Savita Subramanian’s group at Bank of America Merrill Lynch is out with an update on the state of actively managed mutual funds, noting that “44% of all managers outperformed” the Russell 1000 index of US large caps year to date. “Value managers had the highest hit rate of 77%, while 36% of Growth and 29% of Core managers beat their benchmarks.”

That’s a big jump over the 2014 disaster, thanks to the fact that all three preconditions for active management outperformance are back in place this year.

So how are actively managed funds getting the job done in 2015? Simple, they’re taking more risk than the benchmark.

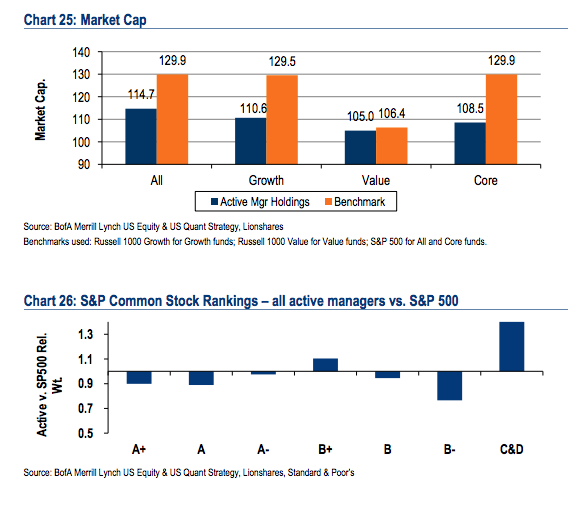

For example, active managers are dipping into smaller capitalization stocks than the index holds and they’re also buying lower quality companies:

Josh here – In addition, the Equity and Quant Strategy group finds active managers currently owning more expensive stocks (on earnings yield and price/book), higher-beta (more volatile) stocks and stocks with lower dividend yields than the overall benchmark.

Whatever it takes?

Source:

What are your neighbors doing?

Bank of America Merrill Lynch – June 22nd 2015

How are Active Managers Beating the Market? By Taking More Risk. by @ReformedBroker http://t.co/0mdCxkb9fC

[…] Active managers are taking on more risk. (thereformedbroker) […]

How are Active Managers Beating the Market? By Taking More Risk. by @ReformedBroker http://t.co/5krVOwf0mK

RT @summitcapital: How are Active Managers Beating the Market? By Taking More Risk. by @ReformedBroker http://t.co/5krVOwf0mK

[…] there have noted. Prominent financial confidant Josh Brown, famous as a Reformed Broker, also has pointed out recently that active managers competence be enjoying a rebirth by holding larger […]

[…] there have noted. Prominent financial confidant Josh Brown, famous as a Reformed Broker, also has pointed out recently that active managers competence be enjoying a rebirth by holding larger […]

[…] there have noted. Prominent financial confidant Josh Brown, famous as a Reformed Broker, also has pointed out recently that active managers competence be enjoying a rebirth by holding larger […]

[…] riferisco ad un recente report di Bank of America trovato qui dal quale emerge come i fondi a gestione attiva stanno comportandosi meglio rispetto al disastroso […]

[…] are working better than they did in 2014. As we’ve chronicled relentlessly on this blog, all of the preconditions for active outperformance are in place thus far in […]

[…] Reformed Broker’s Josh Brown pulled up this chart from a Bank of America Merrill Lynch update on actively managed mutual funds, which finds “44% of all managers outperformed.” Value managers were on top, followed by growth and core managers. How did they do it? By taking on more risk than the benchmark, says Brown. Read more here. […]

… [Trackback]

[…] There you will find 7625 more Information on that Topic: thereformedbroker.com/2015/06/22/how-are-active-managers-beating-the-market-by-taking-more-risk/ […]

… [Trackback]

[…] Here you can find 53415 additional Information on that Topic: thereformedbroker.com/2015/06/22/how-are-active-managers-beating-the-market-by-taking-more-risk/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/06/22/how-are-active-managers-beating-the-market-by-taking-more-risk/ […]

… [Trackback]

[…] Here you can find 30433 additional Info on that Topic: thereformedbroker.com/2015/06/22/how-are-active-managers-beating-the-market-by-taking-more-risk/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2015/06/22/how-are-active-managers-beating-the-market-by-taking-more-risk/ […]