Pascal’s Wager goes something like this:

You cannot prove the existence of God, but you also cannot prove that God doesn’t exist. Therefore, you may as well bet that he does.

If you’re a reasonable person, you recognize that the upside and the downside of believing or not believing are asymmetrical. If you wager that there is no God, and you are right, the reward is very little if anything upon death. But if you wager against the existence of God – and it turns out that God does exist – your downside is immense; eternal damnation for starters. Therefore, a wager that there is a God – and a life lived accordingly – is the only rational course of action.

It’s a weak argument for the existence of God because if you’re only betting (or pretending to believe), surely the Almighty would be able to see your gambit for what it is and damn you anyway. But let’s confine our discussion here to more earthly pursuits – namely, the right approach to tactical asset allocation for a retirement portfolio.

In our view, many market participants conduct tactical strategies as though they’re implementing the stock market version of Pascal’s Wager. By treating every dip in the market as though it’s worthy of a reaction, investors are “betting” that they are saving themselves and being proactive just in case the next bear market is about to begin. As I will show in this post, this belief-based approach is highly destructive to potential returns. Our answer to the tactical puzzle – the “when do we sell?” question – came about by asking the opposite one: How do we structure this to keep us from selling until we’d really want to be out?

First, a bit of background on our overall investment philosophy: We believe that less is more, that costs should be low and that markets work. While we don’t attempt to predict the future, we do analyze the present and calculate probabilities from the past. We prize evidence over excitement and durability over everything.

Our typical client portfolio is heavily invested in a low-turnover, low-cost, strategic asset allocation model that meets the objectives of the financial plan we’ve drafted for them. Alongside this asset allocation portfolio might be a specific weighting to our tactical strategy, which is called Goaltender. In our view, an optimal portfolio for wealthy individuals is predominantly strategic but contains a tactical overlay that acts as a hedge (or an emotional release valve) in times of real market stress. As AQR founder Cliff Asness says, “The great strategy you can’t stick with is obviously vastly inferior to the very good strategy you can stick with.” Our job as asset managers is to build and manage portfolios that our clients can stick with. We believe that the combination of strategic with tactical – if done correctly – can get the job done.

The problem with nearly every existing tactical solution we’ve looked at is that they actually want to trade. They love it, it’s their raison d’être. They’re actively looking for reasons to buy and sell, all the time. Unfortunately, this penchant for taking action stands in direct opposition to our responsibility as fiduciaries – it runs up large trading costs and amps up a client’s short-term capital gains taxes (in a best case scenario!). And these costs come before we even factor in management costs, hedging losses, etc.

And so, when we set about building our own tactical model, the central objective was to come up with reasons to trade as infrequently as possible – and to make every buy and sell count. In other words, our Goaltender strategy is a tactical model built by a wealth management firm for wealth management clients.

To demonstrate why having such a high hurdle for making buy and sell decisions is important, I had my firm’s director of research, Michael Batnick, run a backtest based on a hypothetical investor who reacts to every dip in the market. We’ll call it the “False Alarm” strategy.

Suppose he sold out a portfolio consisting of S&P 500 stocks every time his portfolio’s value dropped by 5%. Now, suppose he bought back in once the market was 1% higher from the point he had sold out at – in other words, the moment “the coast was clear” and stocks were rallying again. Had he been doing this systematically, he would have avoided many of the worst drawdowns throughout history. But he would also have chewed up his potential returns, with an annual gain of just 2.8% being the result of this behavior. He’s effectively turned his portfolio of stocks into a portfolio of bonds.

This is obviously an extreme example, but it is not very dissimilar to the way many tactical strategies work. There’s a recurring guest (character?) on financial TV who is the epitome of this kind of manic trading – he’s a seller on all dips and a buyer-backer after each recovery. One day, the “sell everything” call will work…until then, it’s a clown show.

We believe that a tactical strategy should, first and foremost, be built on the premise that some volatility simply must be endured. It should also encompass the reality that most 5% dips do not become full-blown bear markets. Using data since the inception of the S&P 500 in 1957, we make the following key observations:

- There have been 48 instances in which the S&P 500 was in a drawdown of 5% from all-time highs.

- In only 17 of those 48 instances did the drawdown extend to 10%.

- In only 9 of those 48 instances did the the drawdown extend to 20% or worse – in other words, the nine actual bear markets of the last six decades.

The bottom line is that 5% dips from all-time highs in the S&P 500 become bear markets less than 20% of the time. Said another way, it’s a false alarm more than 80% of the time.

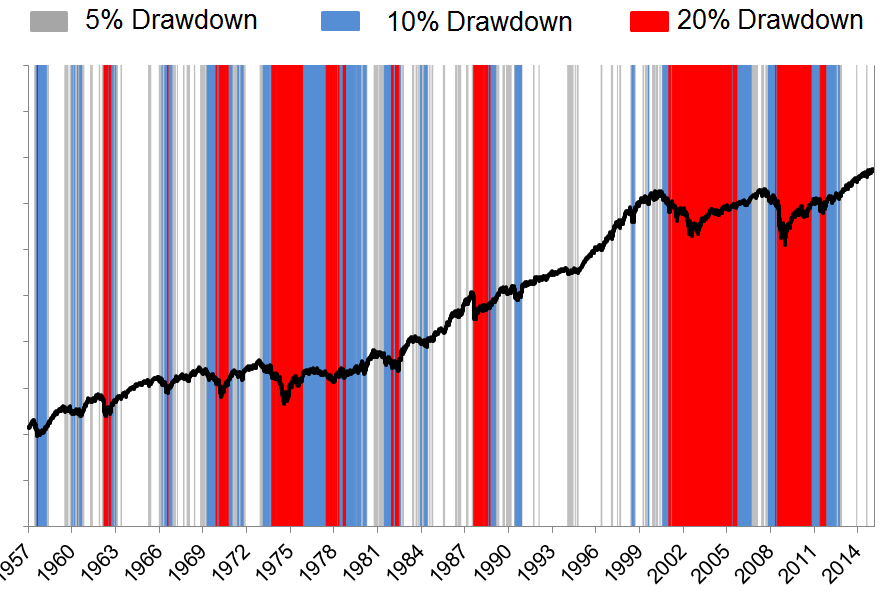

In the chart below, I’m showing you how often the S&P 500 is in drawdowns of greater than 5, 10 and 20% from all-time highs. The white space is when the S&P 500 is at or within 5% of all-time highs (my god, look at the 1990’s!).

You’ve probably never seen this data displayed quite this way so allow me to unpack it a bit…

On a daily basis, the S&P 500 trades at an all-time high 7% of the time and trades within 5% of an all-time high 36% of the time. This means that on 43% of all days, since the S&P 500’s inception, US large cap stocks were at or close to making new records. Anyone who tells you that new highs are abnormal or a reason to sell is a fool.

It should come as no surprise that investors have spent much of the recent bull market biting their fingernails given the “lost” decade that preceded it. Fortunately, it is an anomaly for the S&P 500 to spend that much time in red – or more than 20% from all-time highs. Other than the mid-1970’s, there’s really nothing similar to the post-millennial bear that’s left such a nasty scar on the collective psyche of the investor class. Most of the time, stocks are within 10% of record highs and being overly tactical becomes a cost rather than a benefit.

Our tactical methodology, then, is based on isolating the potential for when a 5% dip may become something more. We can’t predict in advance, obviously. We can calibrate our reaction, though, and we do so based entirely on price and trend inputs. Goaltender does not utilize emotion, instinct, opinion, narrative, gut feelings, political leanings or hopes and dreams.

Because Goaltender was built with our wealth management clients in mind, we’re forced to shrug off the routine dips that are a fact of life for the stock market. Minimizing normal market volatility is not the objective. By focusing our attention on the severe downtrends that our clients (rightly) fear, we hope to avoid the costs and taxes that the more trigger-happy tactical strategies inflict.

As the stock market fluctuates, the Pascals of the world may ask “Why not sell, just in case?” We’re looking for reasons not to.

***

If you think we can help you with your portfolio and financial planning, get in touch here.

Advisors: Ritholtz Wealth is now expanding. Get in touch about joining our team here.

As a reminder, nothing mentioned in the post above should be considered as advice or a solicitation to buy or sell any securities.

رفع ارور 1009

Hey! I know this is fairly off matter but I was pondering which weblog system are you using for this web site? I’m acquiring ill and exhausted of WordPress simply because I’ve experienced problems with hackers and I’m looking at options for an addition…

تبلیغات در صفحه اول گوگل

Sohan is also becoming accused of leaving the jurisdiction in December last 12 months with no permission.

رفع ارور 1009

If you are heading for most excellent contents like myself, just go to see this internet site everyday since it provides attribute contents, many thanks

خرید کولر صنعتی

Fantastic story, reckoned we could mix many unrelated data, even so actually really value taking a search, whoa did one particular distinct grasp about Mid East has got a lot a lot more problerms also

رفع ارور 1009

I absolutely love your site and find a lot of your post’s to be specifically I’m hunting for. Does one particular offer guest writers to create articles accessible for you? I wouldn’t brain generating a put up or elaborating on a few of the topics you…

تبلیغات در صفحه اول گوگل

Many thanks yet again for the site publish.Truly thank you! Fantastic.

وی پی ن آیفون

Verify beneath, are some entirely unrelated net-web sites to ours, however, they’re most trustworthy resources that we use.

تبلیغ در گوگل ادوردز

Thank you for some other great write-up. In which else may just anyone get that kind of info in this kind of an ideal implies of composing? I have a presentation next 7 days, and I am on the lookup for this kind of details.

vpn ایفون

What’s up it is me, I am also visiting this site on a normal basis, this internet site is really pleasurable and the viewers are truly sharing good views.

تبلیغ در گوگل ادوردز

Just beneath, are a whole lot of totally not connected web internet sites to ours, however, they could be definitely actually value likely above.

reseller rights ebooks

[…]check below, are some entirely unrelated websites to ours, nonetheless, they may be most trustworthy sources that we use[…]

cctv

Wonderful story, reckoned we could merge many unrelated info, however genuinely really worth having a research, whoa did a single distinct learn about Mid East has got a good deal much more problerms also

دوربین

Hey! I know this is relatively off subject but I was questioning if you understood in which I could get a captcha plugin for my comment form? I’m utilizing the exact same site platform as yours and I’m possessing troubles discovering one? Thanks a whol…

سرور مجازی فرانسه

[…]that will be the end of this post. Right here youll come across some sites that we feel youll appreciate, just click the links over[…]

سیستم حفاظتی

Thank you for some other great post. The place else could just any person get that kind of details in such an perfect implies of producing? I’ve a presentation up coming 7 days, and I am on the lookup for these kinds of data.