One of the things I’ve learned over the last few years is that the United States is not a single economy, but rather a collection of regional economies that are moving at a wide variety of different speeds. Where you live in the US will give you an outlook on how things are going that may be different from someone in another state / city / time zone.

The QE Era that began in 2010 has probably exacerbated these differences. The types of jobs that people tend to hold in cities are the ones where there are wage increases, employee stock option participation and lots of upward mobility. Manufacturing and industrial jobs, which tend to be held by people living outside of major cities, are not seeing the same amelioration. It’s not quite that black-and-white, but it can seem that way.

If the entire country was experiencing the same kind of economy that’s happening in New York City, Boston, DC, San Francisco or Miami, the Fed would already be at a 3% interest rate with a bias toward hiking further. The restaurants and bars are all full, the malls are jamming and real estate prices / activity are on fire. In some areas of these markets, there are non-stop bidding wars for houses; apartments find renters within hours of hitting the market.

UPDATED: here’s yet another example of this phenomenon (an extreme on) – San Francisco median house prices are up 103% since the first quarter of 2012! Condo prices are up 74%!

But this is not the experience that many Americans are feeling hundreds of miles away from these cosmopolitan areas. Attitudes are very different and the anecdotes are night-and-day from the stuff I’ve described above.

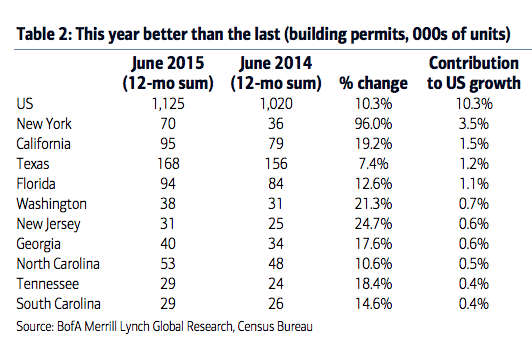

Bank of America Merrill Lynch economist Michelle Meyer has a housing report out that explains this phenomenon through the lens of building permits. Meyer looks at the difference between the “Fantastic Four” – Florida, New York, Texas and California – and the rest of the country, noting that these four states accounted for nearly two-thirds of the nation’s gain in building permits over the last 12 months!

Focusing on the national housing data often masks interesting stories at the regional level. We find this to be the case for the homebuilding figures. Building permits have climbed over the first half of the year, reaching 1.337 million saar in June, equating to a 29% yoy increase. The gain in starts has been more modest, but presumably activity will turn higher over coming months as permits lead to starts. While the turn higher in homebuilding is encouraging, we advise some caution after examining the regional data.

Josh here – When someone from the rust belt is talking to someone from the California coast or the Upper East Side of Manhattan about the state of the economy, they are frequently talking past each other. Stock and bond market gains probably have a lot to do with that. There is a much greater wealth effect occurring in the areas of the country where the technology, biotechnology and banking booms are raining dollars down upon their participants.

This is not a new phenomenon – it’s just that the industries change around every generation. We’ve had auto booms and steel booms and oil booms in other areas during other eras that have produced these multi-speed regional economic differences before. It’s just that this time around, it’s the knowledge economy and the service economy that are enjoying their time in the sun.

Source:

Tortoise or the Hare

Bank of America Merrill Lynch – August 19th 2015

RT @ReformedBroker: Only four states (TX, CA, NY, FL) accounted for 2/3rds of the national gain in building permits this year.

http://t.c…

RT @ReformedBroker: Your view of the economy is colored by where you live http://t.co/II2hrSwEvd

RT @ReformedBroker: Only four states (TX, CA, NY, FL) accounted for 2/3rds of the national gain in building permits this year.

http://t.c…

Similar to your perfomance/where you’re invested, your view of the economy is based on where you live @ReformedBroker http://t.co/iRCnxZGXOV

RT @ReformedBroker: Only four states (TX, CA, NY, FL) accounted for 2/3rds of the national gain in building permits this year.

http://t.c…

RT @ReformedBroker: Your view of the economy is colored by where you live http://t.co/II2hrSwEvd

[…] Your view of the economy is colored by where you live. (thereformedbroker) […]

Your view of the economy is colored by where you live by @ReformedBroker http://t.co/FtVskDQ1Be

RT @ReformedBroker: Only four states (TX, CA, NY, FL) accounted for 2/3rds of the national gain in building permits this year.

http://t.c…

RT @ReformedBroker: Your view of the economy is colored by where you live http://t.co/II2hrSwEvd

Your view of the economy is colored by where you live by @ReformedBroker http://t.co/eblXl3pJPD

RT @rc_markets: Your view of the economy is colored by where you live by @ReformedBroker http://t.co/eblXl3pJPD

RT @rc_markets: Your view of the economy is colored by where you live by @ReformedBroker http://t.co/eblXl3pJPD

“Your view of the economy is colored by where you live” http://t.co/e6NoLFzZcx

[…] A reminder that my reality is not your reality. Depending where you work and where you stay, your view of what the world looks like is very different. In South Africa we have a dual economy so my reality is definitely not the same as someone who works in the mines and lives in the rural areas of the platinum belt – Your view of the economy is coloured by where you live […]