There’s a fascinating trend happening within the asset management industry where the public is using data and the information available online to make better investing decisions, slowly but surely. There is absolutely zero data that links high fund costs with outperformance over any relevant period of time and the “persistence” data from SPIVA has done a number on the idea that investors who overpay for active management get what they pay for.

Investors are leaving higher cost funds and gravitating toward lower cost funds. I would surmise that the education they are getting on financial blogs and from their advisors is helping to drive this trend.

A new Morningstar study released today shows that the asset-weighted expense ratio across all funds (including mutual funds and exchange-traded products, or ETPs, but excluding money market funds and funds of funds) was 0.64% in 2014, down from 0.65% in 2013 and 0.76% five years ago. The trend is being driven more by investors seeking low-cost funds than it is by fund companies cutting fees.

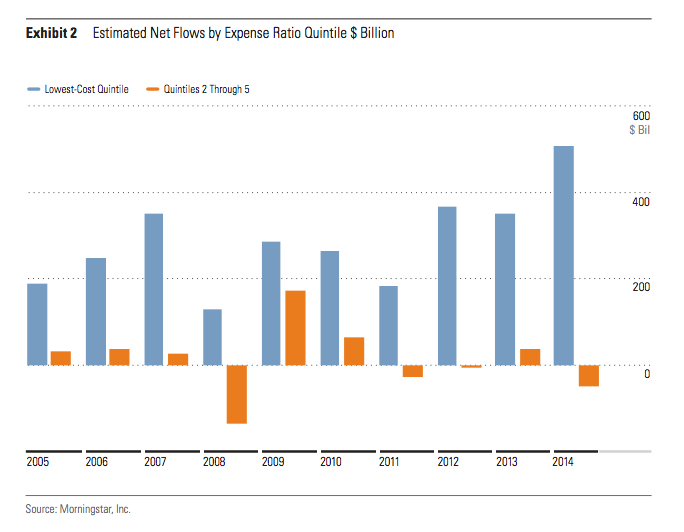

The data is undeniable: the investor class is learning:

Mutual funds and ETPs with expense ratios ranking in the least-expensive quintile of all funds attracted an aggregate $3.03 trillion of estimated net inflows during the past 10 years, compared with just $160 billion for funds in the remaining four quintiles. That is to say that 95% of all flows have gone into funds in the lowest-cost quintile.

There is an implied link to the fact that service models among financial advisors have shifted dramatically in recent years. There are many more clients now being served by fee-based financial advisors than pure transactional brokers – a trend I have documented laboriously on this site and in my book.

With less brokers, there is the commensurate decline in the type of funds brokers favor (the ones that pay them most). Broker-sold or “load” funds are going the way of the dodo in place of ETFs in wrap accounts or institutional share class mutual funds. Morningstar notes that “Load shares, which charged an asset-weighted expense ratio of 1.02% in 2014, held just 20% of assets as of year-end, down from 37% in 2004.”

The pendulum is not going to be swinging back to higher-cost funds any time soon. Actively managed funds will either react by rationalizing their costs or continue to watch the dollars flow out.

One other anomaly worth mentioning – investors are allocating to one area with higher than average fees, the liquid alts space. That said, it’s such a small pocket of the overall fund biz that it’s hardly worth mentioning at this point. Time will tell whether liquid alts can grow into a much large contributor to the industry and still maintain high internal expense ratios.

Source:

Investors Drive Expense Ratios Down (Morningstar)

2015 Fee Study: Investors Are Driving Expense Ratios Down (Morningstar)

Another dope single from the lost Beastie aka @ReformedBroker http://t.co/LxSGoDDsc0

Funds aren’t cutting fees, investors are http://t.co/Lwxj5Cg1mf

Funds aren’t cutting fees, investors are http://t.co/w6ekP60Ml3 #investment #mutualfunds

[…] Investors are driving down fund fees, not fund companies. (thereformedbroker) […]

RT @ReformedBroker: Funds aren’t cutting fees, investors are

http://t.co/9IgcC8cRfz

(mom and pop get one right)

Another homerun piece by @reformedbroker on individual investors driving investment costs down

http://t.co/YuIG05tseD

RT @RobinJPowell: “There is absolutely zero data that links high fund costs with outperformance over any relevant period of time” http://t.…

RT @RobinJPowell: “There is absolutely zero data that links high fund costs with outperformance over any relevant period of time” http://t.…

RT @rjparkerjr09: Investors are allocating to one area with higher than average fees, the liquid alts space. “Hardly worth mentioning.”

htt…

RT @CharlesBoinske: “There is absolutely zero data that links high fund costs with outperformance over any relevant period of time” http://…

RT @CharlesBoinske: “There is absolutely zero data that links high fund costs with outperformance over any relevant period of time” http://…

Funds aren’t cutting fees, investors are by @ReformedBroker http://t.co/3TOqRQanVn

Woman of Alien

Great function you might have completed, this page is absolutely great with great facts. Time is God’s way of retaining every thing from occurring at once.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/04/23/funds-arent-cutting-fees-investors-are/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2015/04/23/funds-arent-cutting-fees-investors-are/ […]