to “normalize” rates. HSBC says EM fund buying came back in a big way last week, but that most of it was in ETFs. Traditional EM mutual funds continued to lose AUM. So perhaps it’s a trade.

Two charts below illustrate last week’s flows into EM funds with the longer-term flows in context (EM still a net loser of assets on the year):

Says HSBC:

In the second week of October 2015, EM equity funds managed to snap 13 weeks of continuous outflows to post positive flows. Easing volatility across emerging markets and a relief rally in EM equities (MSCI EM index up by 7.2% m-o-m) helped to arrest the exodus of funds from the asset class. EM funds have already suffered USD62bn worth of assets moving out so far this year – highest in the last five years. EM equity funds were hard hit in Q3 2015 with redemptions at their fastest pace (net outflows of USD48bn in ten weeks in Q3 2015), but the last few weeks saw withdrawals ease significantly and finally, recorded their first positive flows in the week ended 14 October. Encouragingly, the inflows appeared broad-based with investors subscribing to all three major EM regions.

Josh here – so was that it? Have we seen the definitive flush? My gut says “too easy, probably has to get worse.” But that’s consensus, right?

In the meantime, EM stocks have rocketed off their recent lows, with the Shanghai up 15% in just a couple of weeks.

Sources:

Slight Edges

Ritholtz Wealth Management – October 15th 2015

Money is flowing back into EMs

HSBC – October 16th 2015

EM stocks catch fire as inflows return by @ReformedBroker http://t.co/JcndQUVvJ3

RT @jposhaughnessy: EM stocks catch fire as inflows return by @ReformedBroker http://t.co/JcndQUVvJ3

EM stocks catch fire as inflows return

http://t.co/EClaRgzU1p

EM stocks catch fire as inflows return by @ReformedBroker http://t.co/xy1cToQLFC

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] There you can find 89374 more Information on that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] There you can find 50744 additional Information to that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Here you will find 64082 more Info to that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2015/10/16/em-stocks-catch-fire-as-inflows-return/ […]