The pendulum always swings too far in both directions. I would tell you the ratio of passive fund inflows to active fund inflows over the last few years but I can’t because the latter category would be a negative integer.

Instead, I’ll just tell you that almost 100 cents of every dollar has gone into index / passive / low-fee funds on a net basis pretty much since the financial crisis.

Until now, perhaps.

BlackRock reported earnings yesterday and shared an interesting fact about the flow of funds to their products during the second quarter.

Mr. Fink said 10 of BlackRock’s biggest clients have pulled more than $40 billion from institutional index equity assets this year. But the firm’s revenue has been helped as the clients reinvested into active equity and fixed income, multiasset and alternatives strategies.

In the latest quarter, BlackRock said $23.6 billion of net inflows into higher-fee active and iShares products helped drive base fee growth, in part offsetting $30.9 billion in net outflows from low-fee institutional index offerings.

So $31 billion out of index products and $23 billion into active ones. This is a break from the script, for sure.

Why now?

That’s easy. The S&P 500 has been flat for almost 8 months. A lot of newly passive, patient money turned out to not be all that patient after all. And this is a year in which active strategies are working better than they did in 2014. As we’ve chronicled relentlessly on this blog, all of the preconditions for active outperformance are in place thus far in 2015.

The chase never ends. It just bides its time until there’s something new to glom onto. In this case, it’s momentum. Amazon, Facebook, Netflix and the biotech sector have it. Institutions want it. Especially in a flat market that chops around a tight trading range and never goes anywhere.

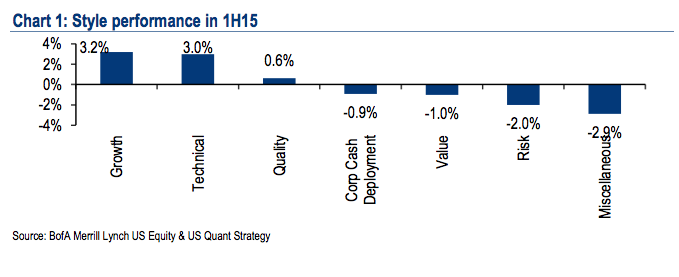

As Savita Subramanian notes in her latest PM’s guide to stock picking (BAML, July 15th 2015), momentum and growth stocks are leading the market this year and wiping the floor with value strategies:

YTD, Value factors (-1.0%) still lag Growth factors (+3.2%). Every growth factor we track has outperformed the index so far this year, led by High Projected 5-yr Growth (+5.2%). Meanwhile, seven of the nine Value factors we follow lagged the benchmark in the 1H amid weak 1Q performance.

Josh here – chasing the stocks with the highest price appreciation over the last 12 months (momentum) in a market selling at one of the highest historic valuations is a phenomenon we tend to see toward the latter stages of a bull market.

You’re on notice.

STOP THE PRESSES:

BlackRock Has a Passive Index Outflow

http://t.co/eE98TDZ3Sx $BLK

Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/V8hxrpIPCi #Uncategorized @ReformedBroker

RT @ReformedBroker: STOP THE PRESSES:

BlackRock Has a Passive Index Outflow

http://t.co/eE98TDZ3Sx $BLK

This is big: Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/wDwJws3eR9 @ReformedBroker

Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/0cCcgAz4Us The pendulum always swings too far in both directions. I w…

Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/6L2zUTqJue

Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/wiPt5PaBuq

Stop the Presses: BlackRock has a Passive Index Outflow by @ReformedBroker http://t.co/5aHwx3Zff2

RT @ReformedBroker: Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/6L2zUTqJue

RT @ReformedBroker: Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/6L2zUTqJue

RT @ReformedBroker: Stop the Presses: BlackRock has a Passive Index Outflow http://t.co/6L2zUTqJue

Stop the Presses: BlackRock has a Passive Index Outflow by @ReformedBroker http://t.co/RylxCdmY2k

#Momentum stock are red hot + US market at historical highs = final stage of bull market? http://t.co/9LseMNy7iJ via @reformedbroker

Passive Index Outflows. Momentum stocks are leading the market this year and wiping the floor with value strategies. http://t.co/FaeHkf5tC2

RT @ReformedBroker: STOP THE PRESSES:

BlackRock Has a Passive Index Outflow

http://t.co/eE98TDZ3Sx $BLK