I had dinner last weekend with a financial advisor friend who works on a large wirehouse team based here in New York. Last year “was a major pain in the ass” he told me. He had to remind his clients again and again about the wisdom of global asset allocation while the S&P gained 14% and the rest of the world slumped.

Convincing someone that there is a right way to invest for the long term is hard enough, “re-closing them on our approach every few months is nearly impossible,” he said. I agreed with him. I spent a lot of last year blogging about the frustration among professional wealth managers borne of the huge dispersion between US and foreign stocks. As James Osborne says, what works over most years doesn’t work during every year.

“All the data I could come up with to prove the truth wasn’t enough. People don’t want to see the data when there’s a party going on and they feel left out.”

This year is a different story, he tells me. He got an email the other day from a client to the effect of “Thanks for keeping my portfolio intact and not listening to me when I complained.” Supposedly he had kept the guy from an all-in bet on US stocks just before Christmas. The US stock market is now flat with where it was the first week of Thanksgiving. International stocks have gone berserk to the upside.

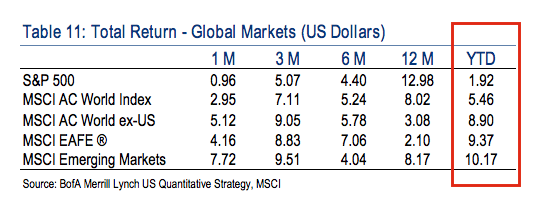

So far this year, the power of a global portfolio has reasserted itself, right on schedule – just at the moment where it looked like there was no reason to allocate outside the “best house” ever again:

table via Bank of America Merrill Lynch

The reality is that foreign stocks and US stocks take turns outperforming each other in roughly four year increments. The last such timeframe where foreign developed equities beat the S&P was from 2003 to 2007. There’s no way of seeing the next such streak coming. The first five months of 2015 could be a blip or the start of something bigger.

The point is that it’s likely a diversified portfolio, if history is worth anything at all, will ultimately reward the investors who can stick with it. Even through years like 2014. “They can judge me against the S&P 500 this year if they want,” he said with a laugh.

If you fired your advisor last year to run off and join the Circus of What’s Working Now, don’t be surprised if you find yourself making yet another change in the near future when the grass turns out not to have been greener.

… [Trackback]

[…] There you will find 59069 more Information on that Topic: thereformedbroker.com/2015/05/04/the-circus-of-whats-working-now/ […]