I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.

But of course it isn’t the move itself that is causing the problem, but the implication that they can do it again with the predictable now becoming the unpredictable. It opens up the ruler and pencil cupboard to the extrapolatinists who are now free to draw future conclusions as as to where this action can lead with little other than fresh air to stop them predicting the end of the financial world. Yet this also raises the spectre of 'availability heuristic' and ‘recency' behavioural biases associated with recent events, which can be encapsulated into overestimating the probability of a recent event reoccurring and underestimating the probability of distant past events reoccurring. Earthquakes and terrorist events are good examples. The vacuum of other financial news in an August market leaves the landscape clear for these biases to propagate.

So China devalued its currency a smidge. Probably better to sell now and ask questions later, no? That’s usually worked in recent history, hasn’t it?

The move by Beijing has presented investors with the newest “headwind” to toss onto the pile, now that the Greece thing has lost its ability to startle us.

As Michael Batnick explains, there has always been a good reason to sell out…

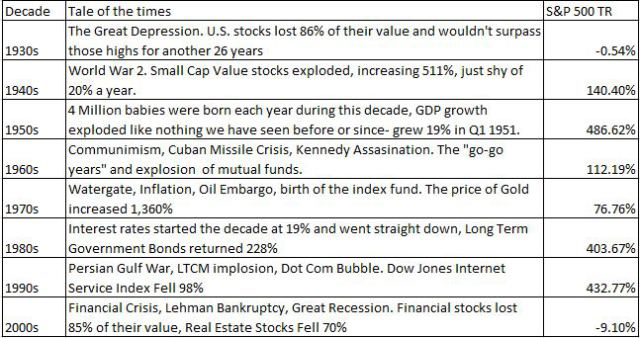

One of the biggest psychological challenges of investing is that there is alwayssomething out of the norm. Take a look at the table below which highlights different times investors had to live through and the extreme performances that accompanied them. I wonder at what point would somebody would have described the times as normal.

Josh here – stocks go up and stocks go down, but “headwinds” are a constant. And in the absence of a serious one, a bullshit one will do just fine when people are in the mood to panic.

To put it another way, there’s this:

2025: “Honey, what happened to our retirement investments?” I liquidated back in 2015. “What?!? Why?” Something about the yuan…

— Downtown Josh Brown (@ReformedBroker) August 12, 2015

“I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

a new “headwind” is born http://t.co/Jsv2sEReG4 #Uncategorized @ReformedBroker

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

Herlig fra @ReformedBroker om Kinas mikroskopiske devaluering http://t.co/rpxRxfsxdX #selgselgselgselgselg 😉

a new “headwind” is born http://t.co/3ODkEzXUyu

a new “headwind” is born http://t.co/m4ukp9o7RU I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.

…

RT @ReformedBroker: a new “headwind” is born http://t.co/3ODkEzXUyu

a new “headwind” is born by @ReformedBroker http://t.co/sBXJDcpZgH

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

a new “headwind” is born http://t.co/De1bu7to5E

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da

RT @ReformedBroker: “I don’t think I’ve ever seen a 1.8% FX move cause such global consternation.”

http://t.co/EvUMC8P8da