The difference between this year’s Euro Brinksmanship and the old 2010-2011 version is that this time, the banks don’t give a f**k. Literally. The ECB is buying $60 billion or so of sovereign debt securities every month and the sovereigns have most of the “Greek risk” now.

Remember back in 2011 when Bank of America dropped to six bucks on a mix of Euro exposure and mortgage lawsuit risk? Not happening now – BAC is breaking out to the upside.

Remember when Wall Street traders and short-sellers almost single-handedly put Jefferies out of business with nothing but rumor and innuendo about Euro exposure? Seriously, this was a thing that actually happened, less than four years ago.

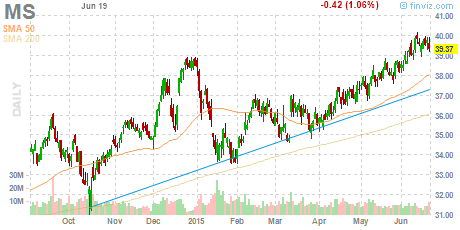

They tried the same thing with Morgan Stanley and crushed the stock. (MF Global didn’t need any help from the rumor mill, they committed suicide.)

In October of 2011, US banks were back on the brink – or so the chattering classes believed – because of systemic risks posed by the possibility of the breakup of the Euro Zone (and the related potential for sovereign bond blow-ups).

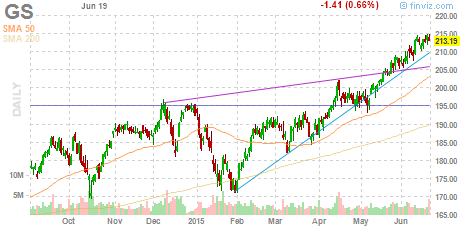

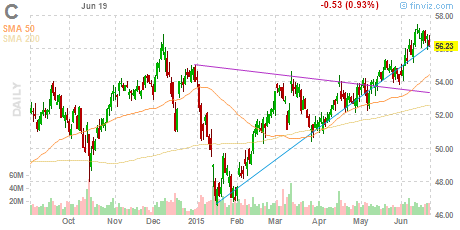

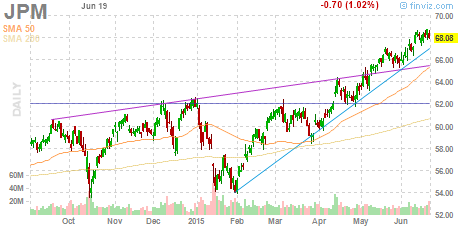

But try shorting these bank and broker names now. The turntables might wobble but they don’t fall down.

Here’s what they look like today, in full IDGAF mode:

Maybe the stock market is lying and there’s huge risks to the banks. It’s happened before. But this would be a whopper of a lie, we’re talking 52-week and near-record highs in these names.

Maybe we should check the Euro banks – perhaps their shareholders are showing more nervousness…

I guess not.

According to the above chart from BAML’s chief technician, Stephen Suttmeier, they’re actually on the verge of a breakout should they continue higher with good breadth. Admittedly, Deutsche Bank’s stock looks terrible, but they’ve got their own issues right now, with the co-CEOs resigning out of the blue last week.

Reuters posits that, absurd though it may sound, the banks have been so chastened by leverage rules that they’re actually being seen as “ports in a storm” these days. How’s that for irony? Don’t take my word for it, read it here.

So if the banks aren’t the big systemic risk these days, what is?

There’s an interesting idea going around that asset management – specifically the metastasizing quantitative strategies run via black box are where the next big scare is due to come out of. Volatility has been so low, for so long, that winning trades have become crowded and leverage is bountiful. And the kicker – they’re all running the same playbook, loading up in the same trades.

A relatively new blog on the scene makes this case and I think it’s worth considering. Here’s Dominique Dassault, “26 year veteran of the institutional capital markets” with a highly quotable take on what’s happening now, below the market’s surface and under the Fed’s radar…

via Global Slant:

What has changed though is the increased dollars managed by these funds [now > $3.5T] and the concentration, of these dollars, at the twenty largest funds [top heavy for sure]. What has also considerably changed is the cost of money…aka leverage. It is just so much cheaper…and, of course, is still being liberally applied but, to reiterate, in fewer hands.

Are these “hands” any steadier than they were ten years ago? I suppose that is debate-able but my bet is that they are not. They are still relying on regression-ed and stress tested data from the past [albeit with faster computers & more data]. They may even argue that their models are stronger due to the high volatility markets of ’08/’09 that they were able to survive and subsequently measure, test and integrate into their current “Black Boxes”…further strengthening their convictions…which is the most dangerous aspect of all.

Because…Strong Conviction + Low Volatility + High Levels/Low Costs of Leverage [irrespective of Dodd-Frank] + More Absolute Capital at Risk + Increased Concentration of “At Risk” Capital + “Doing the Same Thing”…adds up to a combustible market cocktail.

Dassault, in referring to “ten years ago”, is referencing the subject of Scott Patterson’s excellent book, The Quants, in which a handful of genius mathematicians were blown up in a 2006 incident which presaged the global market meltdown that would begin a year later.

I’ll leave you to check out the rest of the piece at Global Slant and ask yourself whether the leveraged black boxes could indeed be to the next market correction what the banks were to 2008.

I’m not sold, personally, but I’ve only just begun to consider it. So please, make up your own minds.

Source:

BLACK BOX TRADING: WHY THEY ALL “BLOW-UP” (Global Slant)

[…] Are quants the new systemic risk? (thereformedbroker) […]

Are Quants the New Systemic Risk? http://t.co/Fs2DwV8HvQ

Are Quants the New Systemic Risk? by @ReformedBroker http://t.co/w91ir4n6rr

Are Quants the New Systemic Risk? http://t.co/NfrRM8NeLX

Are quants the new systemic risk asks @ReformedBroker http://t.co/psdSGWP9s3

With banks said to be seen as “ports in a storm” these days: RT @msgbi Are Quants the New Systemic Risk? http://t.co/vhq3PLuffp

RT @EurexGroup: Are quants the new systemic risk asks @ReformedBroker http://t.co/psdSGWP9s3

RT @aguirrepujol: Are Quants the New Systemic Risk? http://t.co/y7ToyfGxxX

Will the quants blow up the markets again? http://t.co/S4ruIYwm1h and http://t.co/cUq1Q6Z6fn

The ‘quant’ part isn’t scary, the leverage is “Are Quants the New Systemic Risk?” @ReformedBroker @Global_Slant http://t.co/TTVHlEdtPQ

Are quantitative strategies run via black boxes the next systemic risk? #investing @ritholtz http://t.co/TRzsKYENJV

Are quantitative strategies run via black boxes the next systemic risk? #investing @ritholtz http://t.co/U6zLNiSyz3

Are quantitative strategies run via black boxes the next systemic risk? #investing http://t.co/1gUpM6nYFp

Are quantitative strategies run via black boxes the next systemic risk? #investing http://t.co/6ez4PcD2UY

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2015/06/21/are-quants-the-new-systemic-risk/ […]