Given the amazing strength in the US dollar over the last six months, the lack of momentum in US (or Chinese) economic data and the effects of the oil crash still lingering, one thing virtually no one is predicting is any kind of comeback for the commodities market.

Andrew Thrasher, who studies price rather than macroeconomics, had the below remarks and chart in his weekly roundup this morning:

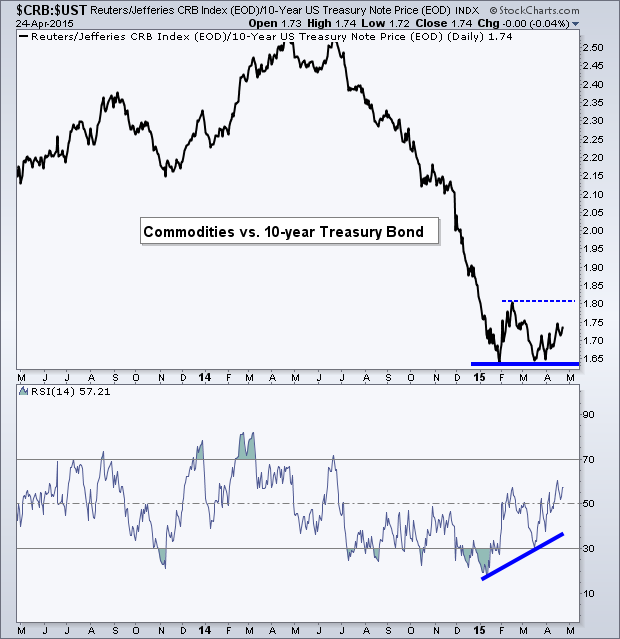

One way we can chart inflation is through the relationship between commodities and Treasury’s.

If commodity prices are rising at a faster pace than bonds, then it’s believed that inflation is also on the rise. As you can see from the ratio chart below, commodities have been under-performing the 10-year Treasury bond since early 2014, However, it seems we may be seeing a possible double bottom in this relationship, which would favor commodities over Treasury’s. At the same time momentum via the Relative Strength Index (RSI) is creating a positive divergence by putting in a higher low.

I’ll be watching to see if the ratio between $CRB and $UST is able to break above its prior high at 1.80. If this happens then we may begin seeing signs of inflation re-introducing itself. What would cause this? That’s not my concern nor on my radar. All I know is this setup may turn to be bullish for commodities after the terrible performance they have had over the last year.

Josh here – It would be both hilarious and par for the course to see a major breakout for commodities right now. With disinflation being the Fear du Jour and the whole world busy hedging against the strengthening dollar, this would literally be the last thing anyone expects.

Source:

Technical Market Outlook 4/27/2015 (AThrasher)

Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/ZoPhm1seNH

RT @ReformedBroker: Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/Zo…

RT @ReformedBroker: Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/Zo…

Chart o’ the Day: Are Commodities Bottoming? by @ReformedBroker http://t.co/1sZsZ2U7tG

Chart o’ the Day: Are Commodities Bottoming?… (http://t.co/QPqKrzV74a)

RT @ReformedBroker: Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/Zo…

RT @ReformedBroker: Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/Zo…

RT @ReformedBroker: Chart o’ the Day: Are Commodities Bottoming? http://t.co/xWBHt34gAT

RT @ReformedBroker: Chart o’ the Day: Are Commodities Bottoming? http://t.co/xWBHt34gAT

RT @ReformedBroker: Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/Zo…

RT @ReformedBroker: Chart o’ the Day: Are Commodities Bottoming? http://t.co/xWBHt34gAT

[…] Joshua M Brown Given the amazing strength in the US dollar over the last six months, the lack of momentum in US […]

Chart o’ the day: are commodities bottoming? http://t.co/JxAw3RuOMe #Corporate

RT @ReformedBroker: Hugely variant perception via @AndrewThrasher – could commodities be bottoming?

http://t.co/v6EIckeB8V http://t.co/Zo…

Thorn of Girl

Very good data might be located on this website website.