Savita Subramanian’s Equity and Quant Strategy team at BAML is out with their 3rd quarter 2015 earnings outlook.

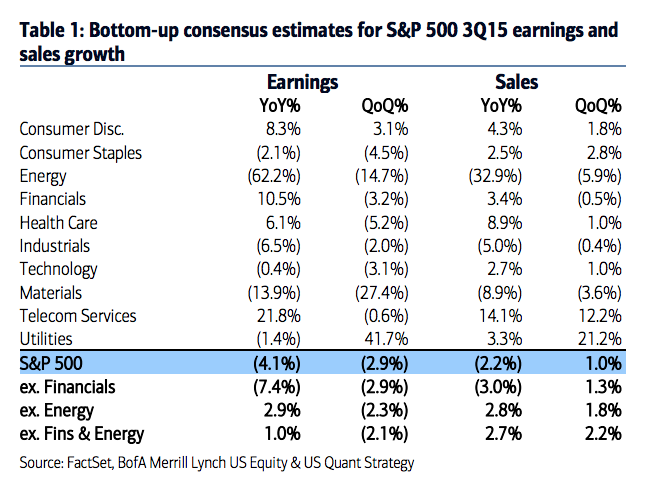

All in all, Q3 consensus estimate is for a 4% year-over-year drop in S&P 500 earnings, with the 60% expected slide for energy companies skewing things quite a bit. Ex-energy, the rest of the S&P 500 should deliver something more like positive 3%.

Subramanian believes guidance will be cautious on the conference calls and that the new leg lower in oil, combined with the dollar’s continued strength, will make this a difficult season overall.

Similar to in 2Q, analysts are expecting an earnings decline this quarter. The expected YoY decline of 4% is less than the 5% YoY decline analysts expected going into 2Q, when earnings ultimate beat by 5%. Our forecast of $30.00 implies a 3% beat vs. current expectations of $29.02. The biggest headwinds to earnings growth this quarter are from a stronger dollar (+17% YoY on avg.) and lower oil prices (WTI -52% YoY on avg.). Excluding Energy, where earnings are slated to drop 60% YoY, earnings growth is expected to be +3% YoY, and sales growth ex. Energy is expected to be+3% YoY (Table 1).

Source:

3Q15 earnings may not be the catalyst we need

Bank of America Merrill Lynch – October 5th 2015

Preview: Q3 Earnings Season http://t.co/BlnzZOuljb

RT @ReformedBroker: Preview: Q3 Earnings Season http://t.co/BlnzZOuljb

RT @ReformedBroker: Preview: Q3 Earnings Season http://t.co/BlnzZOuljb

RT @ReformedBroker: Preview: Q3 Earnings Season http://t.co/BlnzZOuljb

RT @ReformedBroker: Preview: Q3 Earnings Season http://t.co/BlnzZOuljb

RT @ReformedBroker: Preview: Q3 Earnings Season http://t.co/BlnzZOuljb

S&P earnings

Are expected to decline

about 4%. http://t.co/VIW4RweM7H

[…] Q3 earnings outlook: Consensus estimates (2015q3e) | Bank of America Merrill Lynch (BAML) Street analysts consensus forecasts for Q3 EPS & revenues, by sector: – EPS (ex-Energy): +2.9% yoy, -2.3% qoq – Sales (ex-Energy): +2.8% yoy, +1.8% qoq $XLE is expected to report -62% yoy decline in EPS, which is theoretically offset by $XLY +8%; Energy’s Q4 yoy comps will lap the high base. [Previously: The surge in consumption nets-out the collapse in energy] #Bullish […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2015/10/06/preview-q3-earnings-season/ […]

… [Trackback]

[…] There you will find 63081 additional Info on that Topic: thereformedbroker.com/2015/10/06/preview-q3-earnings-season/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2015/10/06/preview-q3-earnings-season/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2015/10/06/preview-q3-earnings-season/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2015/10/06/preview-q3-earnings-season/ […]