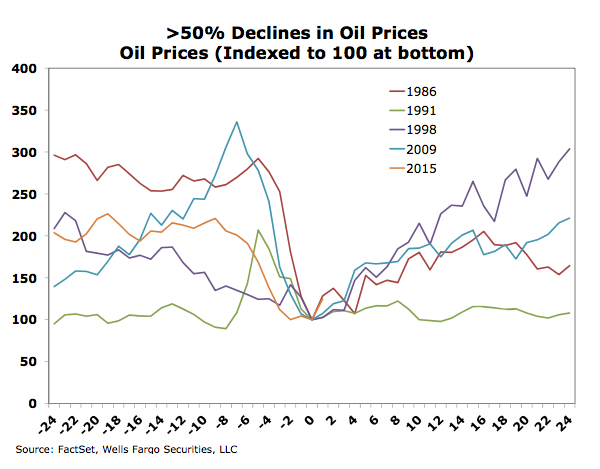

Crude oil plunged 54% from its high last summer to its low this March and has now retraced about half of that loss. The equity strategists at Wells Fargo took a look at what typically happens to the stock market after oil gets cut in half and then stages a rebound like this.

According to the piece from Gina Martin Adams and Peter Chung, there have been four prior instances where the price of oil has been halved since 1980. The average of these declines has been 63%. Adams and Chung note that the average recovery for crude prices from the bottom has been 70% after one year. More interestingly, the S&P 500 has rallied an average of 20% over the 12 months following an oil price bottom of this nature.

Some other takeaways from the report worth mentioning:

* Two of the four oil crashes have occurred during economic recession (1991, 2008) while two have occurred during normal expansion (1985-1986, 1996-1999). The strategists say we should be more focused on the outcomes after the expansionary oil crashes – despite the fact that stocks have gained 20% regardless of the economy during all four episodes.

* After the oil plunge that happened during ’86, the S&P 500 was led by energy and materials stocks over the next 12 months. After the ’99 bottom, it was tech and telecom that led the way.

* Oil prices rebounded to a much greater degree after the expansionary crashes (103.5%) than after the recession-era bottoms (36.4%).

* Averaging out sector returns from the prior four oil shocks, technology is the leading sector with gains of 14% 12 months from the bottom and 16% 18 months from the bottom. Utilities fare the worst, with average losses from the four oil plunges of 20% 12 months after oil has bottomed.

* Industrial Production usually posts a huge drop-off in the immediate aftermath of an oil price bottom but then recovers within a year. 3 months from an oil bottom, IP has been down an average of 3.3%. By the one year mark, however, it has typically recovered to a growth rate of over 1%. Again, by this time, the price of oil has recovered by 70% and, presumably, projects come back online throughout the economy.

* Interestingly, while the S&P 500 does indeed recover by 21% after 12 months from an oil bottom, S&P 500 earnings do not. Adams and Chung show an index earnings decline of 9.9%, 10.5% and 3.6% at the 3-month, 6-month and 12-month marks respectively. The best of the four earnings recoveries inside of one year has been negative 1.2% while the worst has been negative 6.6%.

* Focusing in on the expansionary periods in which oil was cut in half, similar to this one, we see that by 1986 oil had dropped from $28.75 to $10.40 a barrel. 12 months later, it was up 80% back to almost 19. Materials stocks had rallied furiously off the bottom, up almost 400%(!) within 12 months. Energy stocks, unfortunately, were still down 50% however.

* After the 1999 bottom, from which oil had dropped to $11.38 from $25.91 three years prior, the S&P would go on to rally 19%. This was thanks entirely to the tech and telecom sectors, with 51% and 17% gains respectively. The rest of the market remained on the mat – all other sectors were flat-to-down 12 months later including a nasty 30% drawdown for the unpopular staples and utilities sectors.

For me, the lessons are that oil can get cut in half during both recession and expansion. It is very often its own story, subject to idiosyncratic variables that are not necessarily in sync with the broader economy (war, excess supply, etc). Additionally, while S&P 500 earnings often remain stuck in the mud 12 months after an oil crash, the stock market itself has been able to shrug it off each time – similar to what we’re going through now.

Moreover, energy stocks themselves are among the worst way to play a bounce back in oil, which is very counterintuitive. 12 months after a bottom in oil, we see a subsequent 70% rally but energy stocks have been down an average of 4.8% and energy company earnings are still down an enormous 30% over the same time frame.

Source:

What To Expect As Oil Bounces Back

Wells Fargo – May 13th 2015

WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR

RT @ReformedBroker: What Happens After Oil Gets Cut in Half? http://t.co/UY9ZUd0xJ2

“What Happens After Oil Gets Cut in Half?” #feedly http://t.co/wN2bdbUw9B

RT @ReformedBroker: What Happens After Oil Gets Cut in Half? http://t.co/UY9ZUd0xJ2

RT @ReformedBroker: WHAT HAPPENS AFTER OIL GETS CUT IN HALF?

http://t.co/fY0ygqCfTy http://t.co/j6Izjk7joR